Good M Stops is a system that helps owners to run the Gold chart automatically. It was released on the MQL5 community. For more details, we have prepared this Good M Stops review.

Is investing in Gold M Stops a good decision?

No, it isn’t. The robot had a part of the data removed. So, there’s no big trust here.

Company profile

Noorullah Aimaq is a young dev from Afghanistan who has a 1376 rating. There was almost a 1500 rate. His products have a 3.6 rate based on 8 reviews.

Main features

There’s a list with settings about how the system works on a real account.

- We may expect automatic trading from this system.

- This price of $600 isn’t final.

- We should expect it will be $750.

- There are not so many copies left for this price.

- We are allowed to trade on XAUUSD, AUDUSD, USDCAD, EURUSD, GBPUSD, and AUDCAD.

- We can apply it to other symbols if we know how to customize everything.

- There’s “each entry point is calculated using an advanced input filter based on the analysis of the movement of the price chart.”

- We may start trading without knowing how everything works.

- The system has protection against high spreads.

- We have to work on the hedge account type only.

- Trading is allowed with $800 on the balance.

- The system can open trade AUDUSD with $200 on the balance.

- The only time frame is M5.

- It requires a VPS service to be good.

- An ECN account is another must.

- “Every trade is protected by stop-loss and trailing stop-loss.”

- The system isn’t afraid of the wild moves on the market.

- We can set it up easily.

- There are two trailing stop loss features.

Price

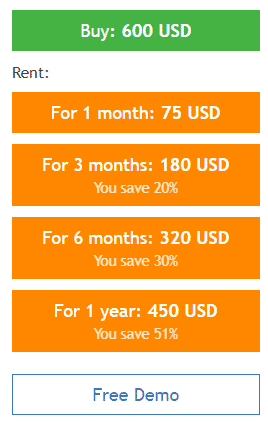

The advisor’s lifetime license is available for $600. Four subscription options are available. The one month rent costs $70 when the three-month rent costs $180. The half a year rent is available for $320. The annual subscription can be purchased for $450. We can download a demo copy of the robot to give it a demo try.

Trading results

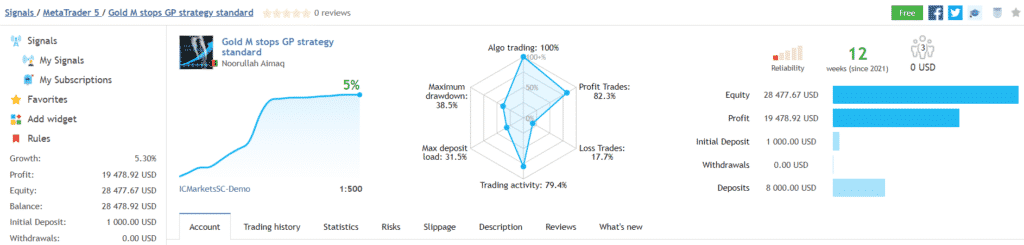

We have no backtest reports provided at all. It’s a bit suspicious because the dev knows that we want to know how the system was tested and what results it achieved, working with the tick data.

