At a glance, we could not figure out what Breakthrough Strategy is really offering. Unlike other Forex vendors that promise to move heaven and earth for the trader, the developer, in this case, goes straight to introducing us to the features and settings of the robot. So, we had to find out for ourselves if the EA is beneficial to traders by assessing how it performs in the live market.

Is investing in Breakthrough Strategy a good decision?

We have taken our time to review the Breakthrough Strategy EA to ascertain if it is profitable. To meet this objective, we assessed its vendor, main features, strategy and trading results, among others. Our findings led us to decide that the system is not worth trying.

Company profile

Breakthrough Strategy is the work of a person called Konstantin Kulikov. The name of his company is known as Kulikov Forex Solutions. This vendor is also selling other EAs like Good Morning, Trailing SL & TP, Friday Monday, Trailing by SAR, and others. But as far as the qualifications of the developer are concerned, we are still in the dark.

Main features

- Developed to work on the following sets: AUDCHF, AUDJPY, AUDNZD, CADCHF, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPCAD, GBPJPY, GBPUSD, NZDJPY, NZDUSD, USDCAD, USDCHF, and USDJPY.

- Does not need to change the magic numbers because it is capable of identifying transactions simultaneously by magic number and currency pair.

- Can work on any timeframe.

From the name, we can tell that this EA targets the breakthrough that occurs in trends. Essentially, the system identifies the key price level expected to break through, and then buys or sells at that price so as to profit. Even then, the developer should have gone the extra mile to elaborate this approach for traders to fully understand the functionalities incorporated to execute it.

Price

You can purchase this EA at $197 on the mql5 marketplace. However, there are cheaper options. As such, you can rent the product for 1 month, and it will cost you $30. If you want to rent it for a longer period, say 3 months, then $60 is required. We have established that the system generates a high drawdown. Furthermore, the vendor does not have a refund policy. For these reasons, we can comfortably conclude that the EA is not worth this money.

Trading results

Backtesting results have not been displayed. We know that it is common practice among EA vendors to showcase the past performance of their systems for traders to see if their strategies are workable or not. Therefore, the lack of transparency in this area hints at a developer who cares less about the needs of traders.

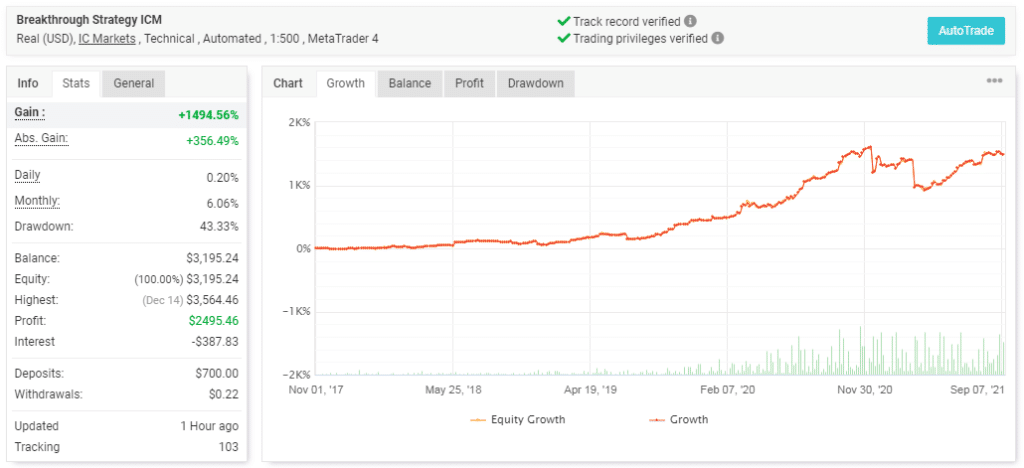

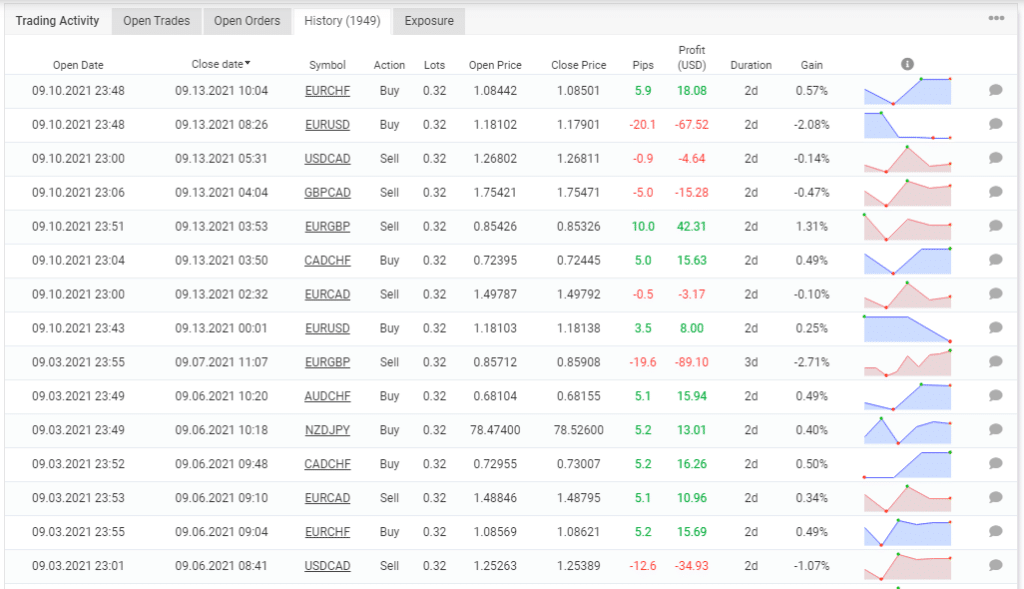

This is a real USD account that has been making 6.06% monthly profits since its inception on November 1, 2017. The gain is massive—1494.56%. The drawdown of 43.33% is disquieting. It is a threat to the account balance. The profit made is $2495.46. The balance has increased substantially from $700 to $3195.24.

