Bitcoin and cryptocurrencies have so far seen an astronomical rise. Despite BTC’s current fall to $30,000 level, investors who would have purchased the token a couple of years back would still be in profit. For example, BTC was trading around the $7000 level at the start of 2020, while currently, it is trading at $35000, indicating a 400% return.

So it is quite natural that proponents of cryptocurrency are in high spirits. It’s not just a currency but a technology that is considered to break the government’s monopoly on currency supply. Given the extremely fanatic fan base for Bitcoin, it is normal that there will be another group that is vehemently opposed to this concept.

But so far, this group could only sit back and watch. Even when they believed that Bitcoin price was in bubble territory, they could not put their money where their mouth was. This is because there was no convenient avenue to ‘short’ Bitcoin. However, in April this year, Horizons ETF launched an inverse Bitcoin ETF that provided an avenue to short the cryptocurrency.

What are ETFs and Inverse ETFs?

Exchange-Traded Funds or ETFs are funds that closely track a particular underlying. For example, the most popular ETF in the world, the S&P 500 ETF, tracks the performance of the S&P 500 index. So, for example, if the S&P 500 index is up by 1% on a particular day, the ETF will also return 1%.

ETFs tracking gold, silver, treasuries, and other indices are also present and quite popular. ETFs are traded just like stocks on the exchanges. So it is possible to invest a very small amount and make intraday trades. ETFs are famous for their cost-effectiveness and convenience.

What exactly are inverse ETFs? ETFs, unlike futures, can’t be shorted. So, for example, if I’m of the view that the S&P 500 index will fall, I can’t really trade that view with an ETF. I will have to go to the derivatives market and short SPX futures for that purpose.

However, futures are traded in ‘lots.’ Which means one needs to buy futures in multiples of lot sizes. For example, the lot size for SPX futures is 50. So anyone looking to invest has to buy or short a minimum of 50 futures or multiples of that. On the other hand, one can buy even a single unit of an ETF.

This is where an inverse ETF becomes very useful. An inverse ETF works exactly like a normal ETF except that it gives inverse returns. For example, an inverse ETF on S&P 500 would yield a 1% return for every 1% fall in the index and vice-versa. So effectively, it is a convenient tool for anyone looking to short an asset.

So far, there was no inverse ETFs on bitcoin. In fact, the US does not have any cryptocurrency ETFs, inverse or otherwise. When it comes to cryptocurrency avenues, Canada often seems to be stealing the march over the US. While the US regulator, the Securities and Exchange Commission (SEC), doesn’t allow any ETF that tracks cryptocurrency, Canada’s regulator is more liberal.

BITI – Inverse Bitcoin ETF

Horizons ETF, an asset management company in Canada, launched an inverse Bitcoin ETF in April this year. The ETF is called BetaPro Inverse Bitcoin ETF and is listed with the ticker BITI. The ETF started trading on the Toronto Stock Exchange on 15th April 2021. The management fee for the inverse ETF is 1.45%. Buying BITI is as simple as buying any stock.

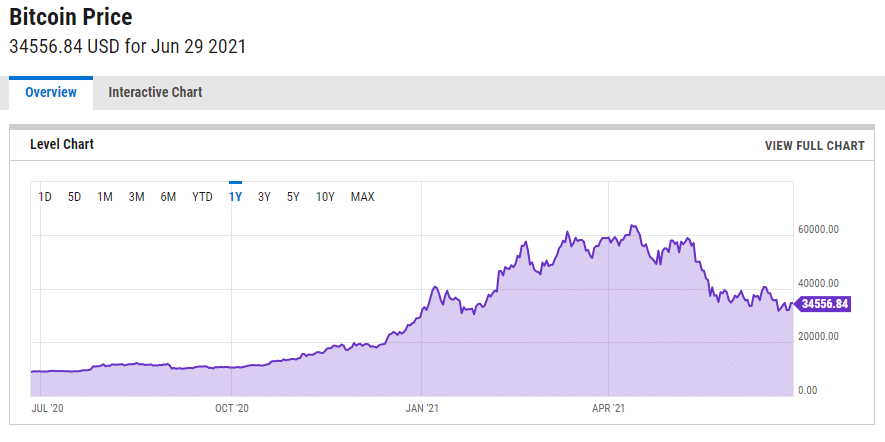

The ETF has already gathered 19 million CAD in assets. The timing of the launch of the ETF was also very beneficial for those wanting to short Bitcoin. As you can see in the chart below, Bitcoin peaked around mid-April when its price crossed the $63000 mark on 14th April. From there, it has been a downhill journey for Bitcoin.

Elon Musk tweeted about Tesla suspending payments in BTC due to concerns about energy consumption and sustainability. That sent the entire pack of cryptocurrencies along with BTC crashing. As you can see, the price nearly halved. This was beneficial for anyone holding the Inverse Bitcoin ETF. As seen below, the price of BITI, which was listed at 15 CAD, jumped up to 24 CAD in early June. It’s currently trading at 22.88 CAD, which implies a 50% return on investment.

The existence of an inverse ETF sounds like bad news for BTC price on the 1st glance. As now there is a convenient way to short BTC, more investors who are bearish on the token will do so. If the price of an inverse ETF increases, investors can make arbitrage trades where they will sell Bitcoin and buy the ETF, which will push down the price of BTC. However, in the long term, an inverse ETF is a positive development for BTC.

For any market, the existence of both bulls and bears is important. When only the bulls are dominant in the market, it leads to artificial price inflation, which in turn often causes price bubbles. On the other hand, when shorts are allowed to express themselves, the price remains in balance.

Also, interestingly, the existence of short positioning also creates the potential of the now notorious short squeeze. If you have followed the story of AMC and GameStop, you would know that hedge funds had huge short positions on these names. So, when retail investors pumped the price of the stocks, these funds were forced to cover their shorts, leading to a short squeeze.

Currently, the position in BITI is small, at around $15 million. That is insignificant compared to Bitcoin’s market cap of nearly $670 billion. However, as the inverse ETF gains popularity, a lot of short positions may accumulate in it. Such a condition might make the BTC ripe for a short squeeze where even a small price appreciation in BTC can catapult its price to highs.

Regardless of these possibilities, the addition of an Inverse Bitcoin ETF offers an easy way for investors to short the token and also maintains balance in the market.