- Falling steel profit margins may affect the demand for iron ore.

- China is still determined to regulate imports artificially.

- Covid-19 in Southeast Asia is a cause for concern.

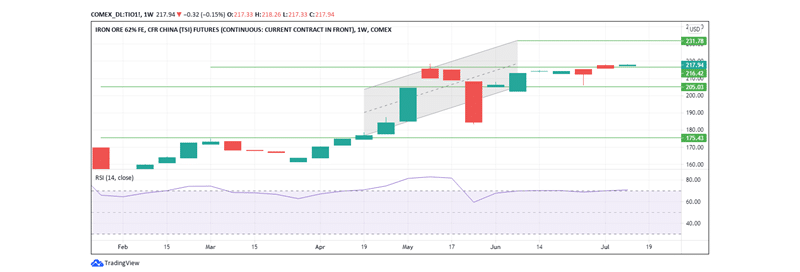

Iron ore prices rose on Thursday despite worries that China could slow down on its demand for the commodity as China steel prices fall. September iron ore futures were up by 3.68% at 1326 GMT as Fast markets MB reported a marginal rise in 62%Fe prices in China’s Northern region by 0.1% to $218.66/ mt on Wednesday. However, at the time of writing, the commodity was $0.32 or 0.15% lower than its price one week ago.

Signs of weakening market demand

After a recent ascent that saw its prices come to within a touching distance of the $237 ATH recorded in May, iron ore may be on its way down, thanks to reduced steel profit margins in China.

In addition, China has reported its first monthly decline in excavator sales figures in over a year, which is linked to a weather-related decline in construction activities in the nation. The spreading of the Covid-19 Delta variant to China’s Southeast Asia steel market may also hamper hopes of a price rally. Iron is a key component in the manufacture of steel.

China’s Tangshan region had recently resumed steel production, and it had been expected that this would have stimulated further rises in price. However, the declining uptake of steel may now cool the recent price rally.

It has also emerged that China’s carbon emissions reduction targets may have put a strain on iron and steel factory activities.

China’s losing battle against price surges

China had also announced last month that it would be taking measures to curb what it considers speculation-driven commodity price rises in the past two months.

The Central State has not hidden its suspicion of Australia’s role in influencing the prices of base metals and has so far shown its intent through a recent auctioning of state-held base metals. China targets to reduce its import of Australian iron ore by $32 billion. However, its efforts have achieved little so far, as market demand keeps iron ore above $200 per tonne.

Things have also been worsened by the halting of mining activities at Timbopeba and partial closure of the Alegria mine, both in Brazil due to safety concerns over a tailings dam. This has led to a reduced supply of the commodity.

As China struggles to control its appetite for iron ore imports, the Bank of America this week said that the market demand and supply forces would ultimately win against the fightback by the government. On Tuesday, for example, the Dalian Commodity Exchange’s most-traded September futures rose by about 3.5%, representing a rise in price to $189.87/mt. On Monday, iron ore rose to as high as $217, asserting the validity of BOA’s assessment.

Technical analysis

At the time of writing, iron ore was trading at $217.94. The weekly RSI is marginally above 70, meaning that the commodity may have been overbought. If that holds, then the market may become bearish, sending the price to the first support level at $ 205.03.

However, if the market fundamentals become unfavorable, the price could go further down to below the $200 mark to settle at $175. However, if the fundamentals hold strong, the price could go as high as $231.78.