There are a total of 1945 trades with a profit factor of 1.32. The long positions won are 75%. They are slightly lower than the short positions (76%) won. The system makes more losses than profits, as shown by an average loss of -14.84 pips, which is almost twice higher than the average win. The worst trade of $-390.40 is also high and can eliminate the gains. The lots traded are big, a sign that the system trades dangerously.

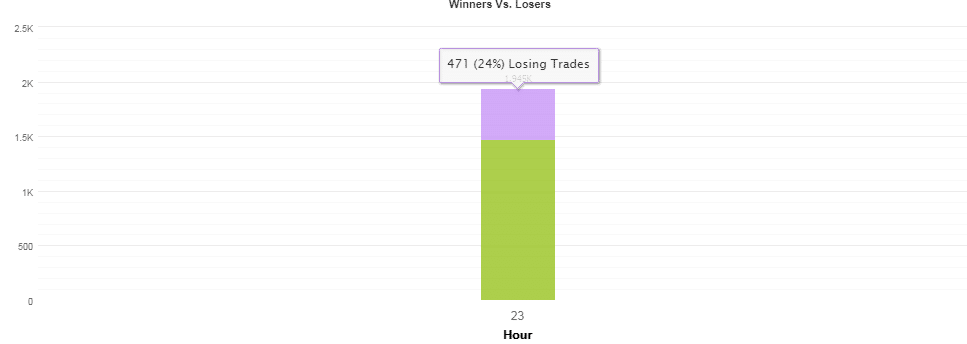

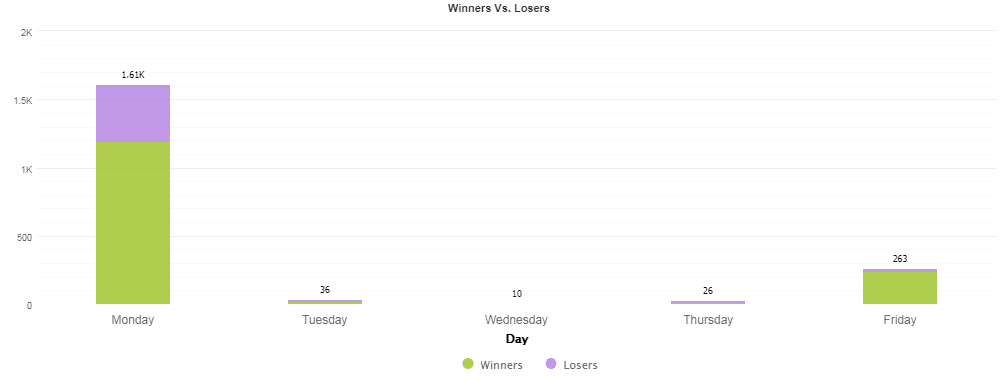

Here, we see that the system only traded on the 23rd hour, winning 1474 of the trades and losing 471 of them.

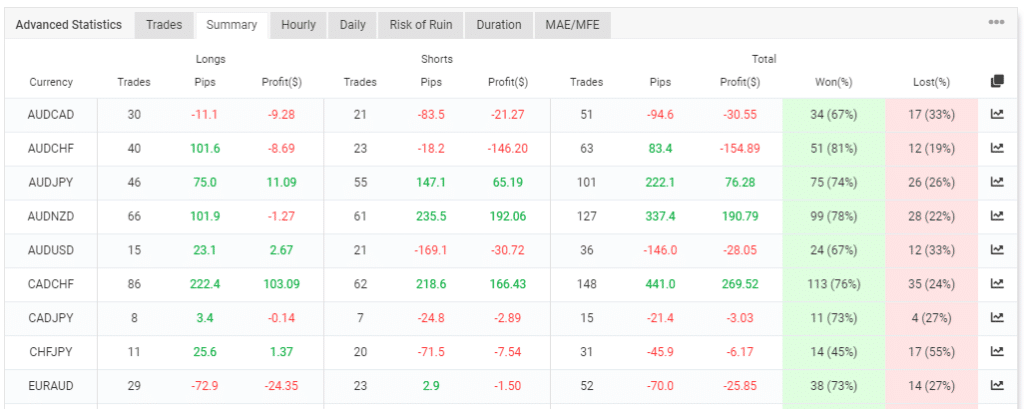

A sneak peak of the performance of some of the trading instruments reveals that some of them have been recording considerable losses. They include the AUDCAD, AUDCHF, AUDUSD, CADJPY, CHFJPY, and EURAUD.

Compared to the profits, the losses made were larger. Therefore, they eroded the gains.

From the stats above, it is clear that the bot was mainly active on Monday with 1.61k trades.

Customer reviews

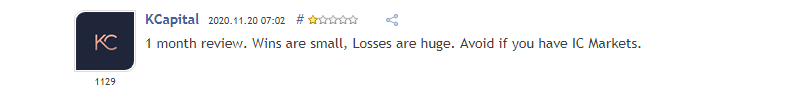

Although we see that thousands of customers have tried out Breakthrough Strategy, only 11 of them have given their opinions on it. Nonetheless, we found a review that corresponds to the trading results we assessed. This trader confirms that the system makes small wins and incurs big losses.

Summing up

Obviously, this is not an EA for the faint-hearted. It trades with high risks to the balance, as demonstrated by the high drawdown and large lot sizes. Even if it manages to make profits, they cannot be enough to eliminate the damage done to the account. Since backtesting data is missing, there is no way of knowing if this system can survive tough times.