Corporate earnings are some of the top movers in the stock market because they provide a picture of how a company performed in a quarter. They also provide a picture of what the management expects for the next quarter. In this article, we will look at what the earning season is and how to maximize your returns during the period.

What is an earnings season?

In the United States and most countries, companies are required by law to disclose their earnings every quarter. These earnings provide disclosure of how a company performed, the challenges it faced, and what it expects going forward.

The earning season is therefore defined as a period when most companies in the US publish their results. It usually comes a few weeks after the end of a quarter. That is in April, July, October, and January. In April, companies publish their first-quarter results and so on.

The “official” season starts when the big Wall Street banks publish their results. In most periods, the first companies to publish are banks like Wells Fargo, Citigroup, and JP Morgan. The others that release in the first week are Johnson & Johnson, Blackrock, Morgan Stanley, and Goldman Sachs.

Why traders focus on earnings

Traders and investors watch the earnings period for several reasons. First, they get more information about how a company performed in a quarter. They get answers on its revenue, profitability, costs, and competition.

Second, in addition to the generic earnings reports, investors get a chance to listen to a company’s management. In the US, many companies usually offer an earnings call where they provide updates and answer questions from analysts.

Third, many companies usually make major announcements during this period. Some of the popular announcements are management changes and mergers and acquisitions (M&A). These tend to lead to more volatility and higher liquidity.

Trading during the earning season

As a trader, it is possible to make a lot of money during the season because volatility usually rises. However, it is also possible to lose a substantial amount of money if you are not careful.

Using the earnings calendar

An earnings calendar is a schedule that highlights when companies will publish their results. It is similar to an economic calendar.

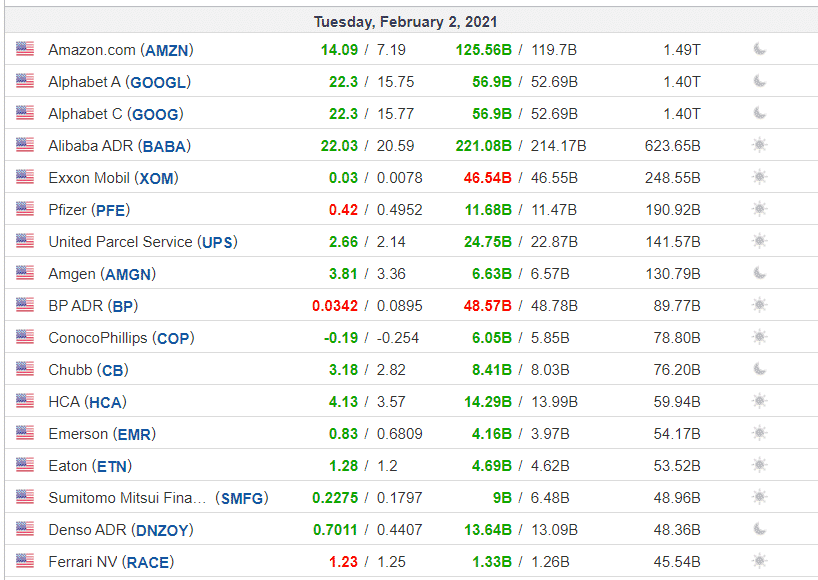

As a trader, using the calendar is important because it will help you be prepared. Fortunately, this calendar is provided by many free platforms like Investing.com and SeekingAlpha. The chart below shows what the calendar looks like.

Earnings calendar example

In the screenshot above, we see several things. We see the names of the companies that published their results on Tuesday, February 2, 2021. We also see the earnings per share, revenue, the market cap of the company, and the time when it will publish its results. The green numbers mean that the company’s results were better than what analysts were expecting. The red numbers mean that the business missed its target.

Use data in the options market

The options market plays an important role in the financial industry. In most periods, a company’s insiders and Wall Street banks use options to prepare for the earning season. While you can use this data in several ways, the most popular one is to use unusual options activity. This is simply a process where you use public data to predict what insiders are doing.

For example, assume that a company’s average volume in the options market is 500. If you see the volume rise to 5,000 before earnings, it means that there are insiders positioning themselves for a big release. You can get this data from platforms like Barchart.com and Yahoo Finance.

Understand extended hours

In the US, companies usually publish their earnings in extended-hours trading. Some publish shortly after the stock market has closed, while others publish before the market opens. Very few companies release their results during the regular session.

Fortunately, most online brokers like Schwab, TD Ameritrade, and Robinhood enable traders to buy and sell shares after the market closes. They achieve this by using Electronic Communication Networks (ECN) that match orders between buyers and sellers. Therefore, after a company publishes its results, you can take advantage of early action during these periods.

However, there are some limitations of trading in after-hours and pre-market. For example, you can only open limit orders, and you may not get the right price.

Understand company-specific information

In theory, a company’s share price should rise when it releases strong results and fall when it has weak earnings. However, in some cases, a company’s stock may decline when it releases strong results. This is mostly because investors usually look at some specific numbers for certain companies.

For example, a company like Netflix focuses on the number of new customers that they added in a quarter. As a result, its shares might fall even when it releases strong revenue and growth numbers. Similarly, a company like Goldman Sachs tends to focus on the fixed income, commodities, and currencies (FICC) segment.

For social media companies like Facebook and Twitter, their main focus is the number of new users. Whenever Tesla is concerned, they look at the number of cars shipped, while for a growth company like Okta, they focus on revenue growth.

Company correlations

Finally, when trading during the earnings season, always remember about company correlations. Ideally, investors believe that similar companies perform similarly. Therefore, when an entity like Google releases strong earnings, the assumption is that Facebook too will have similar results. Therefore, if Google is the first to report, you will likely see other ad-tech companies do well. The same is true for other companies in the banking, oil, and gas, and consumer goods industries.

Final thoughts

If you are a stock trader, the earning season will be your most profitable trading period because of the volatility. In this article, we have explained what the earning season is, how to use the earnings calendar, and some of the top strategies to use during the season.