Cryptocurrency trading has become a relatively popular method of making online. Indeed, the volume of trades by most exchanges has been on an upward trend. Also, in its recent S-1 filings, Coinbase revealed that it had more than 43 million active users on its platform. Binance has more than 100 million users.

Therefore, in this article, we will look at some of the most important risk management strategies cryptocurrencies traders should always follow.

What is risk management?

As the number of cryptocurrency traders increases, one thing is certain – most of them will lose money. This is partly because most of them don’t have vital trading experience. It is also because many traders don’t even know how to separate a good broker or exchange from the wrong one.

Risk management is, therefore, an approach where you assess the prevailing risks and work to minimize them. The goal is to make maximum returns while limiting your exposure to risks. As you will realize, some of these strategies are relatively advanced or technical, while others are relatively simple.

Broker or exchange selection

The easiest method of minimizing risk is selecting the trading platform or exchange. There are three primary types of trading platforms you can use to trade crypto.

First, there are Contracts for Difference (CFD) platforms that have incorporated digital currencies in their platforms. Some of these brokers are Oanda, FxPro, and easyMarkets. Second, you can use the traditional brokers that have also added cryptocurrencies in their platforms like Robinhood and E*TRADE. Finally, you can use crypto exchanges that also provide wallet services like Coinbase, Binance, Crypto.com, and Huobi.

Ideally, you should first do your research on the platform you decide to use. To minimize your risk, we recommend that you select a mainstream company that is also well-known. You should simply avoid the relatively new niche companies that come up.

In the past few years, many crypto traders have lost a lot of money because of selecting the wrong broker. For example, in 2018, traders using Quadriga Fintech Solutions lost money when the founder died. He was the only one with the wallet’s password.

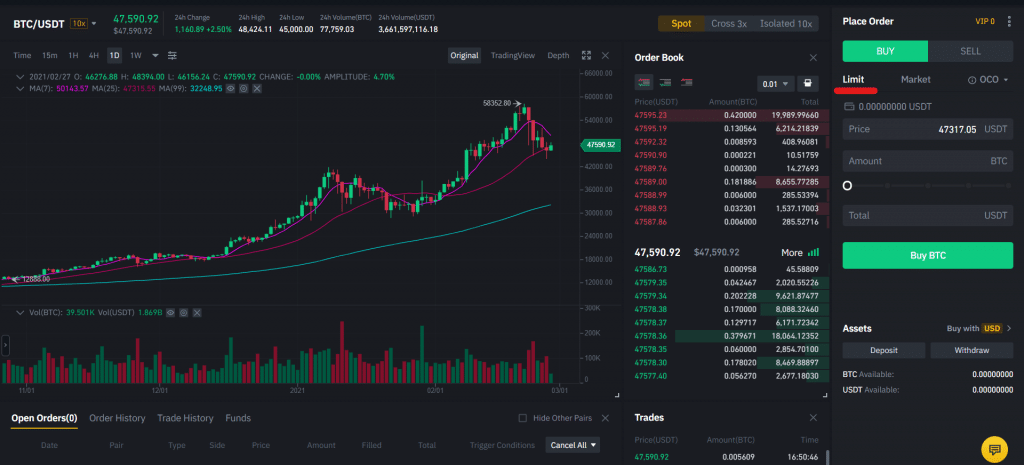

Using limit orders

Cryptocurrencies are relatively volatile products. It is not uncommon for the price of Bitcoin to go up or down by more than $4,000 per day. One simple method of avoiding this is to use limit orders, which are provided by many exchanges.

A limit order is an order type where you direct an exchange to open a trade when it reaches a certain point. It is the exact opposite of a market order, which executes a trade at the current price.

There are four main types of these orders. First, there is a buy stop, which executes a purchase trade above the current market price. A sell stop is the opposite, and it opens a sell trade below the price. Second, a buy limit is one that initiates a buy order below the market price. A sell limit shorts the price above the current price.

There is also another type of order that is known as One Cancels the Other (OCO) order. This is where you place a limit order with a stop-limit order.

Using limit orders is a good risk management approach for two reasons. First, it is a simple way of reducing slippage. Second, it ensures that your trades are filled at a place where you have identified as being important. For example, if Ether is trading at $1,900, you can place a buy-stop order at $2,050. In this case, you could argue that the price will continue soaring if it crosses the psychological level of $2,000.

Limit orders in Binance

Be careful about leverage

Many crypto exchange companies like Binance and Coinbase allow margin trading. This is a trading approach where you use borrowed funds to maximize your profits. For example, if you have a $10,000 account and Bitcoin Cash is trading at $400, you can only buy 25 of them.

However, if you use a 3x margin, you will be able to buy 75 coins. Therefore, if the price rises, you will make more money if you are using leverage.

Many professional traders use leverage to amplify their trades. However, in reality, it usually increases their risk exposure because of the borrowed funds. In fact, with leverage, you can lose more money than your original balance.

Therefore, we recommend that you use as little leverage as you can at first and then add to it as you gain more experience.

Stop loss and trailing stop

Another important crypto risk management approach is to use a stop loss and a trailing stop. A stop loss is a tool offered by many exchanges and brokers that stops your trades automatically when the price reaches a key level.

For example, if you bought a cryptocurrency at $200, you could place a stop loss at $185. In this case, the broker will close the trade automatically when it drops to $185. The benefit of setting a stop-loss is that it ensures that you lose the money you are comfortable losing. It also protects you during periods of high volatility.

A trailing stop is a type of stop-loss that moves with the cryptocurrency’s price. For example, if you buy crypto at $200 and its price rises to $250 and then drops sharply to $200 or below, the trailing stop will capture some of the initial profits.

Summary

Risk management is an important strategy when you are trading cryptocurrencies and other financial assets. In this article, we have looked at some of the most important strategies to minimize your risk. But we have not scratched the surface.

Some of the strategies we have not looked at are position sizing, having a take-profit, backtesting a trading robot, using volume, avoiding overnight positions, and trading popular cryptocurrencies like Bitcoin and Ethereum.