A pump and dump scheme is an illegal activity where an individual or a team decides to push the price of an asset substantially higher and then exit. Although illegal in countries like the United States and the UK, these schemes are extremely popular, especially among small-cap stocks. This article will explore how the schemes work and how you can profit from them.

How a pump and dump scheme works

This term is made up of two distinct terms. The pump is the process of accumulating and boosting a certain asset, while dumping is the process of liquidating the asset.

Pumping can be done through several mediums, including social media, television, newspapers, and other online platforms. After encouraging other investors to buy an asset, the promoter of the scheme can then exit their trades at a profit. The remaining investors are then left holding the bag.

A pump and dump (P&D) scheme can be carried out by ordinary retail investors, a company’s insiders, and even sell-side analysts.

The schemes can be done across most assets, including commodities, cryptocurrencies, and stocks. The best-known form of P&D happened in 2017 during the height of the Initial Coin Offering (ICO) schemes.

An ICO is a period where a blockchain developer sells tokens to investors with the goal of funding their creation. At the time, we experienced many crypto developers team up with celebrities to pump the prices of the ICOs. In some well-notable cases, the ICO promoters disappeared, leaving many vulnerable investors holding the bag.

Another popular example of a pump and dump scheme happened in early 2021. At the time, we saw the share prices of companies like AMC and GameStop and commodities like the silver jump within a short period. We also experienced cryptocurrencies like Shiba Inu skyrocket. This price action was helped by activities in social media platforms like StockTwits and Reddit.

Pump and dump in stocks

P&D schemes are popular in the stock market. However, in most cases, they tend to happen in the small-caps or penny stocks segment. These are significantly smaller companies that typically trade in the over-the-counter (OTC) marketplaces. The biggest provider of penny stocks or pink sheet stocks is a publicly-traded company known as OTC Markets.

These stocks are relatively easy to manipulate because of their small market capitalization. For example, a trader with $50,000 can easily move a stock that is valued at less than $1 million. In this case, the trader will start accumulating the stock, thus increasing its volume.

As the shares rise, the trader can start promoting the stock in blogs and in social media. Further, as the company’s shares rise, the person can then easily exit the stock.

Small-cap stocks are easier to manipulate than large or mega-cap shares like Microsoft and Apple. This is simply because these firms are highly covered by sell-side analysts and that their share prices are not cheap.

How to spot a pump and dump scheme

Fortunately, it is relatively easy to spot a company or an asset that is being pumped. First, we recommend that you identify the top moving stocks of the day. There are many free platforms where you can get this information. In fact, many brokers have a feature that shows you the top movers.

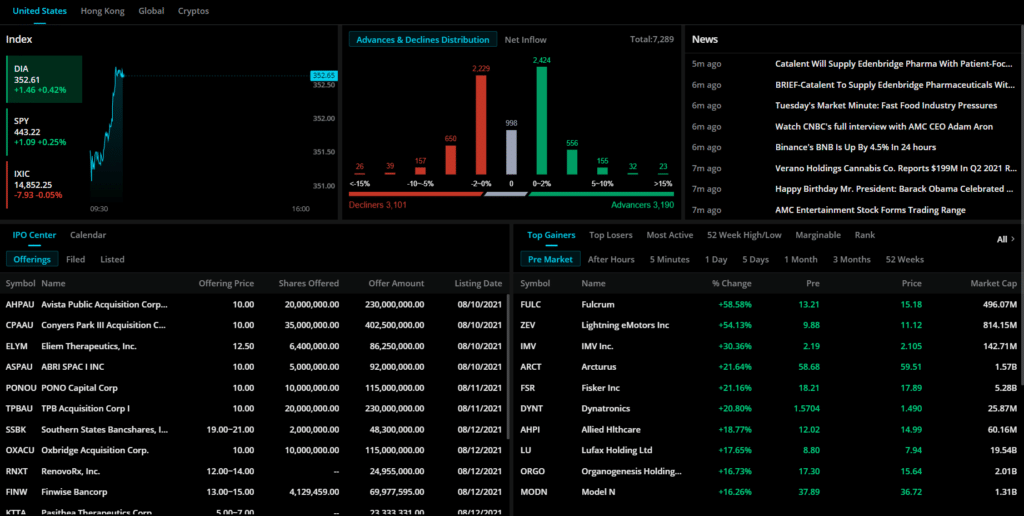

Alternatively, you can use platforms like Market Chameleon and Investing.com to find this information. The chart below shows the top risers at the time of writing this article.

In this chart, we see that stocks like Fulcrum, Lightning eMotors and IMV have jumped by more than 30% in a session. Now, in most cases, those parabolic moves are caused by major events like earnings and mergers and acquisitions.

Second, you should look at the previous price action of the shares to see whether there is an emerging pattern. Next, you should look at the latest news about the company. If there is a major catalyst, then it means that this is not a pump and dump scheme. On the other hand, if there is no catalyst, there is a possibility that the movement is part of a scheme.

At this time, we recommend that you go to social media platforms and find out what people are saying about the firm. You can search the company name or the ticker symbol for this information.

