The fintech industry has done relatively well in the past decade as more people have embraced digital spending. For example, a company like Square has grown from a small payment processor into a $100 billion diversified group. Similarly, PayPal has become one of the biggest companies in the world.

Other popular companies that dominate their industries are Stripe, Visa, and Mastercard. In this article, we will look at some under-the-radar fintech stocks that you should invest in today.

LendingTree (TREE)

LendingTree is a fintech company that was started in 1996. The firm has grown its market capitalization to more than $2.4 billion. It has also grown its annual revenue to over $1 billion.

The company helps customers make informed decisions when taking home loans, personal loans, credit cards, and insurance products. It does this by letting them compare the products offered by more than 800 companies in the United States. As a result, it makes money through commissions whenever a customer buys a product from its partners.

LendingTree operates in a relatively competitive industry. However, its diverse products help the firm to grow its moat in the financial industry. For example, through its platform, customers can check their credit scores for free. They can also use its refinance, mortgage, and home equity calculators for free.

The company has also used its balance sheet to make strategic acquisitions. For example, in 2020, it acquired Stash Financial, a company that helps customers invest in a variety of assets like stocks and exchange-traded funds. In 2021, Stash had more than 5 million customers and exceeded $2.5 billion in assets.

Other companies LendingTree has acquired in the past are Value Holding, QuoteWizard, and Student Hero Loan.

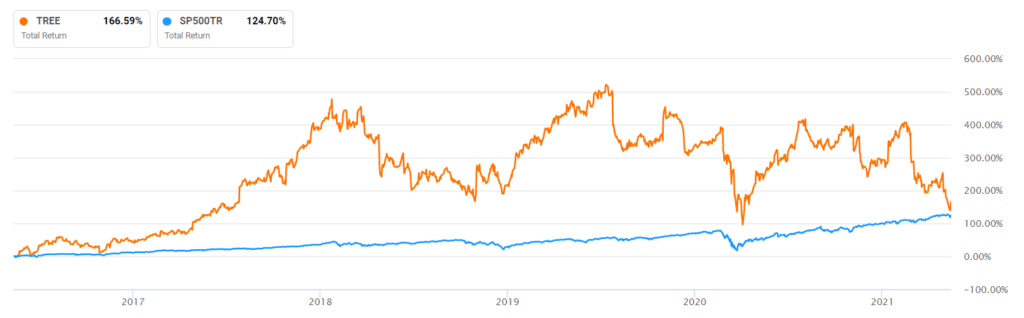

LendingTree has underperformed the market in the past three years partly because of the pandemic and the losses the company has accumulated. This decline has made the company’s valuation relatively cheaper.

LendingTree vs S&P 500

Further, analysts believe that the stock will recover. For example, Needham analysts believe that it will rise to $300 from the current $185. Similarly, those at Oppenheimer, Northlands Securities, and JP Morgan also believe that the stock will rise to above $300.

Shift4 Payments (FOUR)

The payment processing for companies is a big business. Furthermore, it is estimated that there are more than 30.2 million small businesses in the country. Most of these companies don’t have the technical capacity to build their payment processing tools. As a result, they depend on other companies that have the technology to process their payments.

Square is the best-known company in this industry. Shift4 Payments is a relatively small – but fast-growing – company in the industry. It has a market capitalization of over $6.6 billion and annual revenue surpassing $768 million.

The company provides a payment platform that offers end-to-end payment processing, reporting and analytical tools, e-commerce integrations, and point of sale solutions. The firm provides solutions to more than 185,000 customers in the United States.

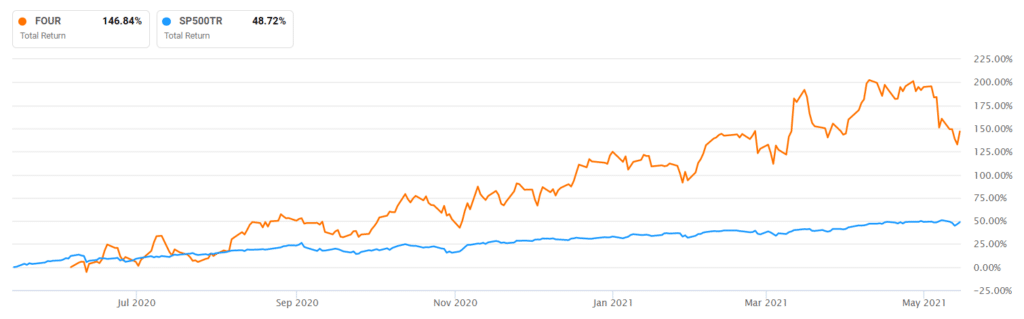

Shift 4 Payments vs S&P 500

You should invest in Shift4 Payments for several reasons. First, there is a large total addressable market in the payment industry.

