Candlestick charts have been in constant use by investors for day trading in the financial industry. The participants who utilize them are also called technical traders. Day trading is an art in which a trader holds and sells securities within the same day.

There are numerous benefits and demerits when you approach the markets in this manner. The most significant advantage rhymes alongside the disadvantage, which points to the risk and reward. While day trading stocks, you get in and out of positions with speed and frequently put your capital on the line.

Time frames

With day trading, you would want to stick with lower time frames as the higher ones are meant for swing or position trading. Use those between daily, H4, H1, M15, and M2 charts. As a technical trader, it is better to mark out potential support and resistance alongside key levels.

You can also add moving averages to mark out trends and support and resistance levels. For our analysis, we will be using the 200 and 20 simple moving averages.

Types of candlesticks and how to use them in stocks

Big bars

We use the big or elephant bars that form in the first two minutes or the rest of the trading day. As soon as we spot a big green or red candlestick, we take the appropriate long or short positions. For additional confirmation, we hunt for stocks that are in oversold or overbought conditions.

SL: One cent below/above the candle.

TP: The next support or resistance, or new high.

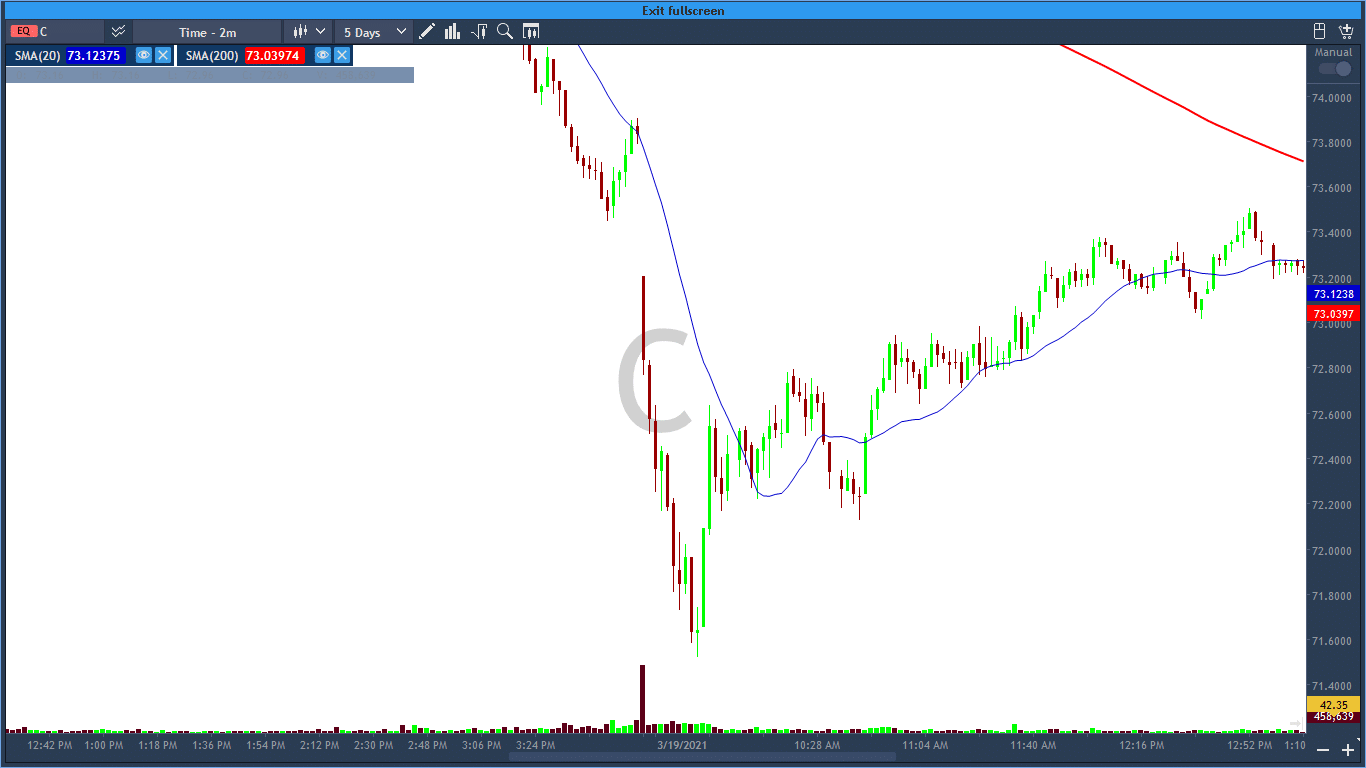

Image 1. We spot a big red bar at the start of the trading day at C. It has a good setup for a potential short where we take a sell with the stop loss above the red bar.

