Hippo Trader Pro is an FX robot that uses the trend-following approach, particularly in European and Asian sessions. The developer claims that this FX EA can provide high profits and a low drawdown. This MT5 tool has undergone stress tests for over 17 years and has produced favorable results as per the developer.

Is investing in Hippo Trader Pro a good decision?

For this review, we have assessed the features, backtests, trading results, and other aspects of this FX EA. From our analysis, we find that this is not a reliable ATS as the backtesting and real trading results show a high drawdown and low profits. We suspect the strategy used is not effective and can result in big losses.

Company profile

As per the info on the MQL5 site which promotes this FX EA, Michela Russo is the developer. This MT5 tool was published in February 2021 and is in version 2.0. Russo is from Italy and has two years of experience in developing FX trading systems which include 6 products and 14 signals.

For support, the developer provides a Telegram channel link, and messaging via the MQL5 site is also present. Turtle Scalper Pro, Spider Crazy Pro, and Squirrel Trader Pro are a few of the products by the developer. We could not find a phone number or location address for support which raises doubts regarding the reliability of the FX robot.

Main features

Some of the features that the developer focuses on in this FX Robot include the following:

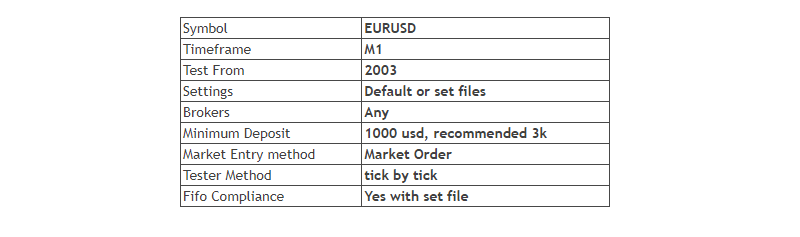

- The EURUSD is the main currency pair with a timeframe of M1.

- With appropriate settings the EA is FIFO compliant.

- No obsolete indicators or charts are used by this EA.

- The backtests with maximum accuracy reveal a high payout rate and resistance to unexpected market events.

- It has been backtested from 2003 up to 2021.

- The global SL of the system is fixed at $1000 for a lot size of 0.01.

- The relative vigor index oscillator is used for spotting the trend.

- Developer recommendations for the system include a minimum deposit of $1000 and a recommended deposit of $3000.

According to the developer, this EA identifies the main trend by entering the market based on volatility using the ATR filter and trend pattern to spot the possible future trend. The strategy explanation looks vague and is insufficient to find out the efficacy of the system.

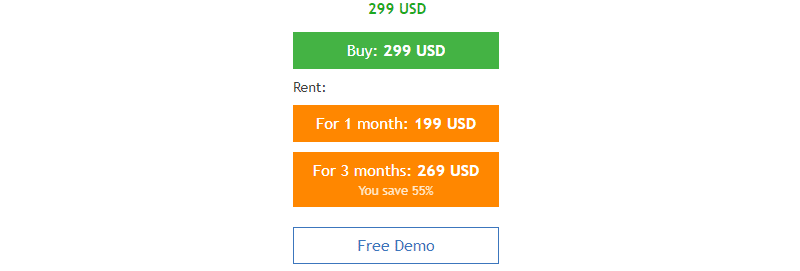

Price

To purchase this EA, you need to spend $299. The vendor offers rental options also that include a one-month rental for $199 and a 3-month rental for $269. A free demo account is present. We could not find a money-back guarantee for this ATS which does not reflect well on the reliability of the system. Furthermore, when compared to other competitor trend-based systems, the price looks expensive and not worth it.

Trading results

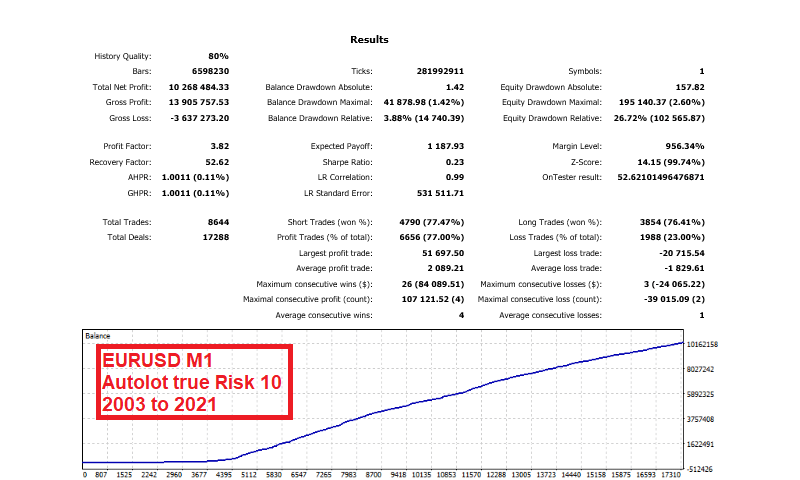

The developer provides backtesting results for this EA done from 2003 to 2021. As per the strategy tester report, we can see a total net profit of 10.268.484.33 was generated for the account. A maximum drawdown of 26.72% and a profit factor of 3.82 were present for a total of 8644 trades. The profitability was 77%.