Second, the company has more ways to monetize its business. For example, Square has succeeded by offering loans to the companies it serves. Third, the company has achieved a substantial market share in industries like hospitality, retail, and food and beverages.

Bill.com (BILL)

Like Shift 4 Payments, Bill.com is a company that focuses on American small businesses. The company helps them simplify their back-office challenges like accounts payable and receivable, and payment services. It also leverages artificial intelligence, mobile capabilities, and advanced risk management strategies to provide these services.

It has a market capitalization of about $11 billion and is one of the fastest fintech companies in the country. It serves over 98,000 companies and more than 2.5 million network members. The firm’s annual revenue grew from around $57 million in 2018 to over $157 million in 2020.

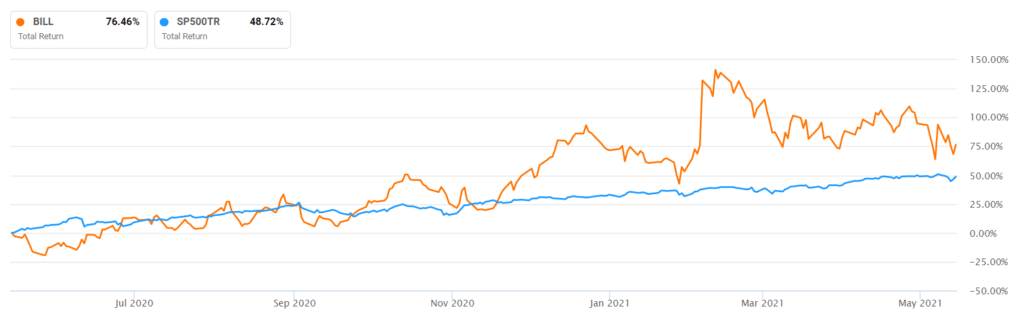

Bill.com vs S&P 500

Some of the reasons that make Bill.com a compelling investment are its strong user base growth, the fact that more small businesses are shifting their businesses to the cloud, and the potential to increase its average revenue per customer by expanding its service offerings.

The only main challenge is that Bill.com is still not profitable, meaning that it does not pay any dividends. Still, the firm could be profitable if it stopped investing in growth.

Avalara (AVLR)

The tax industry is a relatively large one because of the rising number of tax laws locally and internationally. Navigating these legal issues is an expensive thing for businesses, especially those that have an international presence.

Avalara is a fintech company that helps small and large businesses navigate this complex industry. It offers the Avalara Compliance Cloud that helps businesses file returns, calculate the amount to pay, and ensure that firms comply with local and international taxes.

The company has been on a fast growth trajectory. It has grown its core customers from 9,150 in 2018 to 14,890 in 2020. It has also grown its revenue from $167 million in 2016 to $567 million in 2020.

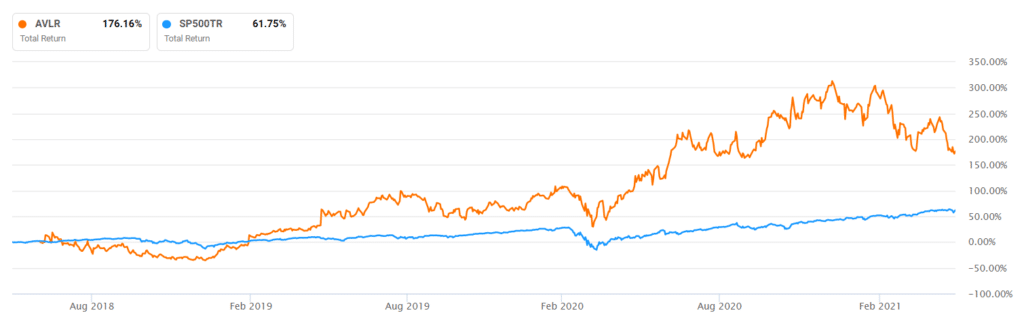

Avalara vs S&P 500

The company is a good investment because of its strong and growing free cash flows, high retention rates, and its large market potential. Like Bill.com, a key challenge for the company is that it is still making heavy losses as the management invests for growth.

Summary

Most investors have put their money in fintech companies. Most of these funds have gone to popular companies like Visa, Mastercard, PayPal, and Square. Still, there are other small and fast-growing companies that are doing really well. Others that we have not mentioned are StoneCo, Temenos, and Fiserv.