EA Super 8 uses an aggressive trading methodology for making money in the market. It requires a minimum balance of $100 as the starting capital. The robot determines the trend on the charts and uses it to place trades. Let us define the crucial qualities and drawbacks of the system to see if we can make any profits from it.

Is investing in EA Super 8 a good decision?

After analyzing all the pros and cons, we concluded that the algorithm still lacks enough transparency on its strategy. There are no live records available that could show us how it can perform in real-time market conditions. Therefore investing in the robot is not a good decision.

Company profile

Vitali Velineska is the author of the product who resided in Belarus. He has a total rating of 4.4 for 368 reviews. The developer has sixteen products published on the MQL 5 marketplace and has a total of 184 subscribers for his services. He has one year of experience in the industry. However, there is no proof of his portfolio that could verify his outcome in the market.

Main features

The robot come with the following main features:

- It comes with free updates.

- The robot determines the direction of trend and uses aggressive trading.

- The minimum balance requirement is only $100.

- There are set files and additional material available with each purchase.

To install the EA, use the following steps:

- Purchase the EA from MQL 5 marketplace.

- Login at the MQL 5 community on the MT 4 platform.

- Download the robot and attach it to the charts to start trading.

Price

The robot is available for an asking price of $149. There is no money-back guarantee. The developer states that he will increase the price after selling a certain number of copies.

Strategy

The developer states that the EA uses trends for trading and requires a minimum deposit of $1000 that needs to be divided into ten parts. Traders have to run the robot individually on all accounts until one of them blows up. This is quite a strange statement as the provider himself tells investors that the algorithm can result in a margin call. We can not analyze the methodology further as there is no trading history due to no live signal tracking.

Trading results

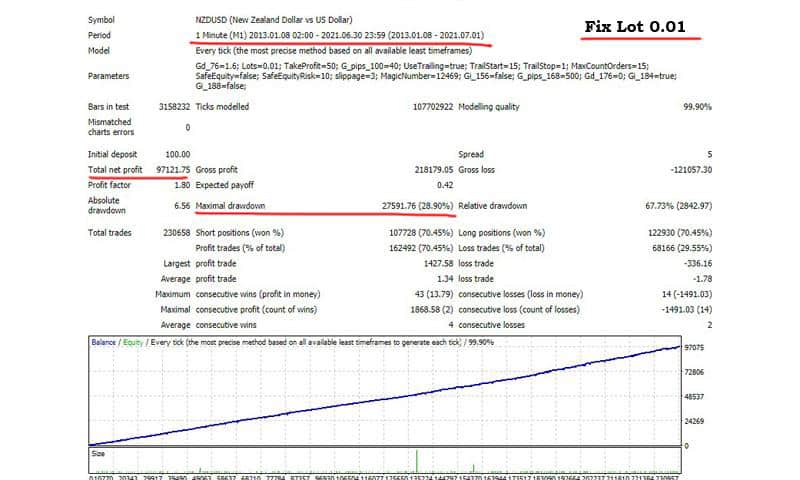

Backtesting results are available for NZDUSD. The duration of the tests is about eight years. The developer presents backtesting results by showing multiple images, and there is no detailed statement available. The robot had a maximum drawdown of 67.73% and turned an initial deposit of 100 into $97121.75. It had a winning rate of 70.45% with a profit factor of 1.80. The average amount of profitable trades was $1.34, while the average amount of losing deals was -$1.78. There were a total of 230658 trades executed during this period.

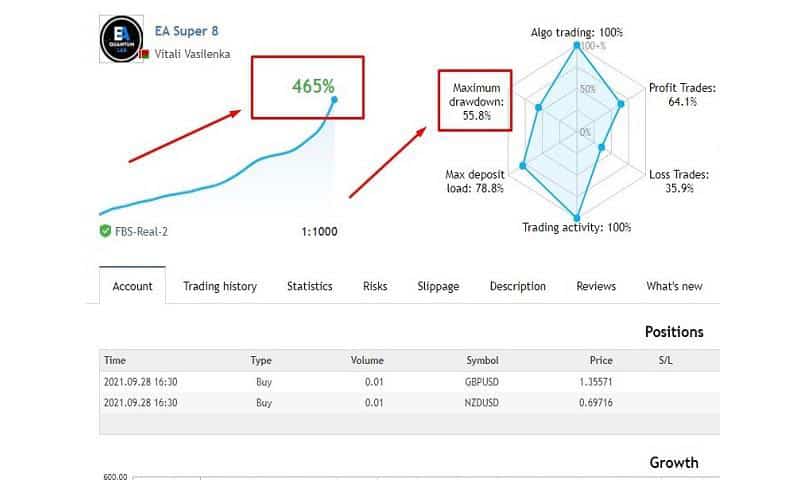

There are no live results tracked through Myfxbook or MQL 5 which is a big turn off. Failure to show records on a real portfolio means that the robot only works on backtesting. It may also be possible that it has blown a live account. The developer shares an image of live results but with no links.

The drawdown stands at 55.8%, showing that the EA losses half of the capital while trading. This can be detrimental for a trading account.

Interesting facts

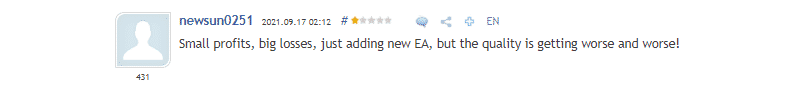

There are a few customer reviews available on MQL 5. A trader says that the robot makes a small profit and has big losses. He adds that the quality of robots provided by the developer is getting bad.

Summing up

EA Super 8 is not a good algorithm to make money. The developer himself warns of a high drawdown. There are no live records that could prove the performance of the algorithm.