Prop Firm EA works on 25 currency pairs and tries to maintain a low drawdown of 4.28% with the aim to make 10 to 28% a month. It does not use a dangerous martingale strategy. The developers claim that it can pass the trading challenge of funded firms. The challenge model has some hard and fast rules that traders must obey. Let us see if the promises made by the robot hold its worth on a real account.

Is investing in Prop Firm EA a good decision?

We have analyzed all the pros and cons of the algorithm through the claims made on the website and the actual results on Myfxbook. After all the observations, we conclude that the robot is not fit for use.

Company profile

The company is not transparent about the developers of the program and their location. They present their registered name as SINRY ADVICE WORLDWIDE (TR0214386-K) and provide Jalan PJS 2C, Taman Medan, 46000, Petaling Jaya, Selangor, Malaysia as their address.

Main features

The software comes with the following main features:

- It can work on all 25 pairs simultaneously

- It can pass the trading challenge presented by prop firms

- It does not use martingale and has spread control

- It uses a news filter to avoid trading in uncertain market conditions

- It can work on funded and personal accounts

To install the robot, it is important to follow the following steps:

- Place the robot in the experts’ directory of MT 4

- Enable the auto trading tab

- Attach robot to all the 25 currency pairs and load the set file to start trading

Strategy

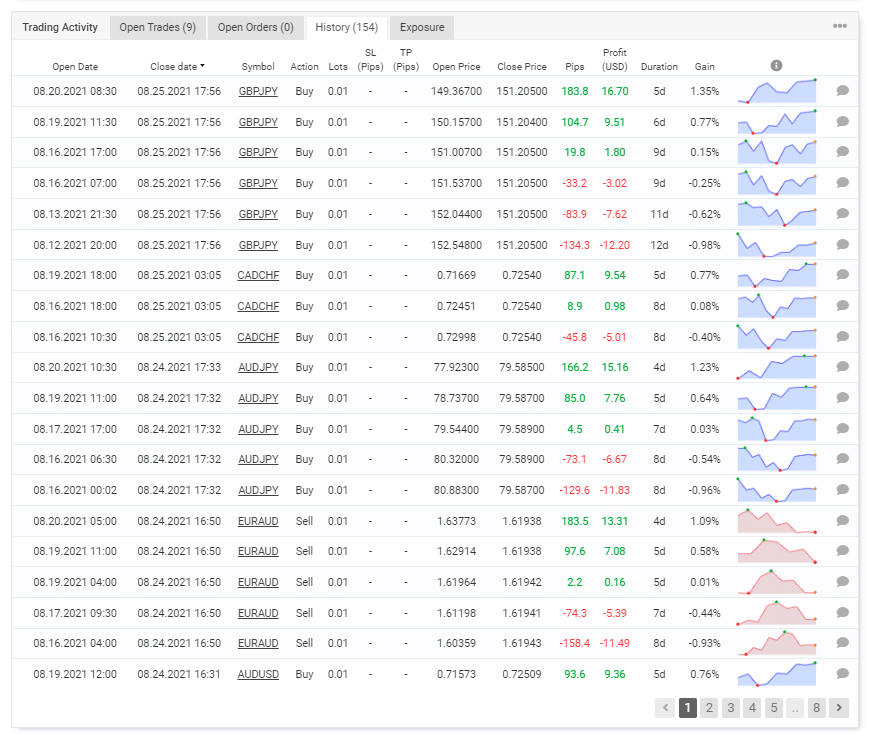

The robot uses a top-bottom reverse strategy and also employs a grid approach to trades. The grid method can result in a high drawdown which is evident from the records on Myfxbook. Through the trading history, we can see that it also does not use a stop loss which makes it riskier.