Dead cat bounce

A famous technical setup amongst traders where they short a stock that is already falling with great speed. The selling does not occur during the fall; instead, it happens when the security tries to move upward towards the big red bar. It gets its name from the same conclusion that a bouncing dead cat will not rise anytime. Extreme shorting usually takes place when a big institution dumps the shares.

SL: Between the big red bar or above it.

TP: Towards the next support or as preferable.

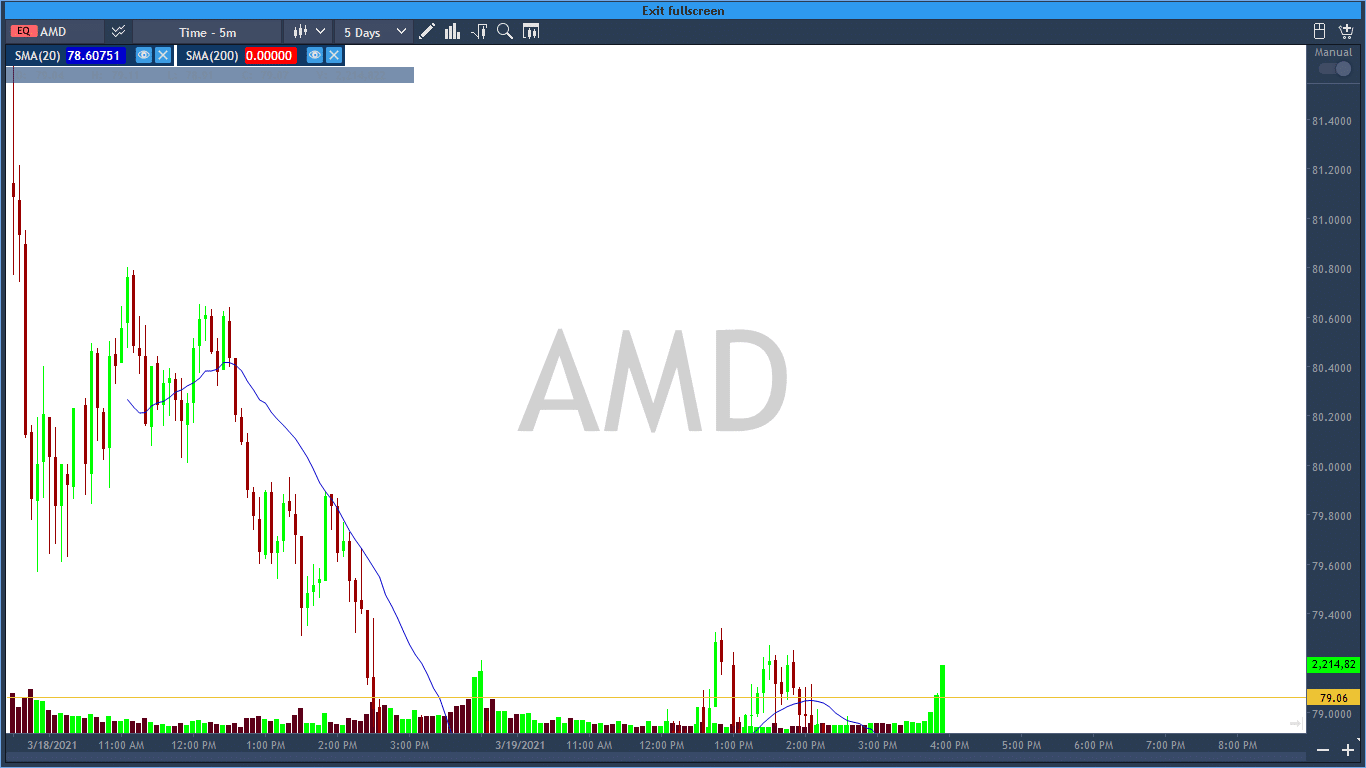

Image 2. Can you figure out the dead cat bounce on the five-minute chart at AMD?

