FXMAC is a managed accounts service that enables users to capitalize on the expertise of its professional traders’ team. The company provides a range of investment programs including a bespoke program. As per the vendor, newbie traders without time to learn the trading basics can make use of the managed account services of the company. It promises strong monthly returns for investors.

Is investing in FXMAC a good decision?

On evaluating the services, programs, and performance proof the vendor provides along with the support it offers we find that this is not a legitimate service. Not only does the company provide proper proof of performance, but we also found several drawbacks that indicate that investing in the company is not a wise decision. These include a lack of sufficient support and negative user feedback.

Company profile

Founded in 2012, the company has been providing steady and verified performances as per the vendor. In the About Us section, the vendor claims that this is a transparent company that provides proof of performance verified by the myfxbook or FXStat site. But we find this is not true as the links to the verified accounts do not work. The company is based in Saint Vincent and the Grenadines and has offices in London. A phone number, location address, and email contact are provided by the vendor.

Main features

The main services of this company include a diverse range of strategies from different asset managers, which the vendor claims, help to keep user investments secure and diversified. As the key objective, the vendor indicates the easy access to the long-term profitable trading approaches by the company. Users can diversify their strategies and increase their profits.

To use the service, you need to first contact the consultants of the company who will provide the recommendation on a suitable Forex program and help you choose the right strategy. Once this is complete, the traders’ team of the company will begin working with you and the vendor claims that you can profit from the knowledge and reliable experience of the team.

Price

Charges for using this managed account service are based on the performance of your account. The firm charges a percentage of the profits as its fees. As per the vendor info, the performance fee is based on the investment amount. For investments that are over 50000, a 25% fee is charged and for investments worth 15000 or more 30% is the fee. In the case of low investments ranging from $3000 to $15000, the fee is 35%.

Trading results

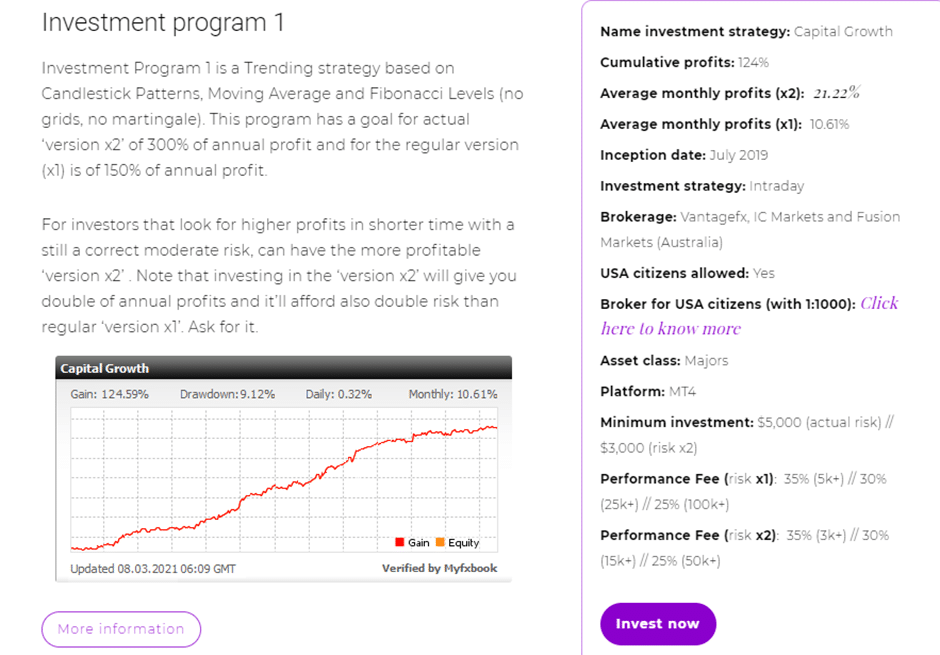

While the vendor claims to have live trading results verified by the myfxbook site and provides trading stats, the link to the site is not working. This may be because of the account being closed or some other reason that the vendor does not wish to reveal. From the info provided, here is a screenshot of the stats for investment program 1, which uses the trending approach that is based on indicators like Fibonacci levels, moving averages, and candlestick patterns.

