According to the data on consumer confidence across the United States, it was trending up in October 2021 after three months of constant decline. Add to that the positive earnings data from various companies, and what you have is fresh record highs in the US stock market.

At writing, both the Dow Jones Industrial Average (DJIA) and the S&P 500 were at record highs. It means the latest earnings data dispelling fears about elevated inflationary pressures and ongoing supply chain challenges.

But the latest surge in the US stock market comes on the back of usual suspects, especially tech stocks like Alphabet, Tesla, and Twitter. So this begs the question, where do sectors like nuclear energy stand?

The state of the nuclear energy sector

After the Fukushima incident brought on by the 2011 tsunami, nuclear energy became a risky bet for governments. As a result, all across the developed world, nuclear reactors declined, leading to a substantial drop in the sector’s power generation capacity.

For example, Japan’s number of nuclear reactors fell 33%, 2% in the United States, and 11% in the European Union.

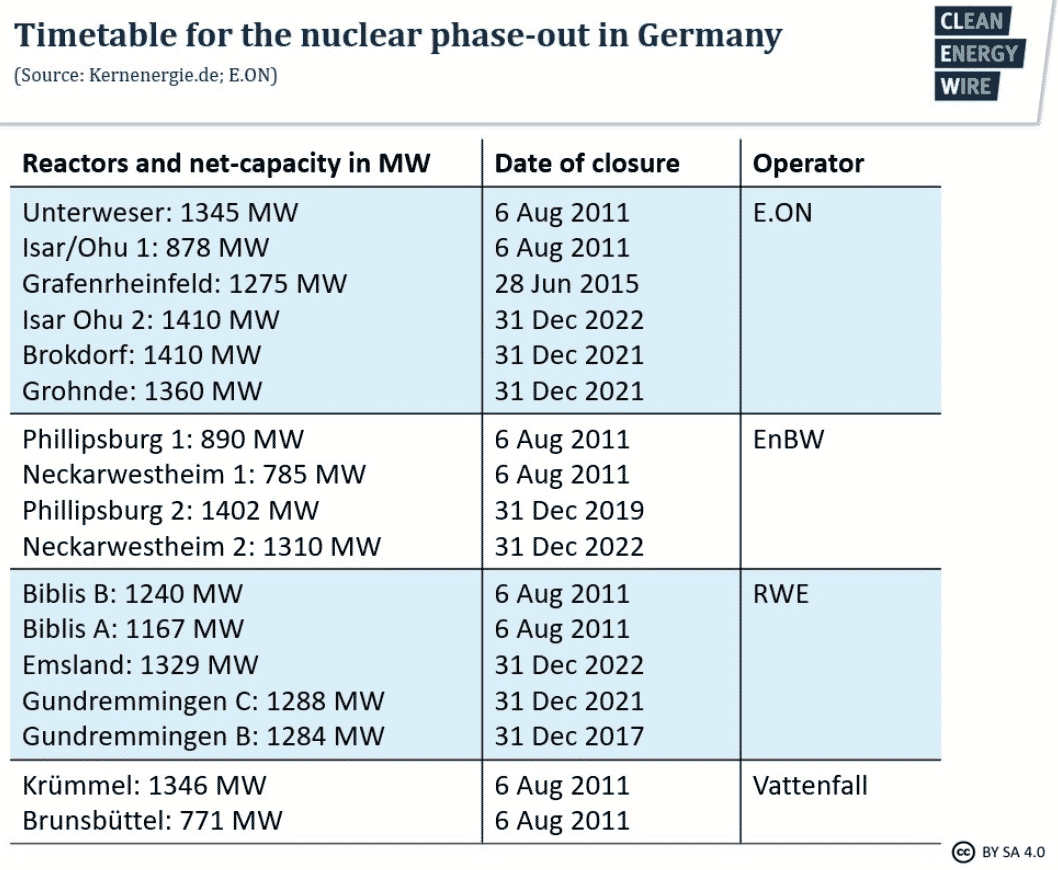

Interestingly, Germans seemed more threatened by a potential nuclear disaster post-Fukushima. This led to the government shutting down various reactors, an ongoing process.

Germany’s energy transition policy, Energiewende, targets a complete dissociation from carbon-emitting energy sources and nuclear power. In fact, the last nuclear power will cease operation on 31 December 2022.

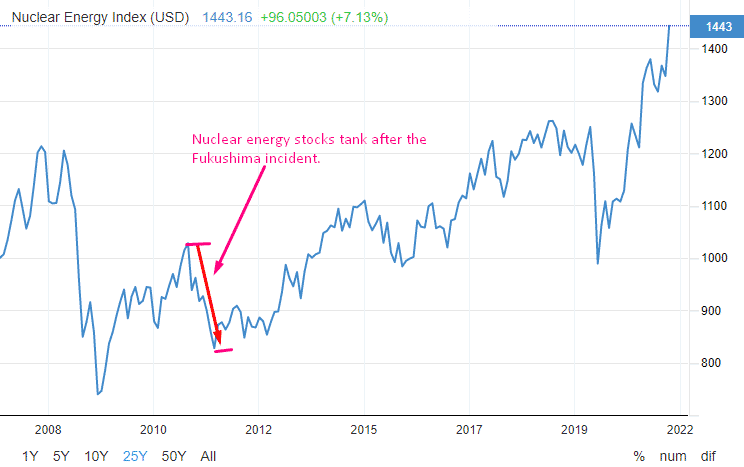

Furthermore, the nuclear energy stocks also took a massive hit post-Fukushima. After the news hit international headlines, investors scampered for the door. As a result, the sector tanked, based on the performance of the Nuclear Energy Index between March 2011 and September 2011; see the chart below.