Topping tails

You may have witnessed these candles for quite some time during trading. With topping tails, you can enter reversals. For better winning probability, use them when the stock reaches new highs as 70% fail. Or you can try adding confluence by looking out for the 20 and 200 SMAs.

SL: One cent below/above the candle.

TP: Midpoint of the recent move. Take out Fibs if you need them.

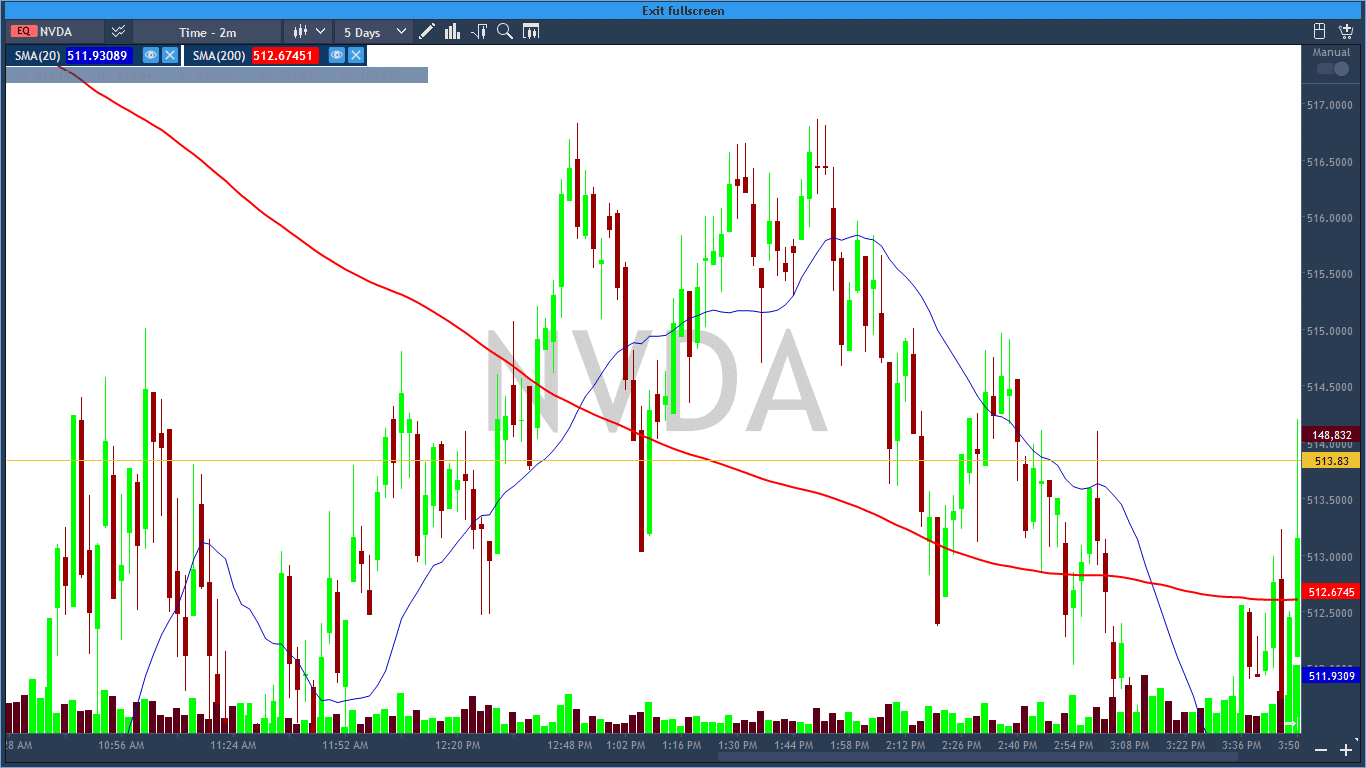

Image 3. The two minutes’ chart at NVDA shows many topping tail bars. The stock is trying to reach new highs but suffers a downfall immediately after witnessing the bearish candlesticks.

