Over the last few years in the crypto world, it seems like there’s a new emerging trend every few months, from decentralized exchanges, smart contracts, non-fungible tokens, and the list goes on.

One such miraculous proposition has been yield farming. While the concept has existed for a few years, it arguably became more prominent in 2020. In simple terms, yield farming is about using your crypto to make more cryptos for earning some yield.

Crypto investors or ‘farmers’ are on the hunt for farming the best ‘crops’ and receive better returns than they ever could from a traditional financial institution. According to CryptoSlate, coins with yield farming capabilities contribute close to 1% (or about $15 billion) of the entire crypto market.

Yield farming is pretty much the ‘rocket fuel’ of DeFi or decentralized finance. The primary methods of holders ‘yield farm’ are staking and lending.

Although these concepts may seem a little complex, fear not, since this article will break them down into simple-to-understand parts, how everything basically works, and the platforms are partaking in yield farming. Without further ado, let’s dig in.

What exactly is yield farming?

At its core, yield farming is a process in cryptocurrencies where you lock or allocate your holdings to a designated protocol to generate returns or rewards in the form of more coins. It is essentially a method to earn passively from your tokens.

Yield farming is also referred to as liquidity mining because when you have your holdings locked up somewhere, you effectively provide liquidity. For any financial instrument to function seamlessly, it needs to be highly liquid.

This concept is similar to how banks offer clients interest when saving money, where they use those funds to lend out to other clients in a pool. In crypto, this quality allows millions of traders or investors to buy and sell coins instantly without any issues.

For instance, if you borrowed some of your Ethereum holdings to a service, you increase the circulation of ETH for lenders who may need them. For these efforts, one receives a pre-defined return.

Countless recognized exchanges (Binance, Coinbase, Kraken, and many more) and specialized DeFi protocols (MakerDAO, Aave, Uniswap, and others) provide yield farming services.

In terms of earnings, such services use the annual percentage rate (APR) or annual percentage yield (APY) to calculate rewards. So, for instance, if a project offered a 10% APY for a $10 000 investment, you would effectively be earning about $2.79 (1000 divided by 365) daily until the end of the locking period.

However, these rates do fluctuate and are never constant. Moreover, they do not consider compound interest. Yet, the returns are often much better than conventional financial institutions, hence the enormous interest in yield farming.

The main methods of yield farming

Now, let’s cover the primary methods to ‘farm yields.’

- Staking: To stake means to ‘lock’ or ‘freeze’ your coins on a proof-of-stake (PoS) blockchain to maintain its security and earn recurring rewards. A PoS network is advantageous for investors in that they do not involve themselves in expensive computational mining, prominent in proof of work ledgers.

Moreover, the holder has no work other than committing the minimum investment for a predetermined period. A PoS blockchain randomly selects validators or forgers (instead of miners) based on the size of their stake.

Hence, the magnitude of your rewards depends on how much you’ve staked. Some projects have no leeway in the locking period, which may be for a week, a month, three months, six months, or even longer.

Other services are more flexible and allow investors to withdraw their stake (along with the rewards) at any time, sometimes at a small or no penalty. As a ‘staker,’ you partake in an eco-friendly method of generating new cryptocurrencies, which is one of the main advantages. Secondly, no mining work is involved.

On the downside, you first have the natural depreciation uncertainty of any cryptocurrency and that no insurance typically exists. Other projects may also require a substantial financial commitment which may not be affordable for the average Joe.

- Lending: This yield farming avenue is also quite popular, where holders lend their cryptocurrencies to others on a platform or exchange to earn interest for a defined period. Borrowers, including ordinary traders and even large financial institutions, typically have to put up collateral (in the form of a supported token) to receive the loan.

Hence, lending in this fashion is somewhat less risky than an unsecured method with no security. For the investor they can regard it as a way of saving their money to earn interest. Similar to staking, there are still the risks of currency depreciation during the whole farming process, a substantial financial commitment, and the lack of insurance.

Best yield farming protocols

As previously mentioned, countless exchanges offer a myriad of yield farming products. However, here, we’ll provide a list of protocols specifically designed for this purpose and a brief description of what they do.

