- The US dollar is on the front foot.

- AUDUSD drops under the pressure.

- USDCAD bounce back gathers pace.

- Oil prices hit by supply concerns.

- Bitcoin and Ethereum sell-off persists.

The US dollar started the week on the front foot even as the focus in the market shifted to this week’s Federal Reserve policy decision. The dollar index, which tracks the greenback strength, was in touching distance of last week’s highs after powering to highs of 95.75.

The rally on the dollar comes at the backdrop of treasury yields edging lower, with the 10-year yield touching session lows of 1.763%. The pullback is the catalyst behind the rally being experienced on gold, showing signs of edging higher. Yields have been under pressure in recent days despite expectations that the Federal Reserve will tighten monetary policy at a much faster pace than initially anticipated.

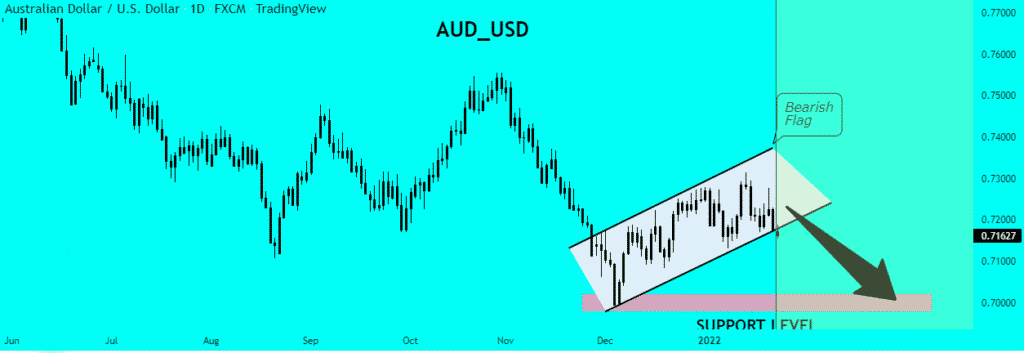

AUDUSD weakness

Meanwhile, the Australian dollar came under renewed pressure Monday morning, with the AUDUSD dropping to crucial support near the 0.7140 level. The pair is at risk of edging lower on a breakthrough the support level, going by the renewed dollar strength.

A drop to lows of 0.7089 could be on the card ahead of 0.6978 on bears steering a drop below the 0.7040 level. Meanwhile, the pair needs to find support above 0.7050 to avert the risk of renewed sell-off.

The Australian dollar is under immense pressure after China, Australia’s biggest trading partner delivers another rate cut. The People’s Bank of China has carried out a 10 bps cut on the 14-day repo as it moves to caution the economy, which is under pressure. The cut comes at a time when most countries are looking to do away with accommodative monetary policy.

Fuelling the weakness on AUD is disappointing economic data, with January CBA Manufacturing PMI easing to lows of 55.3 from 57.4 delivered the previous month. Services PMI also slumped into contraction territory at 45 against 51.8 expected. Concerns about China’s economy and disappointing economic data could continue weighing on the AUD against the majors.

USDCAD bounce back

Meanwhile, the USDCAD bounce back from two months’ lows continues to gather steam as the Canadian dollar remains under pressure amid a rejuvenated US dollar. USDCAD has already found support above the 1.2500 level as bulls set sights on the 1.2600 handle.

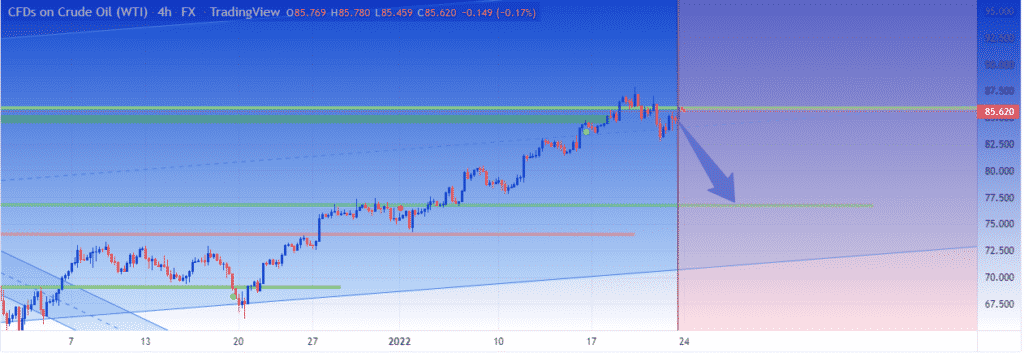

The bounce-back being registered on the USDCAD could be attributed to CAD weakening on oil prices retreating from seven-year highs. Oil prices which have been in a fine form in recent days have started edging lower, attributed to traders taking a profit.

Oil prices supply concerns

However, the pullback in oil prices could be short-lived as supply concerns come to bite. Rising tensions in Eastern Europe and the Middle East are already fuelling concerns about supply meeting demand. OPEC +, which includes Russia, are struggling to meet the monthly output target of 400,000 barrels per day.

Brent crude was up Monday morning to highs of $88.70 a barrel as US oil gained 72 cents to highs of $84.95 a barrel. The major oil benchmarks are on a five-week winning streak gaining about 2% last week to seven-year highs.

US equity struggles

The futures market rebounded Monday morning at the back of one of the worst runs last week in the equity markets. The NASDAQ remains one of the hardest-hit coming of one of the worst weeks since March’s pandemic sell-off. Tech-heavy NASDAQ index is now deep into correction territory.

Investors are extremely cautious in the equity market amid fears that the FED meeting this week will hint of rate hikes as early as March as well as move to shrink the balance sheet soon after.

Crypto sell-off

Meanwhile, the onslaught in the cryptocurrency market shows no pressure of easing with Bitcoin and Ethereum under immense pressure. BTCUSD has already slid to six month low of $35,249, with short-sellers setting sight on the $30,000 psychological level.

ETHUSD is also trading below the $3,000 level, having touched six-month lows of $2,415.