Also clear from the chart is that demand for nuclear stocks entered a general uptrend since 2011. By 2019, the Nuclear Energy Index was trading at record highs. As with all other equities, the sector lost a bit of color at the onset of the Covid-19 pandemic but later recovered massively. The Nuclear Energy Index had gained 14.89% year-to-date, at writing.

Things to consider when investing in nuclear energy stocks in 2022

From the preceding, nuclear energy stocks seem like a great asset to have in your portfolio. However, it is worth noting the following before recruiting the sector.

Nuclear energy is the ultimate green energy play

Many countries worldwide are thinking about eliminating the fossil-fuel-powered energy sector over the next decade to meet climate change targets. One consequence of the policy is the increased adoption of electric vehicles, especially in China and Europe.

The increased use of EVs will push up demand for power, which will not come from coal-fired plants. In addition, because governments worldwide prefer EVs for their low carbon footprint, they will require electricity from non-carbon emitting sources.

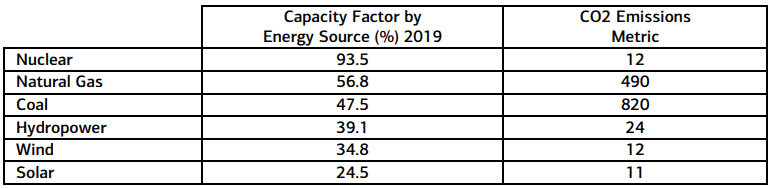

This is where nuclear energy shines. According to data from the US Department of Energy, nuclear energy’s carbon footprint is as low as wind energy (shown in the chart below).

Nuclear energy performs better than wind energy regarding reliability. In the above table, you can see the former had a capacity factor of 93.5% in 2019 compared to wind energy’s 34.8%. It is also more reliable than coal-fired power plants, hydropower, natural gas, and solar energy.

Therefore, it is ironic that regions such as Germany are phasing out nuclear reactors because of the threat of Chernobyl-level accidents.

The bottom line is that the nuclear angst emanating from the possibility of an accident could run out of steam soon. Moreover, the angst seems to be more of a political play than science-based. Thus, the opposition to the pivot to nuclear energy as the ultimate green energy play comes mostly from politicians and environmentalists, not scientists.

The transition to green energy could happen faster than previously thought

According to an International Energy Agency (IEA) analysis, China and Russia kept the nuclear energy dream alive in the wake of the Fukushima incident. Specifically, China commissioned new units, increasing its nuclear power capacity by 5%, and Russia’s grew by 3%.

The analysis further stated that nuclear power worldwide rebounded 2% in 2021, recouping half of the loss suffered in 2020. In 2H2020 and Q1 2021, seven new reactors came online while three shut down. China accounts for most of the new reactors. India and the UAE are also constructing new reactors, bringing the total number to 50, and all should be online by 2027.

Interestingly, the increased potential nuclear energy capacity from the new reactors couldn’t have been timelier.

Few headlines are as attention-grabbing as power shortages today. Over the past few months, reports emerging from all corners of the world point to a global energy crunch. For example, electricity shortages in October turned out street lights, shut down factories in China, and pushed up living costs in Brazil.

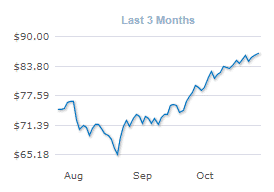

To make the situation worse, fossil fuels prices are at record highs at writing. For example, Brent crude is up 16% from August.

Countries such as China resorted to the most extreme measures to combat the energy crunch – authorities fell back to coal. The problem is that the pivot back to fossils will derail the carbon emission cut goals.

According to knowledgeable observers, the global energy crunch results from “secular transitions from the normal course of business to something new.” Specifically, capital discipline by energy companies worldwide is impacting investments in new hydrocarbon projects. Also, OPEC members are cutting production for various reasons, and the result is tight supplies in the face of rising energy demand.

The take-home here is the capital discipline by energy companies. It means fewer oil and gas wells will be available for drilling in the future, and more renewable sources will join electric grids worldwide. But because the market tends to gravitate towards efficiency, there is little doubt that nuclear energy will become the poster boy of clean energy. As such, we are likely to witness the transition from fossils sooner than expected.

Bottom line

The ongoing global energy crunch is also a consequence of supply chain disruptions. This is another reason for the world to gravitate towards nuclear energy. In other words, nuclear energy ticks the most crucial boxes, and companies participating in the sector are looking at a future full of endless possibilities.