Mood EA is available at the MQL 5 marketplace with a price tag of $149. The algorithm has multiple inbuilt settings such as trailing start, stop loss and take profit that allows traders to control the risk-reward. To better understand the product and know if you should use it in your portfolio, we will analyze it in our Mood EA review.

Is investing in Mood EA a good decision?

Mood EA is an extremely aggressive trading robot that uses martingale and grid for trading. This accounts for bigger gains, but the account can result in a high drawdown or a margin call at any time. The current drawdown of the live results is at 75.3%, which proves that the algorithm is not a good choice for traders.

Company profile

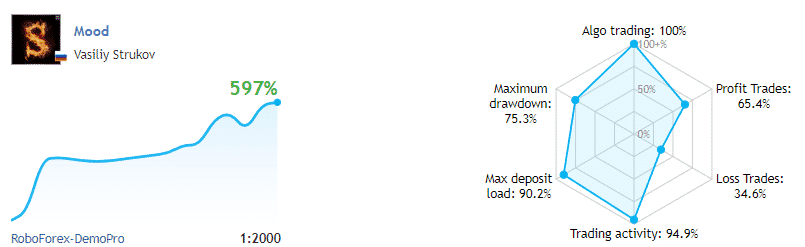

Vasiliy Strukov is the author of the product who resides in Russia. He has a total rating of 5 for 540 reviews. The developer has 16 products published on the MQL 5 marketplace and has 0 subscribers for his services. He has trading experience of 2 years, according to the website.

Main features

The robot comes with the following main features:

- There is a drawdown control system to prevent huge losses

- The stop loss and take profit for each trade can be configured

- Traders can turn the hedging option on and off

- There is a spread protection system built within

To install the EA, use the following steps:

- Purchase the system from the developer from the MQL 5 marketplace

- Download the product on the MT4/5 platform

- Place it on the charts to start trading

Strategy

The developer states that the EA trades using the momentum indicator. It utilizes the overbought and oversold conditions of the expert advisor and places trades accordingly. From the history of MQL 5 results, we can see the use of grid and martingale strategies. The algorithm holds the trades for an average of 15 hours and works on multiple currency pairs.

Price

The robot is available for an asking price of $149. There are no renting options present for now, and there is no money-back guarantee.

Trading results

There are no backtesting records available which raise many concerns about the efficacy of the product. The chances of failing the historical records are high due to the implementation of grid and martingale.

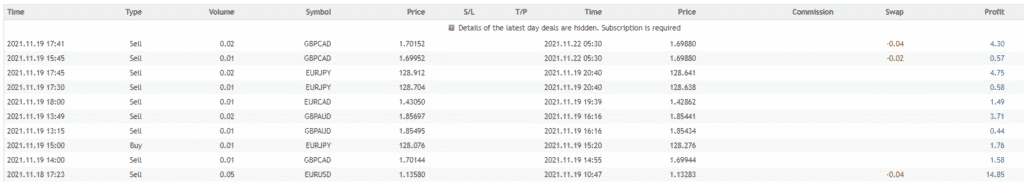

Verified trading records are available on MQL 5. We can see the performance from November 11, 2021, till the current date. The system made an average monthly gain of 597.49% during the period, with a drawdown of 75.3%. The stated drawdown shows that the account nearly reached a margin call while trading. The winning rate stood at 65.39%, with a profit factor of 3.26. The best trade was $1300.77, while the worst was -$313.78 in 289 trades.

Interesting facts

There are multiple customer reviews available at the MQL 5 marketplace where users seem to be content with the system. One of the users states that he has tested it for a week and that traders should use it according to their risk appetite. The feedback may have been purchased by the developer himself.

Is Mood EA a viable option?

Advantages

- Live records are available

Disadvantages

- No backtesting records

- The drawdown is high

- Uses grid and martingale trading

Summing up

Mood EA is using aggressive trading strategies, which results in a high drawdown. This can cause the system to cause complete liquidation of your portfolio. Traders have to be cautious with the use of such an algorithm at all times. It is better to avoid the robot for now and see how it performs in the future.