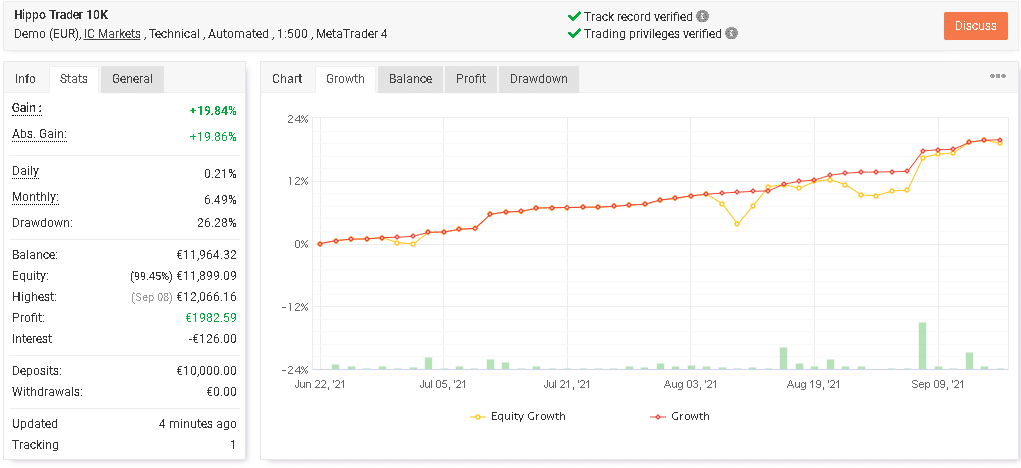

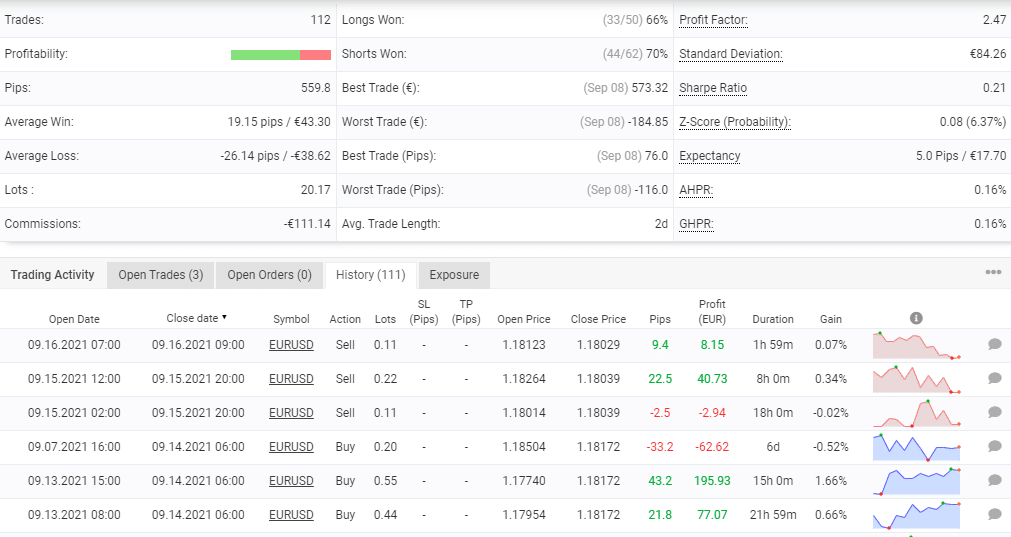

We found a demo EUR account verified by the myfxbook site for this FX EA. The account uses the IC Markets broker and the leverage of 1:500 on the MT4 platform.

From the trading stats, we can see the system has generated a total profit of 19.84% and an absolute profit of 19.86% for a deposit of €10,000. The account started in June 2021 has completed 112 trades until now with a profitability of 69% and a profit factor of 2.47. From the trading history, we can see varying lot sizes are used starting from 0.10 up to 0.90.

The drawdown for the account is 26.28% and the daily and monthly profits are 0.21% and 6.49% respectively. From the results, it is clear that the system uses a high-risk strategy. The big lot sizes and high drawdown are indicators of a risky approach and poor performance. Comparing the backtesting result with the demo account results, we can see that the profits generated are low and the drawdown is high, indicating the approach used is not a successful one.

Summing up

Hippo Trader Pro claims to use the trend-following approach for maximizing profits and lowering risk. Our analysis of the system reveals several downsides in the FX robot. The vague explanation of the strategy, the risky approach shown in the backtesting and demo account results, and inadequate support are the shortcomings that make this ATS unreliable. Furthermore, the price is expensive and does not come with a money-back assurance which also points to the unreliability of this FX EA.