Stocks are among the best investment assets because of their long track record. For example, the S&P 500 index has more than doubled in the past five years. It has jumped by more than 80,000% since the 1970s. The Nasdaq 100 index, on the other hand, has risen by >10,000% since 1985. In this article, we will provide a top to bottom approach to analyze stocks.

Start from the industry level

There are thousands of companies you can invest in in the United States. There are approximately 2,600 companies listed on the New York Stock Exchange (NYSE) and 3,300 listed in the Nasdaq. Further, there are thousands of American Depositary Receipts (ADR), which are international companies you can invest in.

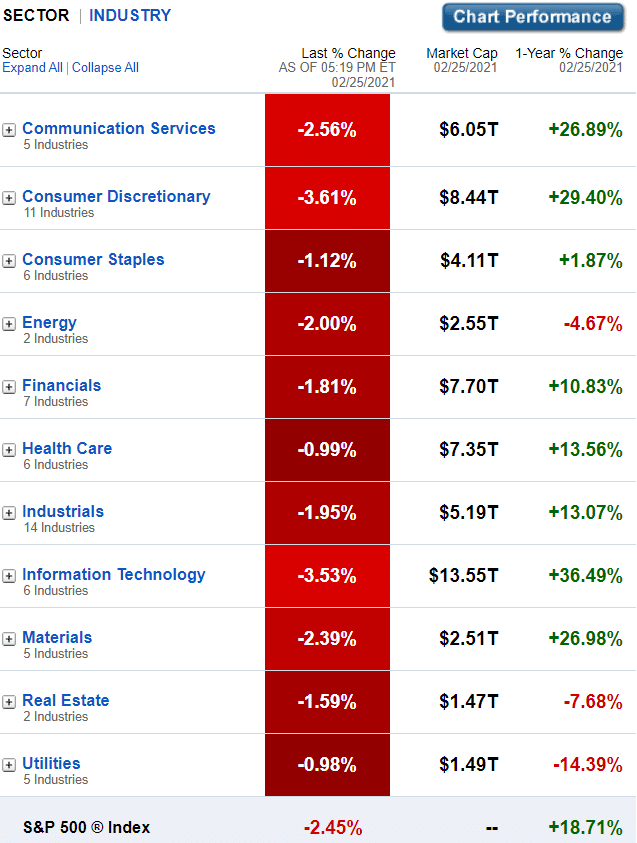

Broadly, all companies in the US are put into 11 key categories based on what they do. Some of these categories are consumer staples, consumer discretionary, healthcare, technology, and real estate. According to Fidelity, the technology industry is the biggest in the country, with a market cap of >$13.5 trillion. It is followed by consumer discretionary, financials, healthcare, and communication services.

S&P 500 sectors

In a top to bottom investment analysis, you need to start with the industry because investors value these companies differently. For example, companies in the technology sector tend to have higher price-to-earnings (PE) than those in the oil and gas sector. That’s because technology firms like Salesforce and Microsoft tend to have faster growth than energy firms.

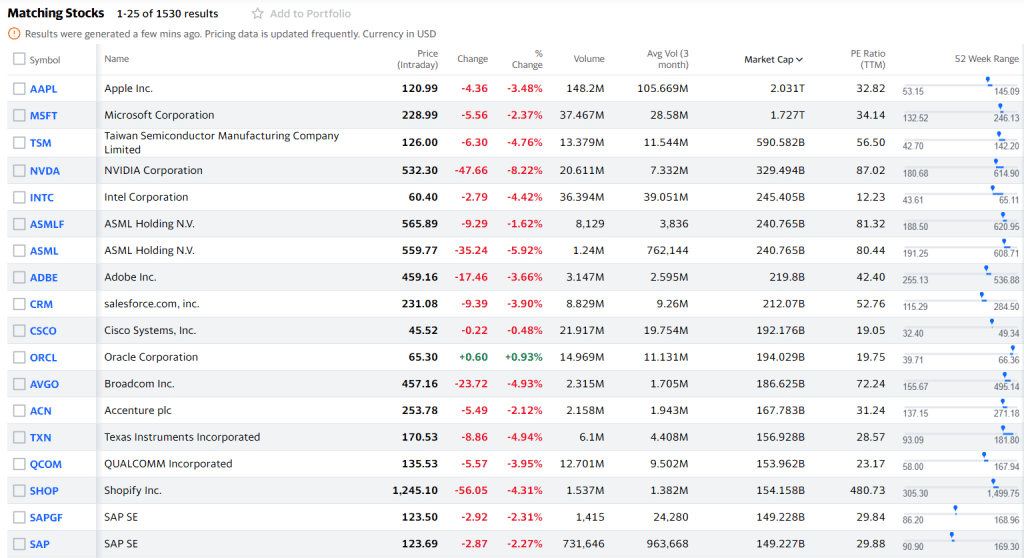

A simple way to approach this is to use a free screener. Fortunately, there are many websites that allow you to screen companies based on their industry. Some of the most popular ones are Yahoo Finance, Webull, and Barchart. The chart below shows some leading technology companies.