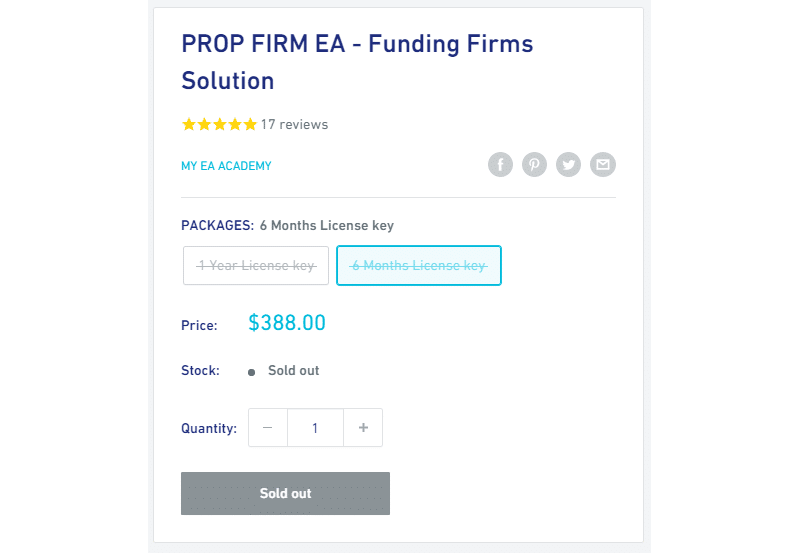

Price

The robot is currently sold out and is not available to the general community. Previously it was sold for $588 with a license for one year and $388 with a 6-month key.

Trading results

It is sad to note that there are no backtesting results available for the algorithm. The robot might have failed during the procedure or had a high drawdown. The lack of transparency on this part raises many concerns about the efficiency of the product.

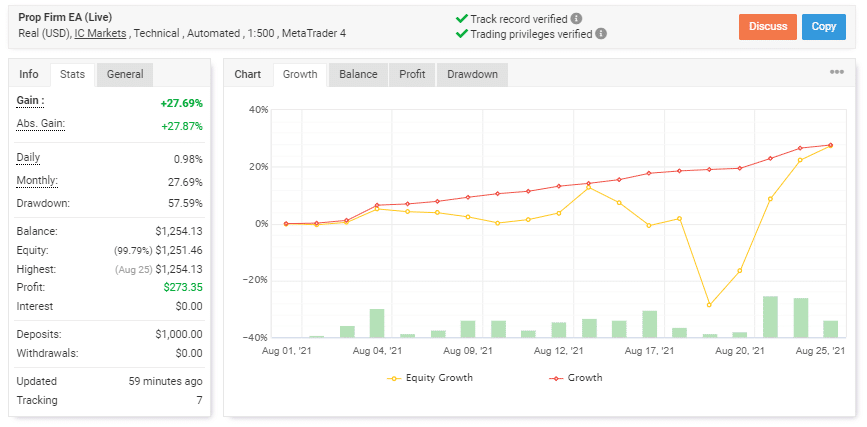

Live trading results are available on Myfxbook, which show performance from Aug 01, 2021, till the current date. Since then, the robot has had an average monthly gain of 2769%, with a drawdown of 57.59%. The stated drawdown is super high, showing that the robot loses more than half of the trading capital. This is much higher than what the company claims on the website. They are lying about the system to make sales and scam customers.

There were 162 trades in total, with 1.62 lots traded. The expert advisor traded with a winning rate of 73% with a profit factor of 2.39. The best trade was $17.29, while the worst one was -$12.29.

Interesting facts

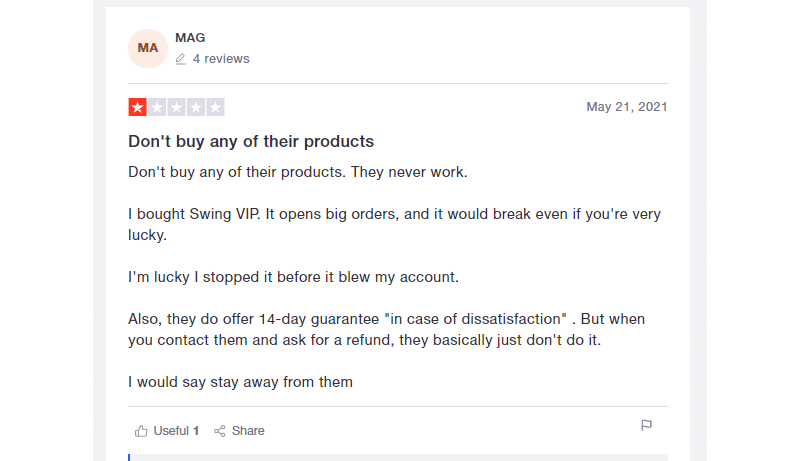

There are 54 reviews available on Trustpilot, which gives the company a rating of 4.0. Customers warn traders that the robots offered will blow up your account. They state that the company doesn’t obey their refund policy.

Summing up

Prop Firm EA is not a profitable algorithm. There is a high drawdown on the account, which exceeds our expectations. The company is not transparent about the poor performance of the algorithm