Summary

- Increased production is expected to offset higher demand, thereby stabilizing prices.

- High prices in the current season are expected to lead to increased acreage by farmers next season.

Sub-optimal weather to affect production in South America

Since mid-last year, soybean prices have been on the ascent, driven by high demand in the Chinese market and sub-optimal weather in Brazil and Argentina. According to a report released by the International Grains Council last week, there has been a spike in demand for oilseed. This is expected to drive up the demand for soybean, leading to a price upsurge.

Brazil remains the world’s largest soybean exporter, while China is the biggest export market. For the United States, the Chinese market is critical, considering that soybean constitutes about 60% of all of its agricultural exports to the market.

The current price rally is expected to stimulate increased production in the coming season, as farmers will be hoping to increase their profit margins going forward. IGC estimates that the next season will experience a 6% increase in production to new highs of about 383 million metric tonnes. Trade is expected to involve about 173.4 million metric tonnes. This may offset potential increased demand, thereby stabilizing prices.

In Argentina, it has been reported that about 53% of the expected soybean yield has already been harvested. This is however below the 66% average reported in the past five years. This means that the current rally may slow down as more harvest comes in.

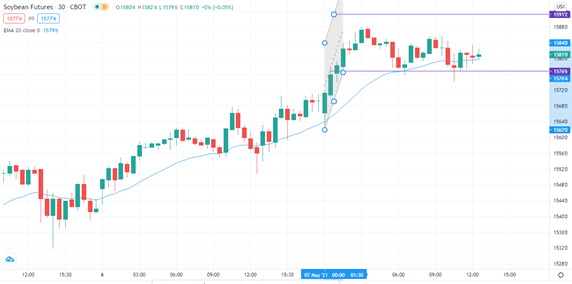

Futures market responding to productivity

As unfavorable weather continues to hamper yields in Brazil, soybean futures have been on the rise. May contracts have more than doubled from $7 per bushel to about $15 per bushel in the US market.

Soybean futures have risen by 27% since January 2021. In Chicago, November futures crossed the $14 per bushel mark, an eight-year high price. The January-April rise is the best on record since 1969. On Wednesday, the contracts were at $15.42 per bushel, an increase of 4 cents over the previous session’s price.

The current market highs are perhaps linked to the March 31 Prospective Plantings report by the USDA that US farmers were likely to reduce the acreage of soybean in the coming season. However, as intimated above, the prevailing high prices may trigger increased acreage.

Low carryover and an expected rise in Chinese imports

The impact of carryover crops may be diminished this season. According to the April 9th report by USDA, the figures were revised downwards from 525 to 100 million bushels for September 1st, 2021. The authority also adjusted demand figures from March estimates, raising the 2020-21 exports projections by 30 million bushels.

The projection may be already in play, with China reporting an 11% increase in imports in April compared to the same period last year. This represented about 7.45 million metric tonnes, compared to 6.71 million metric tonnes imported in April 2020. However, the Chinese figures in this instance were attributed to arrivals from Brazil which had been delayed earlier.

Technical outlook

The current price rally has crossed the 20-period exponential moving average which signals that the price could move higher.

Using the current momentum, the price is likely to find support at $15.76. An upward movement will encounter the first resistance at $15.84 and the second one at $15.91. A bear-controlled market will see the price move to $15.62.