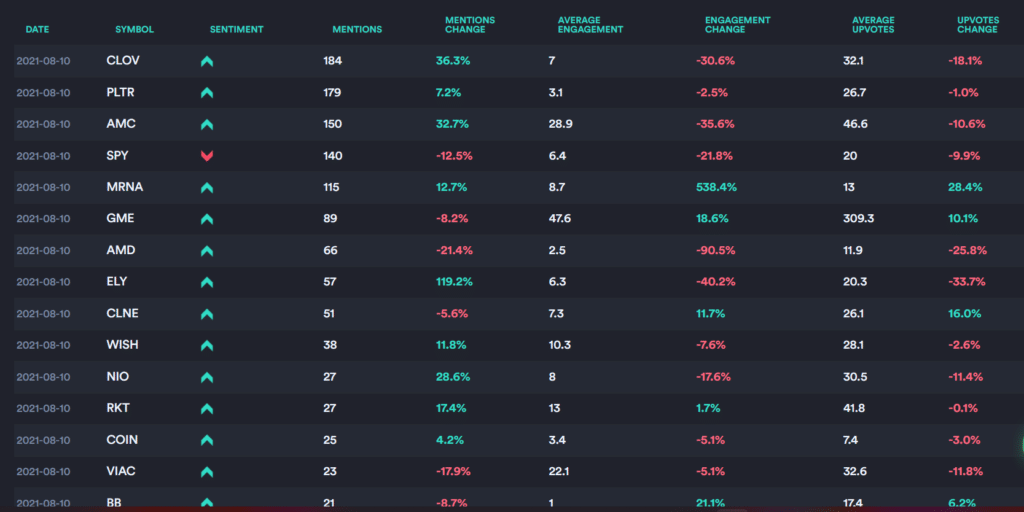

Top mentions on WallStreetBets

Alternatively, you can use free platforms to find companies that are being discussed in WallStreetBets. If there is no news and the firm is among the hot topics, then this could be a pump and dump scheme. The chart above shows some of the top mentions on the platform.

How to trade pump and dump schemes

Another fortunate thing is that it is relatively easy to trade pump and dump schemes. The first step is to identify the asset that is being pumped using the techniques mentioned above.

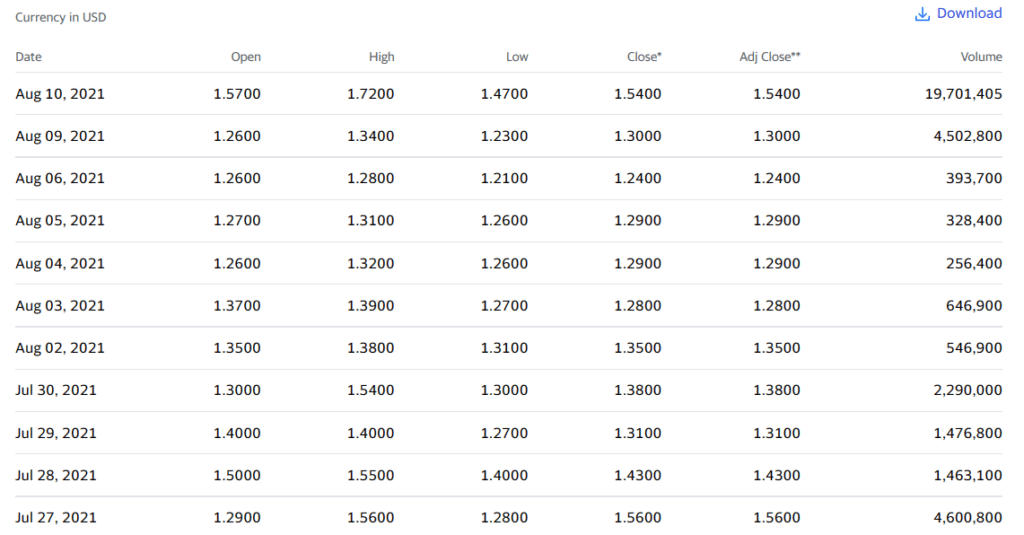

The second thing you need to do is to look at the average volume of the stock. You can look at this data on several platforms like Yahoo Finance and Barchart. For example, in the previous chart, we see that Dynatronics is one of the top movers.

Now, looking at Yahoo Finance, we see that the stock’s volume jumped to more than 19 million shares. On average, the stock trades less than 400k shares per day. This signals that the bullish trend will likely lack support. As such, if your broker offers it, you can short the stock and benefit as its price declines.

Dynatronics Corporation volume chart

Another way of making money in pump and dump schemes is to use pending orders and stops. A pending order is one that is only opened when a stock’s price reaches a key level. For example, in the case of Dynatronics above, you could set a buy-stop at $1.59 and a take-profit at $2.1, and a stop-loss at $1.55. In this case, if the stock keeps rising, the buy-stop will be initiated at $1.59 and a take-profit at $2.1.

Summary

While pump and dump schemes are illegal in the US, they are still popular. That’s because, at times, it is very difficult for regulators to make the case of these schemes in a court of law. Still, as a trader, what you need to know is when to identify these schemes and some of the key strategies to use.

Another one that we have not mentioned is about not being in them for the long term. You should not buy and hold these stocks since they tend to go back to their usual levels in the long term.