Technology companies

We recommend that you should only invest in companies that are in a growing industry.

Learn more about the company

After finding a company that interests you, we recommend that you learn more about it. You should start by first visiting its website and seeing the services and products that it sells. Most importantly, you should download its annual report, also known as S-1, for more details.

According to the SEC, all companies must submit an S-1 document every year. This document has several mandatory sections like business description, select financial data, director and executive remuneration, and other exhibits.

The S-1 document is important because it gives you all details that you need about a company. For example, the document has a segments section that explains how the company makes money.

Look at its financials

The next stage in conducting a top to bottom analysis for a stock is to go through its latest financials. Ideally, there are three key documents that you need to look at:

- Income statement. Also known as a profit and loss, it is a document that shows the company’s revenue and its overall profitability.

- Balance sheet. This document shows the company’s financial position. It shows its total assets and liabilities.

- Cash flow statement. This is a document that shows how a company spends its cash. In it, you will find cash flow from operations, cash from investing opportunities, and cash flow from financing activities.

Ideally, you want to invest in a company whose revenue is growing and one that has a strong balance sheet. In the balance sheet, look at the total cash and short investments and compare them with the total debt. If a company has a huge debt, go to the cash flow statement and see the performance of its free cash flow.

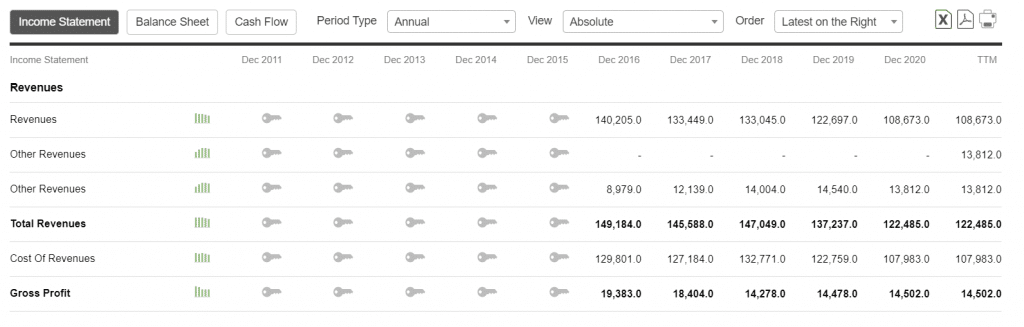

As you will find out, some of the most valuable companies don’t generate a lot of profit. For example, while Tesla is the world’s most valuable automobile company, it only had revenue of $31 billion in 2021 and a net profit of $721 million. In contrast, General Motors, which has a smaller valuation than Tesla, made more than $122 billion in revenue and $6 billion in profit.

This is simply because Tesla had a faster revenue growth than GM. Also, it has a strong market share in the fast-growing electric vehicle industry.

You can get a company’s financial statement from its annual and quarterly releases. However, we recommend that you use free online platforms like Yahoo Finance and Seeking Alpha to get this information. The chart below shows a section of General Motor’s income statement.