Bullish and bearish engulfing

Bullish and bearish engulfing patterns are those where the second big bar engulfs the prior one. It is also a reversal sign which indicates that the current trend is over and respective buyers/sellers are coming over to form a new one. Like topping tails, you can use new highs alongside support and resistance to add to the winning chances.

SL: One cent below/above the candle.

TP: Midpoint of the recent move. Take out Fibs if you need them.

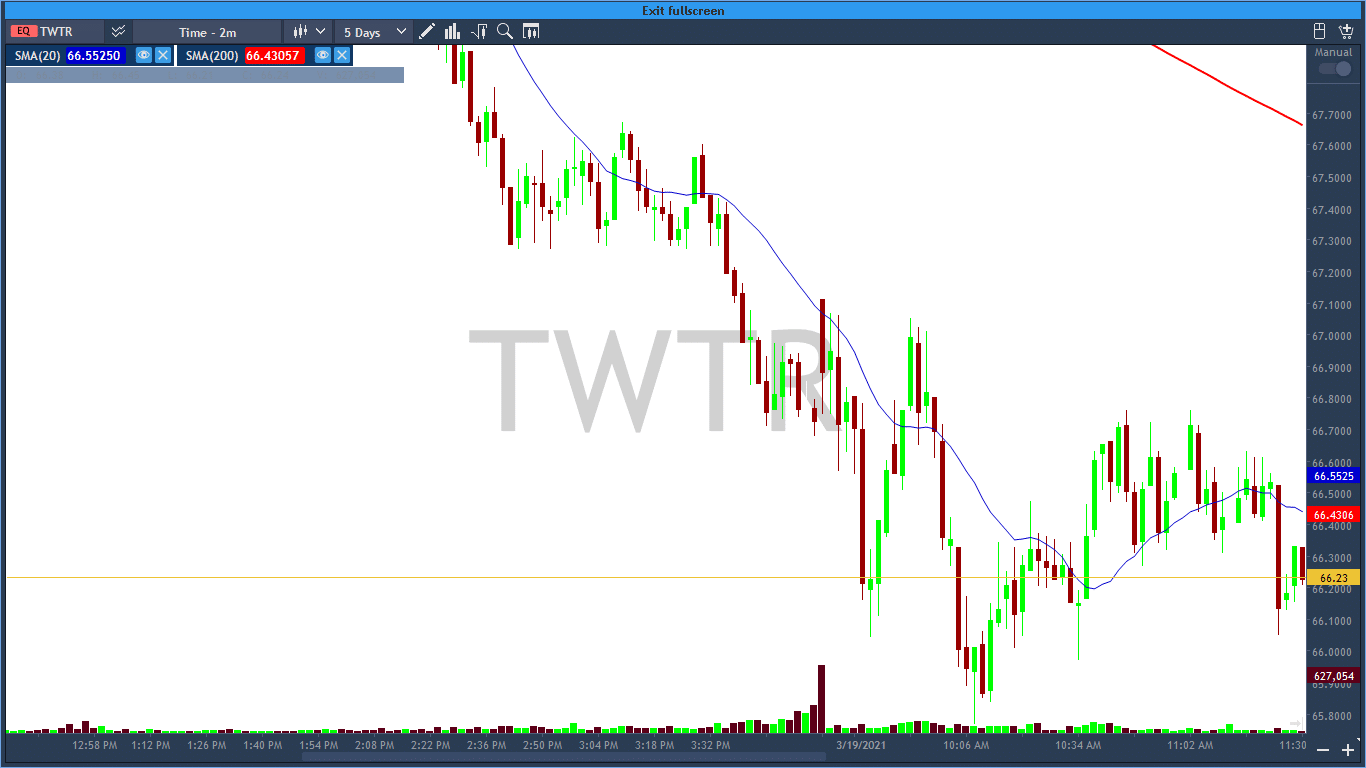

Image 4. Beautiful bearish engulfing patterns on the Twitter chart. Notice how the market is following its current trends by making subsequent bearish bars on lower highs.

