In order to diversify one’s risk, one can use hedging, which involves purchasing an investment that is negatively correlated to the assets in one’s portfolio. There are numerous exchange-traded funds (ETFs) available that can provide some type of protection. However, some people simply change to safer investments like bonds or equities. Also, to profit from stock declines, some people own puts on the market.

Inverse ETFs

It is generally recommended that ETF investors concerned about the possibility of future declines have some exposure to bearish or inverse ETFs to protect their portfolios. Portfolio managers can use low-cost ETFs like inverse ETFs to partially or completely remove market risk from a portfolio.

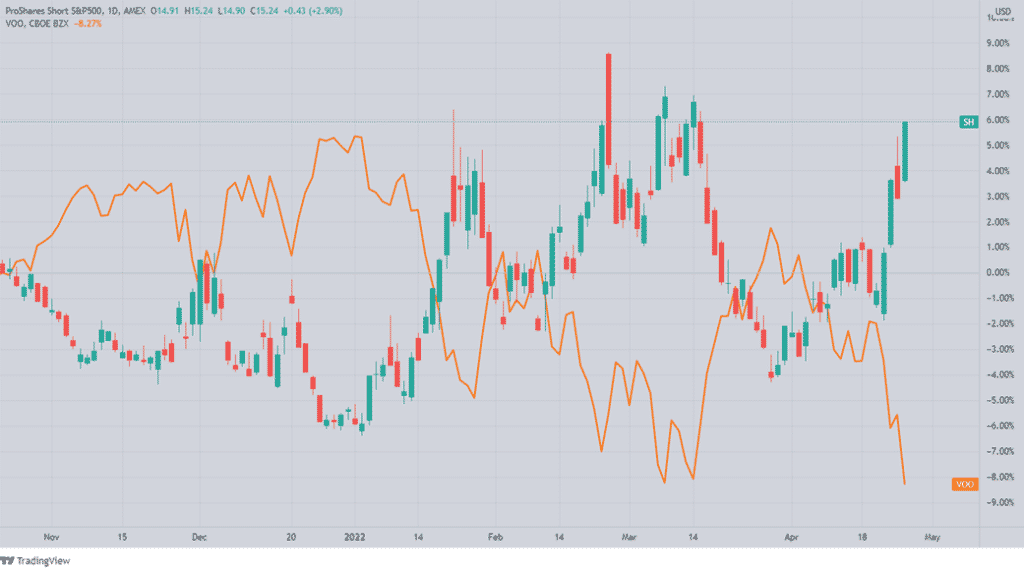

ProShares Short S&P500 (NYSEArca: SH) is an example of an ETF that tracks the S&P 500 index in the opposite direction. Others include the ProShares UltraShort S&P500 ETF (NYSEArca: SDS), which tries to reflect -2x or -200 % of the daily performance of the S&P 500, and the ProShares UltraPro Short S&P500 ETF (NYSEArca: SPXU), which also takes -300% of the daily performance of the S&P 500.

You can also use inverse ETFs to protect your long positions in the Dow Jones Industrial Average from potential losses due to market volatility. For instance, ProShares Short Dow 30 ETF seeks to replicate the Dow Jones Industrial Average’s daily performance at a -100% level.

Using an inverse ETF to hedge has the added benefit of clearly delineating and restricting your risk. However, it’s important to remember that an investor who shorts the market outright faces an undetermined and potentially infinite amount of danger. Investing in an inverse ETF carries a risk equal to the amount you’ve put in.

As a buffer against asset correlation and investment risk, using Inverse ETFs can be an effective technique. It is also a method that necessitates meticulous implementation, monitoring, and periodic rebalancing. As long as they are used correctly, inverse ETFs can be an effective risk management tool.

There is a danger, though, in using these advanced investment techniques. Because of the higher fees, these investments should only be included in a broader portfolio as short-term or very minor assets. Nonetheless, investors concerned about hedging risk or making a quick profit in an unsettling market can have a look at a variety of inverse ETFs.

When to buy an inverse ETF

Inverse ETFs can be used in a variety of ways by traders. As an example, some traders utilize short ETFs as a hedge against decreasing stock prices. In such an instance, as one position declines, the other rises, limiting the losses. Traders can also utilize inverse ETFs to wager in the opposite direction of the market on a specific stock or benchmark.

Investors can also take advantage of leveraged ETFs that move two or three times faster than their underlying assets. Typically, traders use leveraged short ETFs to boost investment returns. A sped-up fund is what you get with leveraged ETFs.

SQQQ, for example, leverages swaps and futures to produce three times the opposite daily performance of the Nasdaq 100 index for ProShares UltraPro Short QQQ ETF. Theoretically, this short ETF might rise by 3% if the Nasdaq 100 drops by 1%. It all comes down to the type of leverage utilized and the way it correlates to the news that causes the shift.

That may sound like a good idea, but the risks are just as high. When bad news comes out, financial derivatives and other exotic market items react differently. For example, if the Dow Jones Industrial Average rises 2 percent, a leveraged short ETF may fall roughly 6 percent.

Inverse ETF and overnight position

Inverse ETFs may appear straightforward at first appearance, but their daily rebalancing makes them highly complex. All price changes are expressed as a percentage for the current day and just for the current day. You start from scratch the next day.

When daily rebalancing leads your predicted profit and loss projections to go off track and result in worse-than-expected results, that is an example of beta slippage. Suppose you pay $500 for a single share of an ETF that tracks a 7,000-point index in the opposite direction. Buying an inverse ETF means you’re expecting the index’s values to fall so that your ETF’s value rises. Let’s assume a 10% decline occurs the following day, as the index falls to a closing value of 6,400. Because of this, your percentage will rise from $500 to $550.

What you need to know about daily rebalancing: You have to start all over again the next day. If the index begins the day at 6,400 and closes at 7,000, that’s a 10.93 percent increase. However, if your inverse ETF rises in value by 10%, your share will drop from $550 to $489.88 (10.93 percent of $550 is $60.115).

Long-term investors who don’t know how inverse ETFs can suffer the adverse effects of daily rebalancing and always run the risk of losing money.

Implied volatility

You should expect some volatility in the market if you plan to apply this approach on an intraday basis. Even if you are correct in your negative outlook, a small change in the market could result in losses that are not even close to covering your commissions and the bid-ask spread, much alone making this strategy worthwhile.

In summary

Inverse ETFs have a straightforward principle. The ETF’s value is intended to rise as the underlying target index falls. The strategy can be used to profit from unfavorable intraday trends. However, one must be aware of the underlying risks, such as the market rising instead of falling; and ensure that they diversify their portfolio adequately.