From the above image, we can see the account shows a total gain of124.59%, a daily profit of 0.32%, and a drawdown of 9.12%. Although the results look good, the broken link makes us suspect that the vendor is not revealing the true details of the account. This raises a red flag.

Customer reviews

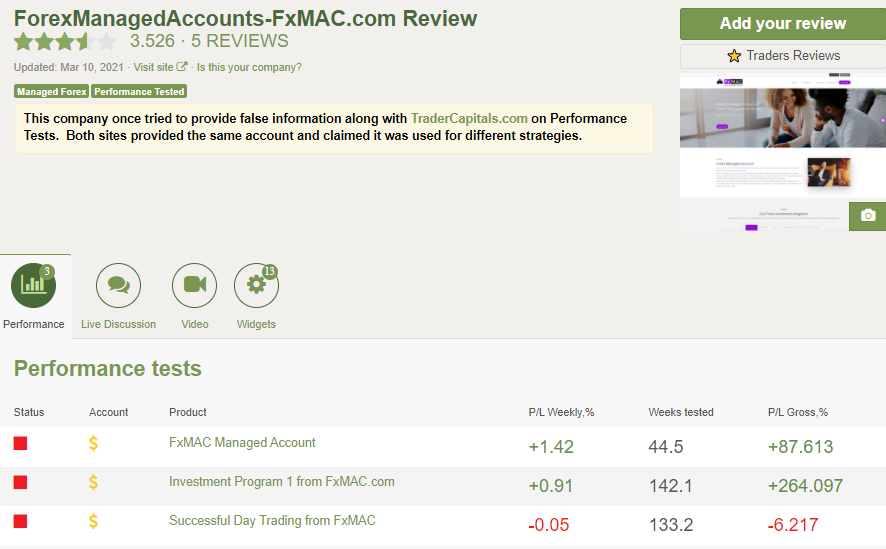

We found 5 reviews for this company on the Forexpeacearmy site with an overall rating of 3.526/5. The site mentions that the company tried to provide false information for its tests. Further, it has no live accounts now.

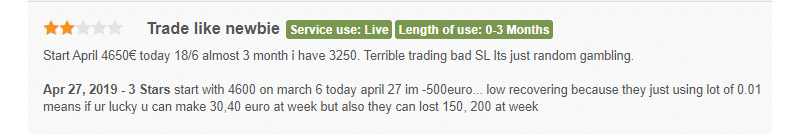

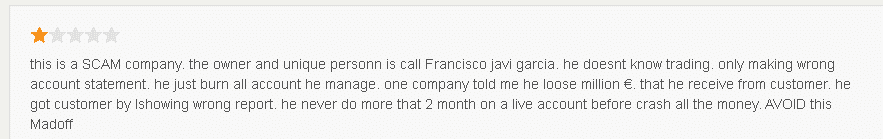

Here are some of the user reviews:

From the feedback, we can see that the trading approach has resulted in bad SL and resulted in a big loss. Another review states that this is a scam company that has crashed all the capital of the user.

From the reviews and the warning about false information, it is clear that this is not a legitimate company. Besides using a risk and ineffective trading approach, the company has also tried to manipulate its results. This indicates the company is not trustworthy.

Summing up

FXMAC claims to provide different programs that help investors diversify and earn big profits from their investments. But our analysis shows that the company does not provide a proven track record which is disappointing. The broken links and negative user reviews indicate that the company is not trustworthy and users can easily lose money with this service. While the performance fee is comparable to other similar services, the vendor fails to provide adequate info on the services it offers, the support options, and its performance. In short, this is not a service we would recommend.