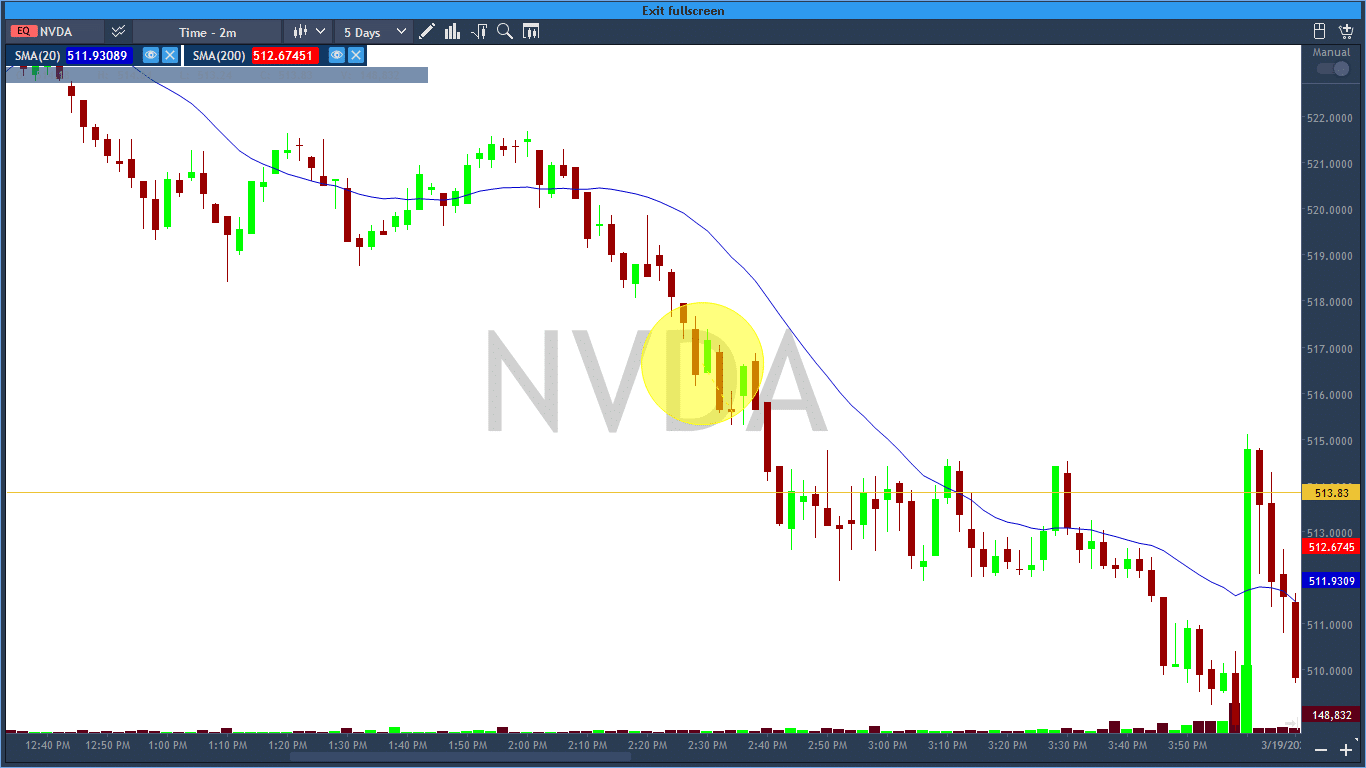

Red and green bars ignored

Trading these candlesticks is simple. Just follow the current trend, and whenever a bar of opposite color appears, get ready, we will be placing a trade when the next candle overtakes it. The name rhymes with the statement as the market ignores the previous red or green bars.

SL: One cent below/above the contrasting candle.

TP: Towards next support and resistance.

Image 5. To make it easier to understand RBI or GBI, we have highlighted the pattern with the yellow color.

