Simple interest vs. compound interest

Simply put, interest is the cost linked to borrowed money. It is the amount that the borrower needs to pay the owner of the funds in addition to the initial loan.

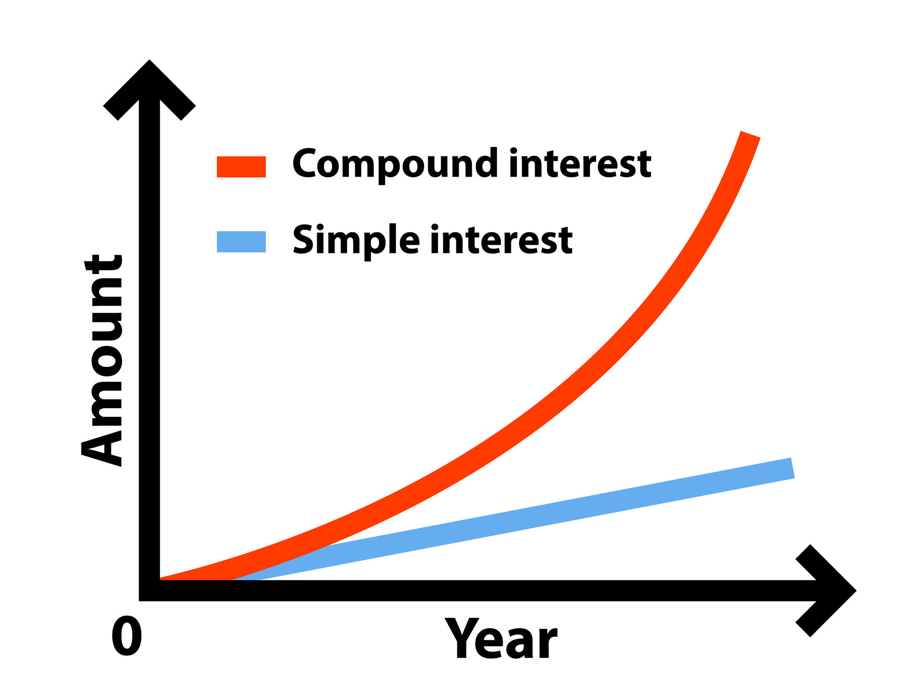

This also applies to funds deposited with a financial institution. Interest can either be simple or compound.

Simple interest

Simple interest is computed as the annual percentage of the initial amount (principal). Notably, the prior interest is not included in the calculation.

For instance, if an investor deposits $1,000 in his savings bank account at an interest rate of 5% for three years, the simple interest will be $1,000 *7% *3 = $150. This means that at the end of three years, the principal $1,000 will have earned him an additional $150.

Compound interest

The key difference between the computation of simple and compound interest is that the latter considers the previous interest. The principle of compounding allows investors to earn more money compared to simple interest.

The compounding can be annually, bi-annually, quarterly, monthly, or daily depending on the terms agreed upon with the financial institution. It is important to note that a higher compounding frequency equates to a larger interest.

To better understand the concept of compound interest in the financial setting; let’s consider the following example:

You put $100 in your retirement account that will earn an interest of 10% per annum.

Year 1: interest will be $10; thus total amount will be $110

Year 2: you will begin with $110; thus, the interest will be $11. Add that to your balance, and the new amount will be $121.

Year 3: you will start with $121 and will earn an interest of $12.10. The year will end with you having $133.10 in your account.

Year 4: with $133.10 as the new principal amount, you will earn an interest of $13.31 and end up with $146.41.

Year 5: with the $146.41 in your account, your interest for that year will be $14.64. Upon the year-end, you will have 161.05. With a span of 5 years, your money will have worked for you by earning you $61.05.

Now let’s assume that you decide to withdraw the interest earned in the first year and all the other ensuing years.

This means that in year 2, you will start with $100 after withdrawing the $10 interest. In years 3, 4, and 5, you will begin with $100 upon withdrawing $10 at the end of the year. In total, the principal amount will have earned you $40. This is in comparison to the $61.05 you would have gotten if you reinvested the interest.

The rule of 72

The rule of 72 is a concept used in compounding to compute the time it will take to double the value of your investment. According to the formula, the years it takes to double your investment is computed by dividing 72 by the applicable rate of return (interest rate).

How to apply the rule of 72 in investment

The rule of 72 is not just a theoretical formula but a principle that one can use to evaluate the profitability of an investment idea. For instance, a typical investor has a target amount in mind before engaging in a particular commercial activity. By considering the expected rate of return from the investment, one can compute the period it will take to hit the target.

For example, if you invest $1 million as your retirement fund at an interest rate of 10%, 22 years before your actual retirement, the amount will double three times. This is based on the formula of dividing 72 by the interest rate (10%). After the first 7.2 years, it will increase from $1 million to $2 million. After the remaining two phases of 7.2 years each, the funds will double further to $4 million and then to $8 million.

Depending on the health of a financial institution or overall economy, it is possible for the applicable interest rate to change with time. In such a case, the rule of 72 is helpful in evaluating the alterations needed on your investment plan to reach the target amount.

Furthermore, the rule of 72 is applicable in evaluating an investment’s risk vs. reward. To better understand this concept, let’s consider two scenarios. On the one hand, there is a low-risk opportunity that has the ability to double your funds in 30 years based on an interest rate of 5%. In comparison, a higher-risk investment will double your money in 10 years at an interest rate of 10%.

Depending on one’s risk appetite, the results based on the rule of 72 form the basis of informed financial decisions. For instance, a young professional may be in a position to invest in a high-risk opportunity with the intent of accumulating wealth before retirement. On the other hand, those close to the retirement age may go for the low-risk option as security of the attained funds is more important to them than accumulating more money.

How to increase profits with compound interest

For one to harness the power of compounding in growing wealth, it is important to focus on certain key principles. Let’s look at them below.

Time is money

Indeed, this is one of the primary pillars of compounding.

The basic concept of compound interest is allowing your finances to grow with time.

Be consistent

To understand how consistency is linked to the power of compounding, let’s consider two scenarios. On the one hand, a young professional deposits $1,000 in his money market fund account at the end of every month without fail.

At the same time, another individual deposits the same amount in a similar account when he “feels he has some money to spare.” Assuming that the interest rate in both entities is the same, the first case will yield higher earnings than the latter.

You can decide to increase your savings as you go along. However, the most important thing is to start with whatever amount is available and be disciplined and consistent.

Pay debts

Just as compounding has the power to have your money work for you, it can also work against you. This is especially common when dealing with credit card debt. If you fail to make payments within the required timeframe, it is bound to accrue interest. The longer you wait, the higher the amount you will owe the credit card company. In fact, some issuers compound the interest on a daily basis. This means that every day past your payment due date attracts interest on the already recorded interest.

Consider the compounding rate

Investment options have different interest rates. As such, it helps to conduct detailed research on several entities and select the one that will yield you more earnings. However, it is important to note that in addition to considering the compounding rate, the overall terms and conditions are crucial.

Don’t withdraw your earnings

As we mentioned, compounding benefits investors by having interest on the principal amount gain even more interest. This means that to maximize your profits via compounding interest, one should avoid withdrawing the investment and allow the money to work for you over time. One of the key principles for effective compounding is to reinvest the acquired funds.