Exchange rates in the forex market fluctuate in response to economic and geopolitical developments in the global scene. While economic factors tend to have the biggest impact, the level or amount of trade that a nation carries on the international stage also greatly influences the fluctuating rate.

What is BoT?

Balance of trade (BoT) impact on exchange rates is well documented given its effect on the demand and supply of the underlying currency. In simple terms, it is the difference between the total value of goods that a country sells to other countries and the total value of goods it buys to meet a deficit back at home.

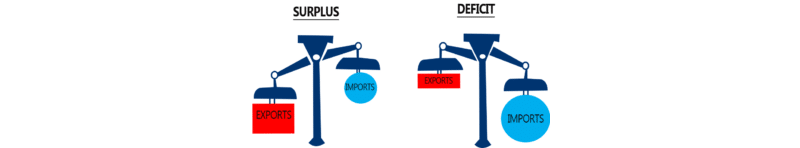

It is computed by taking into consideration the total value of all international transactions. A positive balance comes into play whenever a country sells more than it buys from other nations resulting in a trade surplus. Likewise, a deficit is achieved whenever a country purchases more than it sells to other countries.

Balance of Trade =

Exports value – Imports value

A positive or a negative trade balance does not paint an accurate picture of the health of a given economy. For instance, the U.S has been operating under a deficit for years, with China importing more than it sells. The deficit has also been the subject of a fierce standoff between the two economic powerhouses.

The duration of a trade deficit or surplus is known to significantly impact the foreign exchange rates of the native legal tender in question.

Impact on exchange rates

Whenever the difference between the amounts of goods a country sells and those that it buys don’t net to zero, there is usually a significant impact on the underlying currency strength. The difference that comes into being is known to influence the supply and demand of the currency.

Whenever a nation is selling more to other nations, there is a strong demand for its goods. Similarly, there is usually strong demand for its money as buyers from other countries must buy the goods they need.

Increased demand for a legal tender to finance the purchase of goods on the global stage amid limited supply tends to trigger significant exchange rate appreciation. Consequently, a country that exports more than it imports would always experience a strengthened legal tender compared to other peers given the strong demand in the market.

In contrast, whenever a country buys more goods from other nations, importers are often forced to sell their currencies to purchase other countries’ legal tender to finance their purchase. The selling of a country’s money to buy other legal tenders often reduces the buyer country’s demand, resulting in depreciation.

Some nations strive to maintain a trade surplus because it positively impacts the economy more than a deficit. By selling more goods, a government may support a higher living standard for its citizens.

Protectionism mechanisms often come into play to make exports more competitive than imports to ensure trade surplus. For instance, tariffs or quotas may be applied to make imports more expensive. Other countries responding with similar measures can result in a fierce trade war, consequently hurting the economic conditions of both nations.

Trade balance

Prolonged periods of trade deficit have the potential to trigger significant currency deprecation. A currency losing substantial value against its peers over a long period ends up making exports attractive once again.

With a depreciated currency, exports become cheaper as importers have to pay a small amount of money to buy the goods. If this were to happen, importers would end up buying more of the exporting country’s currency to finance their purchases. The increased demand would end up causing the exchange rate to appreciate once again.

Similarly, a prolonged trade surplus can result in significant exchange value appreciation, which can end up hurting a country’s export business. In most cases, exports become quite expensive depending on the underlying legal tender exchange rate appreciating.

Likewise, other nations will opt to buy goods from other states to avoid paying much more than what they would have paid for the same item from other countries. Importers opting for other nation’s goods would end up causing a significant reduction in demand for the underlying money resulting in its exchange rate depreciating afterward.

Therefore, a prolonged trade surplus leading to significant currency appreciation is always not good for an export-dependent economy such as China. For this reason, most countries try to maintain a balance between imports and exports.

By ensuring balance, the nations can keep the demand and supply of the underlying currency in check. The balance often goes a long way in ensuring the stability of the underlying legal tender, thus shunning any potential wild swings in value.

Some countries try to fend off the significant impact of trade balances on their legal tender value by stocking fixed or pegged exchange rates. China is a perfect example of a nation known to maintain a fixed rate of the yuan to ensure export competitiveness.

Being an export-dependent nation, China maintains a fixed exchange rate or pegs the yuan against other currencies to ensure currency fluctuations don’t come into play to take a toll on its export business.

Bottom Line

A nation experiencing strong demand for its goods tends to sell more than it buys. The net effect is usually increased demand for the underlying legal tender, often causing it to appreciate.

In contrast, a nation buying more than selling experiences reduced demand for its legal tender globally. The net effect is usually the depreciation of the underlying exchange rate against other majors.

Therefore, currency values can swing up and down in response to the kind of trading activities that a country is involved in. Other countries fix or peg their exchange values to limit the impact or trade imbalance on the export business.