Interest rates and the overall monetary policy in a country play an important role in the financial market. For example, the relentless rally that happened during the Covid-19 pandemic was attributed to the lax policies by central banks like the Federal Reserve, the European Central Bank, and the Bank of England (BOE).

Therefore, with the global economy recovering, there is a likelihood that central banks will start tapering their asset purchases and hike interest rates. Some central banks like Norges and the Reserve Bank of New Zealand (RBNZ) have already started hiking rates. The Fed and the BOE will likely be next. So, let us look at some of the top stocks to invest in when rates start rising.

Sector rotation in stocks

Before we look at the specific stocks, we need to look at the concept of sector rotation in the financial market. This term refers to a situation where investors move from one asset to the other. For example, in a period of low-interest rates, investors tend to rotate from value stocks to growth stocks.

This is simply because low rates lead to what is known as a risk-on sentiment. For example, during the Covid-19 pandemic, growth stocks such as Roku and Okta did well. On the other hand, the so-called value stocks lagged.

Therefore, before and when interest rates start rising, we will likely start seeing sector rotation from growth to value. For example, the financial segment has been the best performing sector in Wall Street this year.

Goldman Sachs (GS)

Goldman Sachs is a leading Wall Street bank that offers several services. Some of these services are investment banking, wealth management, and consumer banking, among other services. In its investment banking, the company offers services like mergers and acquisitions advisory and trading.

Goldman Sachs will benefit from higher interest rates in several ways. First, higher rates tend to lead to higher volatility in the financial market. Banks that offer fixed income, commodities, and currencies (FICC) business do well when there is high volatility.

At the same time, many companies that gained significant valuations during a period of low-interest rates will start looking for growth elsewhere. This could lead to more demand for mergers and acquisitions. Indeed, this trend has already started.

The volume of transactions this year has already risen to more than $6 trillion. Therefore, as one of the leading players in the industry, Goldman Sachs is expected to benefit from this trend.

Its lucrative wealth management industry is also expected to see strong performance as many wealthy individuals look for strategies to manage their wealth. Most importantly, its consumer business will benefit from the overall higher interest rates in the US.

Mastercard (MA)

Mastercard is a financial services company that is best known for its card business. The company partners with banks and other financial services companies that offer debit and credit cards. The firm then makes money whenever these customers buy both online and offline. Unlike the contrary belief, companies like Visa and Mastercard are never exposed to the loans that their credit cards offer.

There are several reasons why Mastercard, Visa, and American Express share prices are expected to do well when interest rates keep rising. First, higher rates happen when the economy is doing well. This means that consumer confidence is high. Therefore, it means that the companies are expected to see more transactions from their customers.

Another reason is that Mastercard is a global company that has exposure in almost all countries. Therefore, rising interest rates could be offset by lower rates in other countries.

Meanwhile, the global economy is reopening, and more people are expected to travel more. This is a good thing for Mastercard because this will mean a rebound of airline and hotel bookings. It also means that the firm will benefit from the rising spending among customers as they travel.

Therefore, there is a likelihood that the Mastercard stock price will keep rising as interest rates keep rising.

Evercore (EVR)

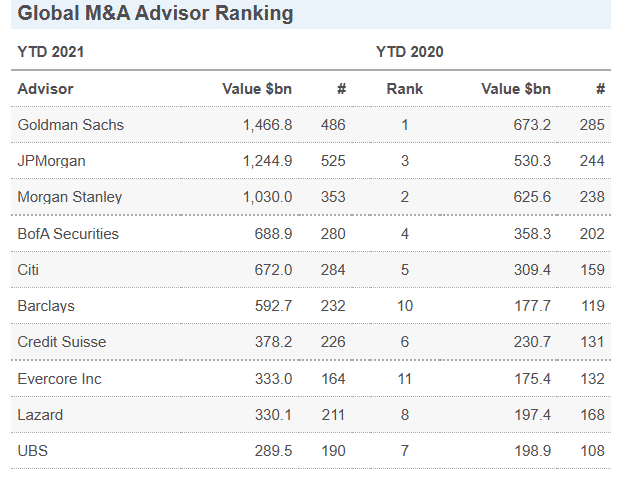

Evercore is a relatively small boutique investment bank that has a market capitalization of more than $7.2 billion. The company provides three key services. It offers global advisory services to companies. This includes services like restructuring, IPOs, and capital markets. It also offers institutional equities and investment management. The table below shows that Evercore is the best-performing boutique bank in M&A advisory.

Global M&A advisor ranking

There are several reasons why Evercore is a good investment in a period of high rates. First, high rates will likely lead to bankruptcies, which will be a good thing for the firm’s restructuring business. Second, as I noted with Goldman Sachs, the company will benefit as consolidation grows. Third, it will make more money in interest income.

The Progressive Corporation (PGR)

Progressive and other insurance companies benefited substantially during the pandemic since more people paid for insurance and did not file claims. Indeed, the company’s annual profit in 2020 was about $5.7 billion. This was substantially higher than the $3.9 billion that it earned in the previous year.

This year, the company’s profits will be lower than in 2020 because claims will start rising. However, as one of the biggest insurers in the US, the firm will also benefit from higher interest rates. This is because most insurers make money by investing money they receive from their policyholders. Other insurance companies that will benefit are Chubb, Aon, Allstate, and Willis Towers Watson.

Summary

In general, investors tend to allocate their funds in advance before interest rates rise and fall. While this is important, historically, stocks tend to perform well no matter how interest rates are. Therefore, while these stocks will likely do well as rates start rising, there is a possibility that other companies will do good as well.