BlackQueen is a fully automated trading system that trades on multiple currencies. The system can operate on multiple strategies that can be turned on and off depending on the user. To understand the algorithm’s efficiency, we will go through the backtesting and live records. In the end, the users will be able to make a purchase decision.

Is investing in BlackQueen a good decision?

BalckQueen trading robot uses hedging strategies with a high lot size that can be detrimental. No stop loss attached to any trade may bring the drawdown to a higher level.

Company profile

Mikhail Sergeev is the author of the robot that resides in Russia. He has a total rating of 5 for 99 reviews. The developer has 15 products published on the MQL 5 marketplace and has 27 subscribers. The MQL 5 website dictates that he has a trading experience of more than 8 years. There are no certificates or account tracking that could verify this claim.

Main features

The robot has the following features:

- Traders can set the robots’ strategy.

- Updates are available for free.

- It can trade on multiple currencies.

- The minimum deposit required to trade is $50.

To get the service up and running, you the following steps:

- Open a trading account with a broker and purchase the EA from MQL 5

- Login at the MT4 or MT 5 platform and refresh your experts’ tab

- Attach it to the charts to start trading

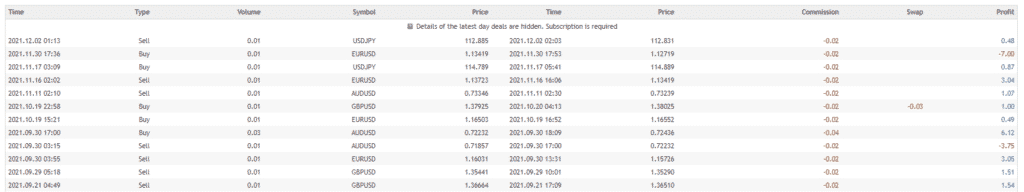

The robot trades on EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCHF, USDCAD, USDJPY and is fully automatic. It enters the market based on stable price movements and can implement two different strategies: e., hedging and one order. From the history present on the MQL 5 community, we can see that the trades have no stop loss for hedging mode. This can increase the drawdown value significantly.

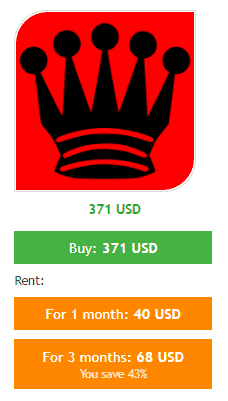

Price

The EA is available for an asking price of $371. According to the rules of the MQL 5 marketplace, there is no money-back guarantee. Traders can also rent the product for one and three months at $40 and $68.

Trading results

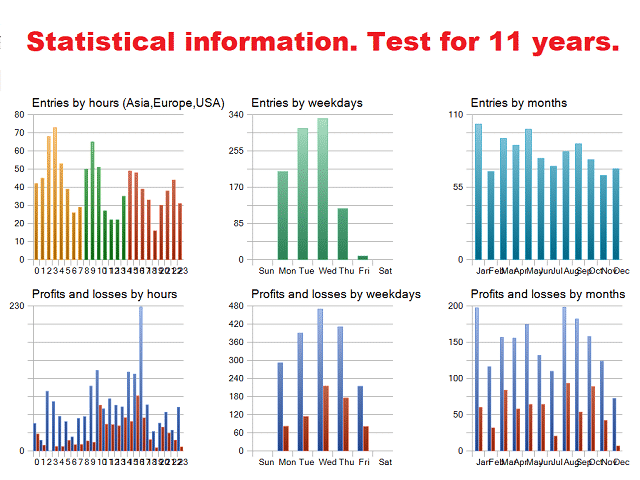

Backtesting results are only available in the form of images. This information is not enough to analyze the true historical performance. The developer shows that the robot has had good profits for several years. We can observe that the robot traded mainly on the middle days of a week. The fixed lot hedging strategy started with $50 and ended the account with a remaining balance of $2111. The testing duration was 11 years, and there were several equity drops along the way.

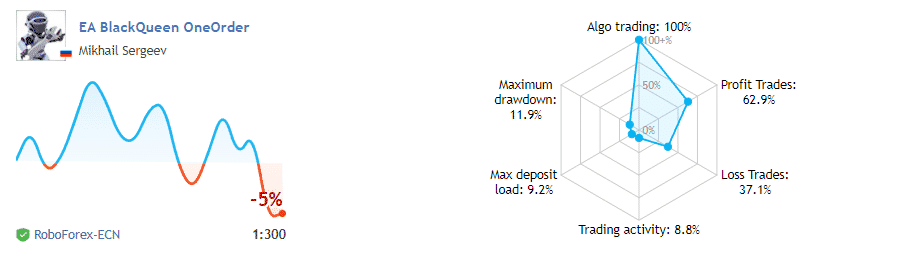

Verified trading records are available on MQL 5. The performance is available from April 13, 2021, till the current date. The system made an average monthly gain of around -0.46%, with a drawdown of 5.7%.

The winning rate stood at 91.83%, with a profit factor of 4.02. The best trade was $6.82, while the worst was -$7.01 in a total of 49 trades. The drawdown value of the account is high, which is quite alarming. Total gains provided by the system are no good as it currently hangs at -5%.

Showing off the live records through Myfxbook or FXBlue would have been a better practice as they detail all the statistics in an efficient manner. This includes getting information on systems efficacy, reliability, and productivity and the chance to filter out the records for a certain period.

Conclusion

Black Queen trading robot uses a hedging strategy for trading the markets. The historical records are scattered over the website and most of the information on the game plan is undisclosed.