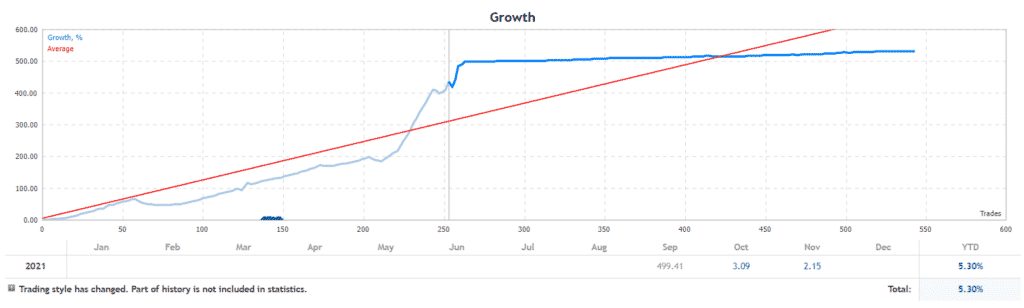

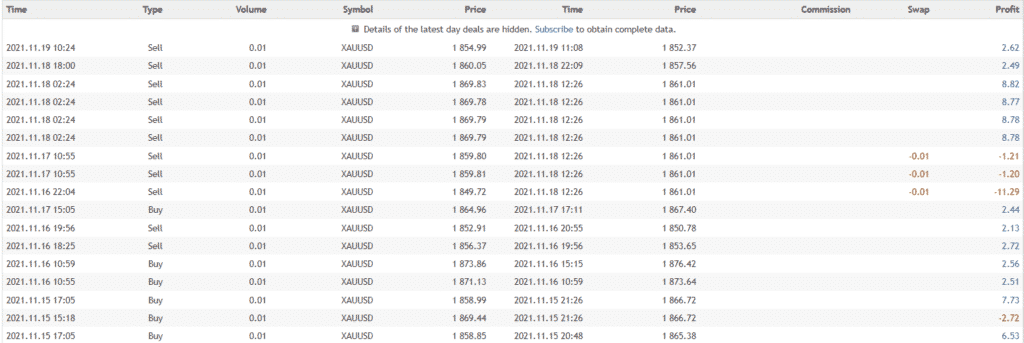

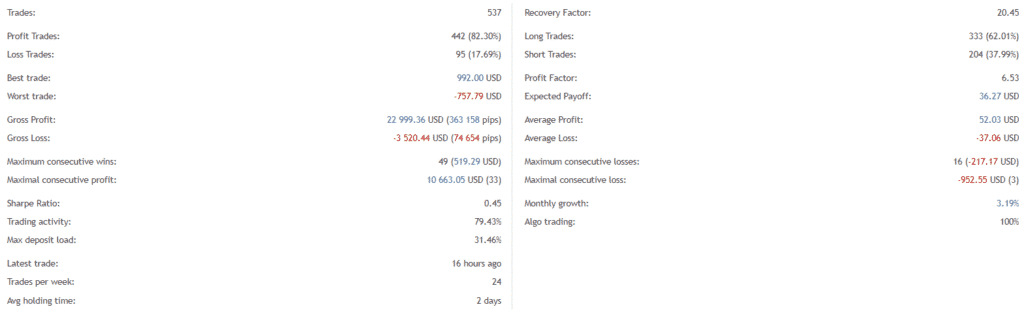

There’s a demo account deployed where the robot works automatically on IC Markets with 1:500 leverage. The maximum drawdown is 38.5%. The maximum deposit load is 31.5%. The win rate is 82.3%. An expected absolute growth is 5.30% only.

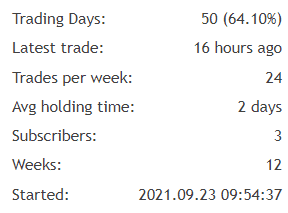

An average trade frequency is 24 trades weekly. The trade length is two days.

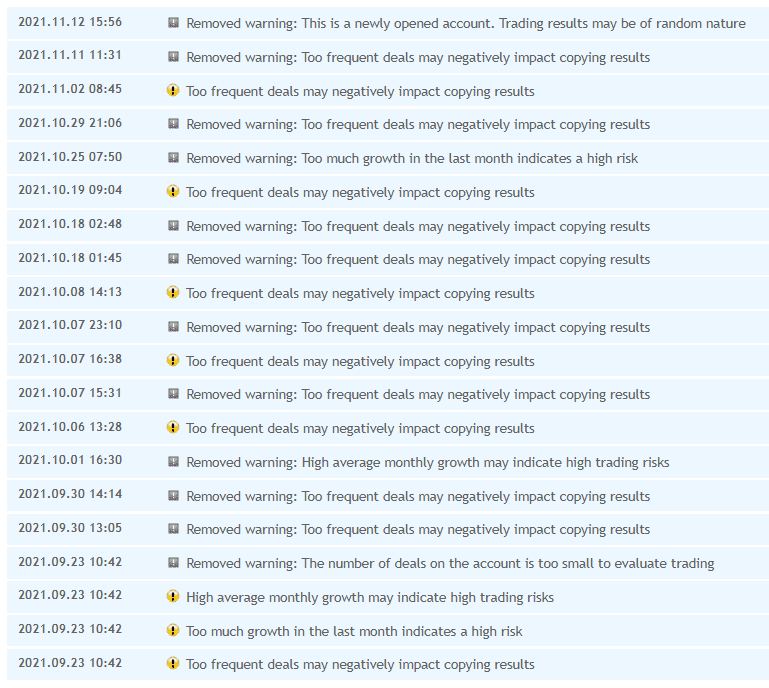

The platform’s robot mentioned that there was a month with high risk results removed.

The robot can easily lose three deals in a row. So, we can’t use Martingale safely.

We may note 537 deals executed. The best trade is $992.00 when the worst trade is -$757.79. An expected recovery factor is 20.45 when the profit factor is 6.53. An average monthly profit is 3.19%.

The list of warnings is truly huge. It’s not okay for the paid advisor that costs $600.

People feedback

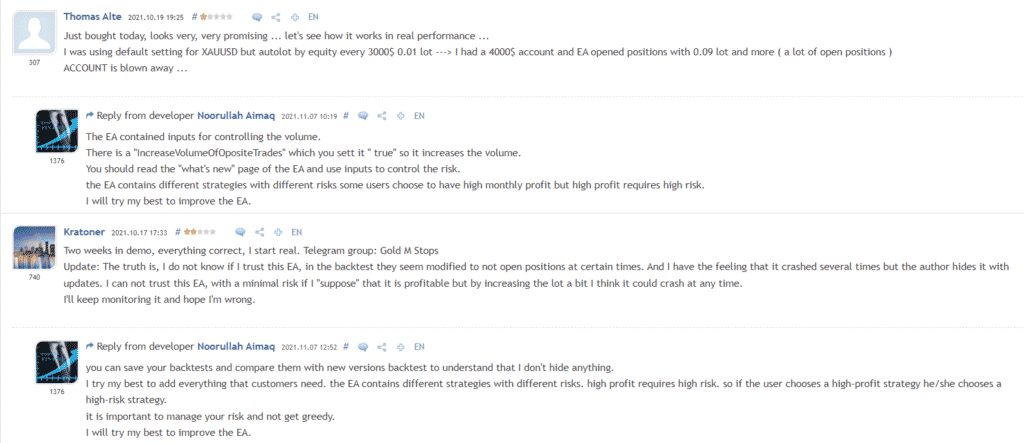

Several clients weren’t happy with how the system worked on their accounts. One of the clients was satisfied with the system performance before it blew a $4000 account. Another one mentioned that the backtests looked modified and can’t be relevant proof of the system stability.

Summing up

Gold M Stops is a system that executes orders with only a demo account. There was a period of the “fixed” data. So, we have no idea if the system is safe and welcome to trade on a real account with conservative risks. The price is at least three times higher than it should be for this type of the system.