- More clientele pushing institutions to integrate Bitcoin in their products.

- Bank of America, US Bank, and Fed Chairman hold favorable positions for cryptocurrency adoption in the US.

- Uruguay is working on crypto assets regulation rather than a ban.

Bitcoin momentarily hit the $51,000 mark on Wednesday before slipping back to trade at $50,999 at 0828 GMT. At the time of writing, BTC prices were up by about 20% over their position 7 days ago, with its market capitalization at $954 billion. As the norm has been in the crypto market, most cryptos followed BTC’s cue, with 9 out of the top 10 digital assets registering gains in the previous 24 hours.

Growing calls for greater crypto adoption in the United States

According to BoA strategists, cryptocurrency is a new asset class that is simply too significant to be ignored. According to the BOA report, despite the numerous problems surrounding cryptocurrency, Wall Street is becoming more enthusiastic about the asset class. Indeed, the crypto market has had a bumpy ride in recent times, following China’s imposition of a blanket ban on digital assets transactions.

Despite China’s moves, digital assets are getting new institutional admirers. In the latest development, US bank, America’s fifth-largest retail bank, has introduced crypto custody services for fund managers to accommodate customer demand for cryptocurrencies. Initially, the program will provide exposure to BTC, LTC, and Bitcoin Cash, with others to be added at a later date.

The move was informed by the results of a survey conducted by the bank to gauge its clients’ interest in digital assets. The poll, which was carried out by Gunjan Kedia, a senior executive at the bank, revealed a spike in the demand for digital assets among the bank’s biggest clients.

According to the survey, a significant number of clients already hold cryptocurrencies and urged the bank to speed up the provision of these assets.

Regulation could be the way to go

In September, El Salvador set the pace for other nations by adopting BTC as legal tender. Even as China remains adamant about its ban on cryptocurrencies, the reality is sinking in, and more governments are likely to push for regulation rather than an outright ban.

The Bank of America believes that additional regulation will be beneficial to cryptocurrency in the long run. The bank’s strategists, through a report, have recently expressed their belief that once rules are in place, investors would no longer be uncertain about how to invest in crypto.

In a related development, the Central Bank of Uruguay has released a statement on digital assets outlining the steps it plans to take to regulate cryptocurrencies. For this reason, the bank has already formed a research team to investigate the workings of the cryptocurrency market and has come up with a conceptual plan to govern the market in the near future.

In another significant move in support of digital assets, Federal Reserve Chairman Jerome Powell said that stable cryptocurrencies like Bitcoin should not be prohibited. Some analysts have even attributed the latest crypto market uptrend to that statement.

Miners’ earnings near record-high levels

The rise in miners’ earnings is a key indicator of market bullishness. According to Glassnode’s latest earnings report, miner revenue is returning to near-record levels. Miners are now earning an average of $40 million each day, which is the highest level in recent memory. It demonstrates a considerable increase in overall revenue, following the reduction in reward from 12.5 BTC to 6.5 BTC per block after last year’s halving event. Despite recent price difficulties, the rise in miner earnings shows that the BTC market remains positive.

Technical analysis

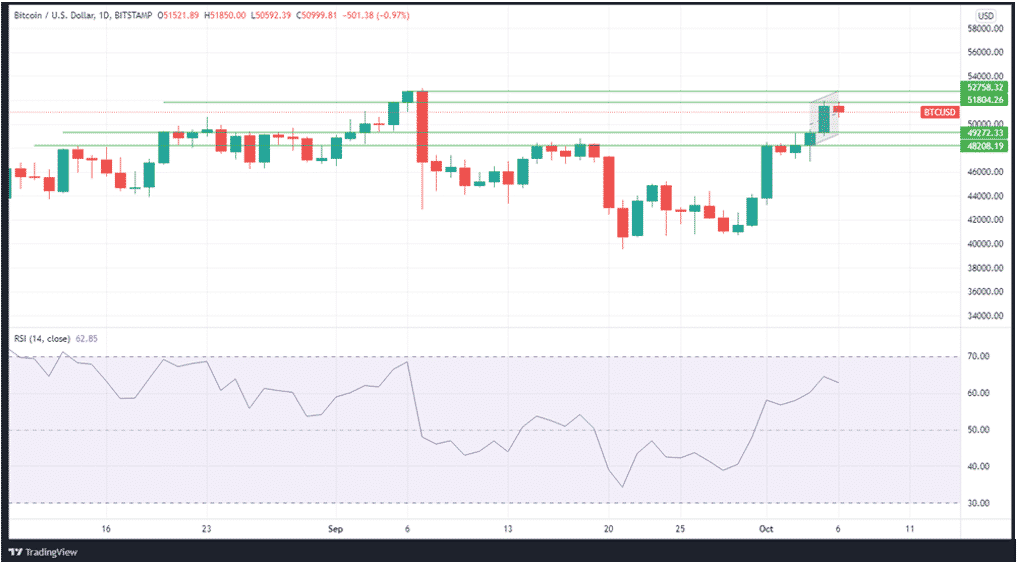

BTCUSD has been on an uptrend for the last 7 days and has broken a key psychological barrier by breaching the $50,000 mark. Over the past week, the momentum for the BTCUSD pair has grown steadily, with the RSI rising from 37 to 62.

If the bullishness continues, the pair may rise further to find the first resistance at $51,804 and the second one at $52, 758. On the other hand, the RSI indicator is pointing downward at the time of writing, suggesting a possible bearishness. If the bears gain some control, they may pull down the price to the first support at $49,272 and the second one at $$48,208.