GM income statement

Read recent news and analysts calls

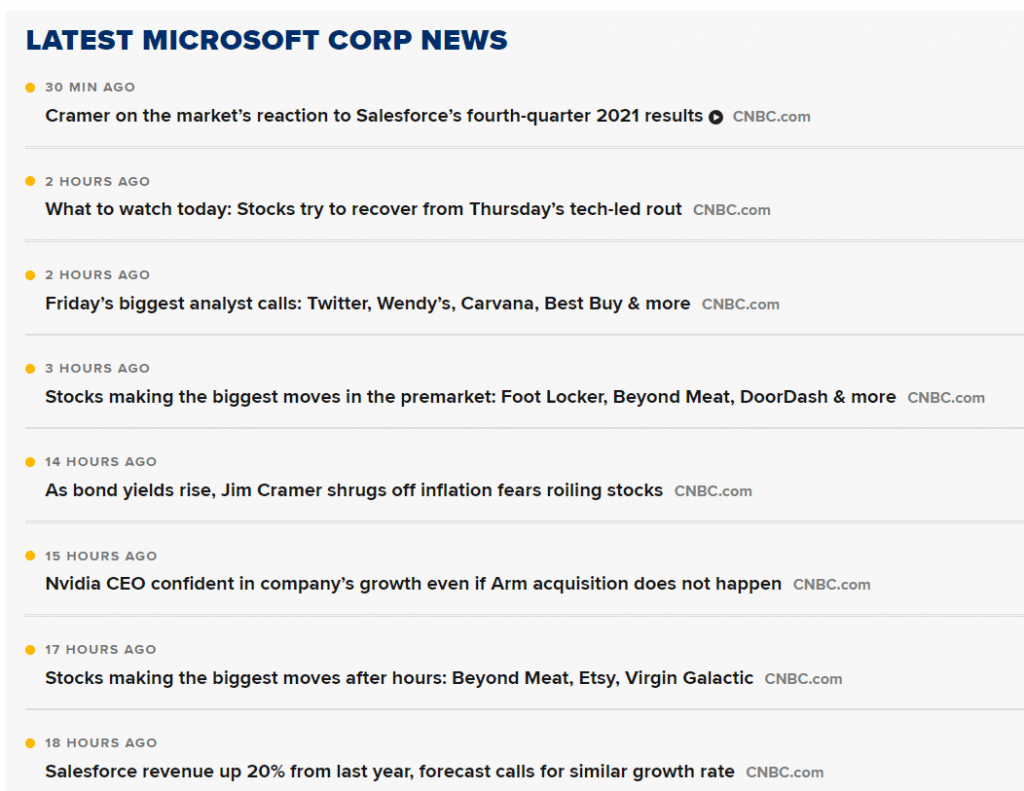

Before you invest in a company, it is important that you look at its recent news and events. To get the latest news, we suggest that you use popular financial platforms like CNBC, Wall Street Journal, and Financial Times. Taking time to read this information will help you understand where the company is and some of its recent market activities.

Microsoft news

In addition, you should read the recent analyst estimates of the company. Marketbeat is a good website that compiles the latest analyst calls, while SeekingAlpha provides crowdsourced information.

Company valuation

In the past few years, there have been concerns about company valuations. Most analysts have pointed to highly valued companies like Tesla, Shopify, Twilio, and Okta. As mentioned above, a company like Tesla is valued at more than $800 billion despite the fact that it only made a net profit of $700 million in 2021.

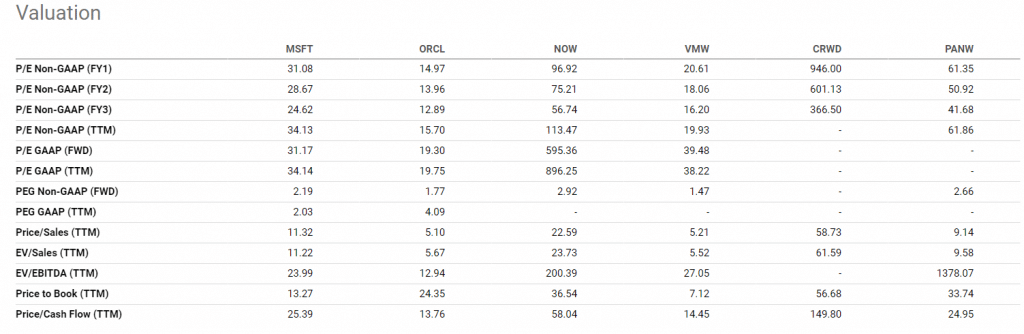

There are many approaches to valuing a company. One of the advanced ones is known as the discounted cash flow (DCF), which attempts to look at the net present value (NPV) of a company. Another popular strategy aims to compare popular metrics like PE, price-to-sales (PS), EV to EBITDA, and price-to-free cash flow (PCF).

Ideally, a company with a lower ratio is said to be cheap. However, this does not mean that you should invest in firms with low ratios. In fact, in the past few years, companies with higher ratios have performed better than their counterparts. For example, as shown below, Microsoft has higher multiples, but it has done better than Oracle.

Valuation ratio table

Summary

We have looked at a top to bottom approach to analyzing a stock. In summary, you should start by looking at the industry, learn more about the firm, look at its financial documents, then the latest news, and finally look at its valuation.