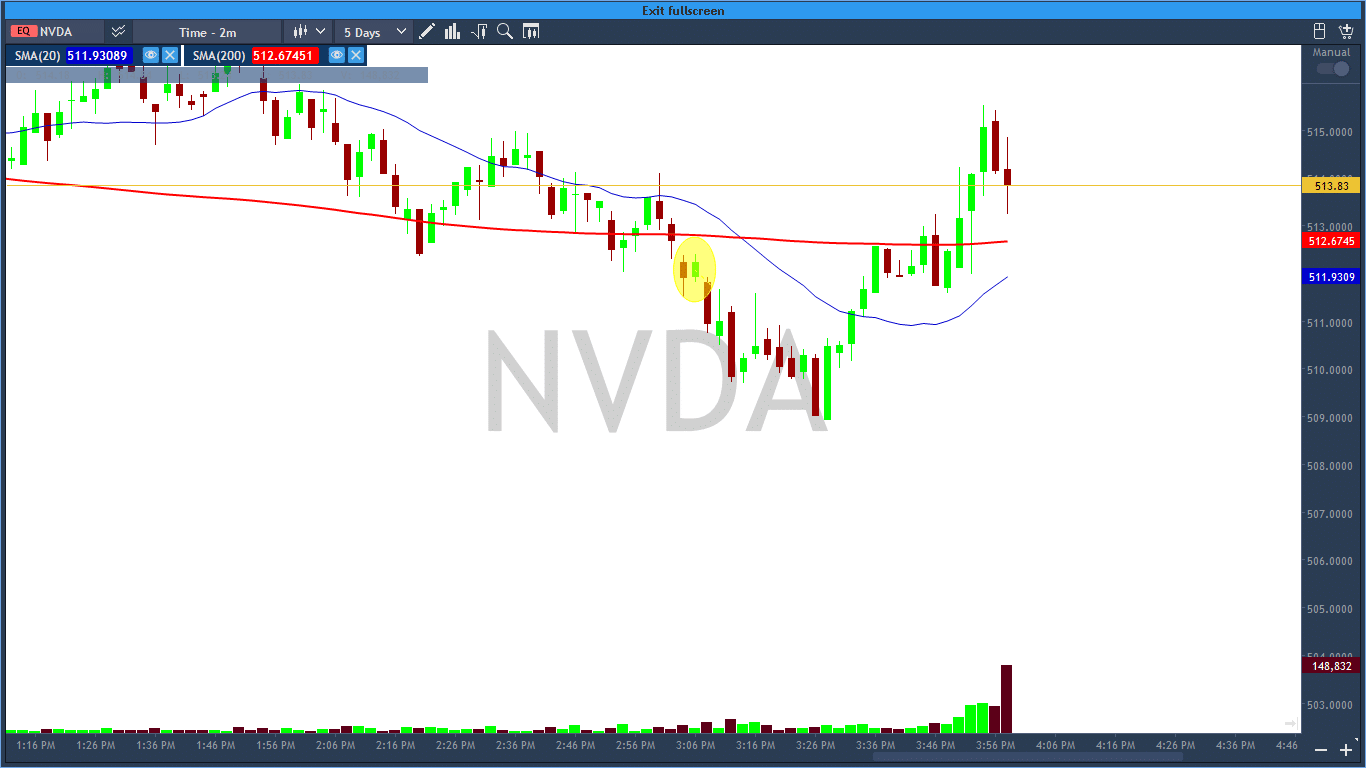

NRB

An NRB, or narrow range bar, provides opportunities with a good amount of risk-reward. It is a small candlestick with a full body that indicates that the market is ready for a massive move in one direction. Place your buy and sell stops one cent above or below the bar as soon as you spot them.

SL: One cent below/above the candle.

TP: Towards next support and resistance.

Image 6. An insignificant NRB at our disposal. We can still witness the bar’s powerful effects where the stock falls $2 in its value after its formation.

How much time will it take for me to master these strategies?

Amateur traders may grab these strategies in a month. For beginners, the times may vary, ranging from a few months to a year. It all depends on the type of trader you are and the current level of your trading.

End of the line

Candlestick strategies for day trading stocks are perfect for any beginner to comprehend and implement. However, it would be best if you didn’t ignore other trading factors, such as managing risk. It may take some while for you to execute the trades wisely. For quick executions, experts recommend using hot keys while trading.