Mergers and acquisitions (M&A) are some of the closely-watched events in corporate America because of the market action they cause. In this article, we will look at what mergers and acquisitions are, why they happen, and some of the biggest players. We will also look at spin-offs, which are the opposite of M&A deals.

What are mergers and acquisitions?

Mergers and acquisitions are two different terms that work to have a similar outcome. A merger is a situation when two companies combine to form one bigger entity. When two companies of equal sizes combine, it is often known as the merger of equals.

On the other hand, an acquisition is a situation when a large company acquires a smaller company. For example, a company with a market capitalization of more than $100 billion can acquire one that has a market cap of $5 billion.

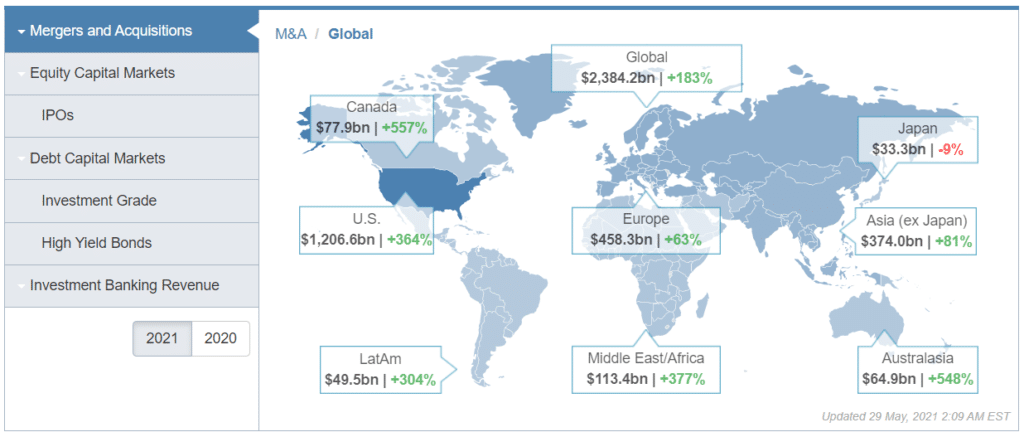

The number of mergers and acquisition deals is constantly growing globally. By May 2021, deals worth more than $2.3 trillion were made, according to the Wall Street Journal. Most of these deals were made in the United States, followed by Europe and Asian countries.

Mergers and Acquisitions in 2021.

Examples of top M&A deals

Hundreds of deals are announced every month. Some of the most iconic mergers and acquisition deals in modern times are:

- Apollo Global Management merged with Athene in a $9 billion deal.

- IBM combination with Red Hat in a $34 billion deal.

- Bristol-Myers Squibb merger with Celgene in a $95 deal.

- AB Inbev combines with SABMiller in a $108 billion deal.

- United Technologies combination with Raytheon in a $121 billion deal.

How the mergers and acquisition process works

The merger and acquisition is a relatively complicated process. Most large companies like Microsoft and Salesforce have employees that are tasked with looking at good companies to acquire or merge with. The employees look at these companies and evaluate the benefits that they will bring to their companies.

Analysts go through publicly-traded companies’ financial statements and identify whether they are a good fit. For privately owned firms, they look at their recent funding rounds and the nature of business.

After finding a good company, the management starts by hiring experts in the M&A industry. These companies use their experience to do due diligence on the other company. After this, the senior management meets with the other company with an offer.

The company being acquired also hires a team of lawyers and consultants who will help them evaluate the offer.

If the two companies reach an agreement, the next stage is to make the announcement public. In most cases, some of the negotiation members are tasked to leak the negotiations to notable media companies like the Financial Times, Wall Street Journal (WSJ), and CNBC.

After the deal comes public, the next stage is to seek regulatory approval. This is a mandatory stage because regulators must approve most deals. For example, a few years ago, US regulators opposed the M&A deal between Time Warner and AT&T for competition purposes.

For domestic deals, the regulatory process can take a few months. On the other hand, international deals can take years to complete. This is because the agreement needs to be approved by regulators in all countries that they do business in.

Top players in M&A deals

M&A is a long and complex process. For it to happen, companies require input from several entities. Some of the most important ones are:

- Lawyers – Attorneys are required in an M&A deal to come up with the legal documents that are necessary during the process. They are also maintained to deal with any legal issues that emerge.

- Advisors – These are companies that are tasked with advising the two parties. Some of the best known are Lazard, Evercore, and Moelis.

- Financiers – These are firms that help to finance an M&A deal. Some of the best-known are Goldman Sachs and Morgan Stanley.

- Public Relations – These are firms that are tasked with conducting the PR for the M&A process.

Why M&A happens

There are several reasons why companies decide to make M&A deals. Among them are:

- It is cheaper – At times, it is cheaper for a company to acquire another firm than commit to developing a competing process.

- To achieve scale – Companies do M&A deals to achieve the scale that is needed to compete with other firms. For example, Time Warner merged with Discovery to compete better with Netflix.

- Geographical expansion – Some companies merge to achieve a presence in a geographical region. For example, Cineworld acquired Regal Entertainment to grow its American presence.

- Investor pressure – At times, some large investors tend to force deals to improve shareholder returns.

- Assets increase – In some cases, companies in finance do M&A in order to increase their asset base. A good example of this was the Morgan Stanley acquisition of Eaton Vance.

Merger and acquisition arbitrage

For investors and day traders, mergers and acquisitions form an easy way to make money. Indeed, hedge funds that focus on merger and acquisition arbitrage hold billions of dollars in assets. This is a strategy where you invest or trade in the price differentials between the share prices of the company being acquired and that of the acquirer.

In theory, shares of companies making the acquisition tend to lag after the deal happens while those being acquired rise. The latter happens because the acquiring company needs to pay a premium for the deal to make sense. For example, Salesforce acquired Slack in a $27 billion deal. At the time, Slack was valued at about $18 billion, meaning that the firm paid a $7 billion premium.

On the other hand, shares of the company that’s acquiring tend to fall because it will likely increase its debt to finance the deal. At times, the firm will also need to slash its dividend to investors to fund the deal.

At other times, it is shares of the companies not in the deal that move. For example, in a highly consolidated industry, shares of the relatively small companies tend to move because they become targets of the larger entities.

Summary

Mergers and acquisitions are important events that tend to move markets substantially. In this article, we have looked at how they happen, why they happen, and some of the top strategies to trade them. However, it is worth noting that many mergers and acquisitions rarely achieve the intended goal. A good example is the recent AT&T and Time Warner deal that was abandoned in less than three years.