According to CryptoSlate, the top 3 services by trading volume with yield farming functionality are:

1. PancakeSwap

PancakeSwap is one of the largest decentralized exchanges (DEXs) currently. Its primary function is for the swapping of BEP20 or Binance Smart Chain-based cryptocurrencies. The exchange has a utility token, the aptly named CAKE, responsible for paying fees on the platform.

CAKE holders can stake this token for more CAKE and be rewarded with tokens from other projects. PancakeSwap offers some of the highest APY rates in the industry.

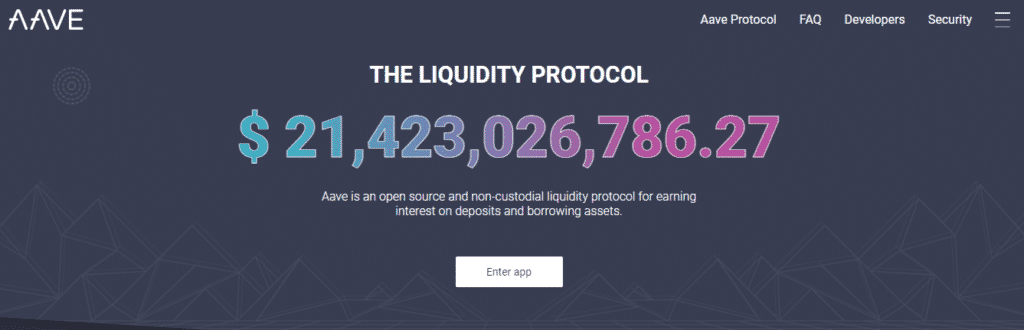

2. Aave

Aave is a multi-faceted decentralized lending/borrowing protocol where users can lend and borrow from over 20 cryptocurrencies with fair interest rates and fees. Aave also has a staking service on its platform and additionally allows for ‘flash loans.’

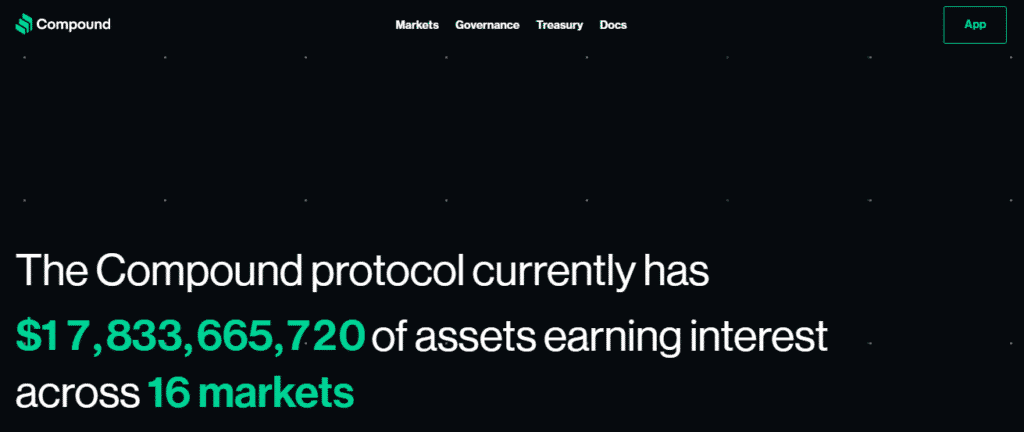

3. Compound

Compound is also a DeFi protocol with similar functions to Aave as it permits lending and borrowing on numerous cryptos with reasonable interest and fees. Users can borrow from 16 markets, including Ether, USD Coin, Dai, Tether, and Uniswap.

Final word

So, is yield farming yet another bubble, or is it sustainable? Experts have provided mixed views in this regard, considering the present levels of hype around this activity. The frenzy can bring about unintentional congestion causing a number of liquidation issues and price corrections.

Like any investment, investors need to perform their due diligence and appreciate the risky ‘uncharted territory’ of cryptocurrencies. Nonetheless, who knows what DeFi has under its sleeve, and it will be interesting how it will contribute to the future of accessible finance for everyone.