The vendor of Kapola Trader claims that the robot generates stable profits monthly without making any losses. The devs also want us to believe that it trades safely, thanks to its advanced winning technique that tackles risks in an intelligent way. Trailing stops are included in the system to secure profits.

Is investing in Kapola Trader a good decision?

From the live trading results on Myfxbook, it is apparent that this robot has made decent profits for the user for the short period it has operated the account. However, the system works with dangerous grid and martingale approaches.

Company profile

The company that developed this trading tool is not known. The presentation doesn’t mention the company or the professionals behind it. This is disappointing, given that some traders rely on the reputation of a vendor to decide whether to purchase their product or not.

Main features

These are the features that the vendor says the robot has:

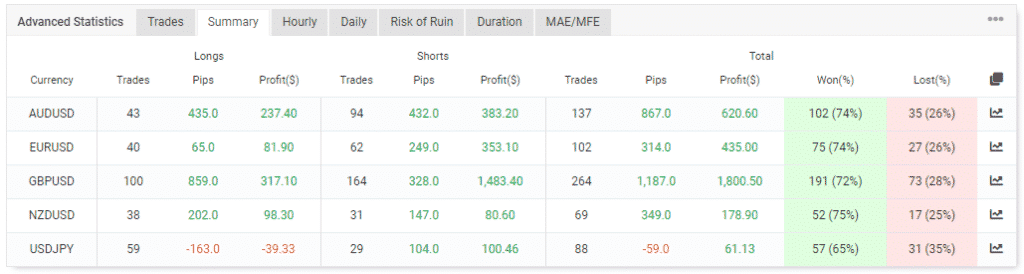

- It trades on the EURUSD, AUDUSD, USDJPY, GBPUSD, and NZDUSD currency pairs.

- The recommended timeframe is M15.

- It does the trading for you on autopilot.

- The EA provides round-the-clock customer support.

- It includes free updates.

- The robot runs on the MT4 terminal.

Kapola Trader EA’s strategy relies on Bollinger bands, CCI, and other different indicators. As such, it uses the Bollinger Bands to place buy/sell orders. The other indicators study the data on the current market price and use the findings to compute precise and accurate entry prices. At times, the system will identify multiple points of entry to optimize profits. To exit from a trade, the EA uses CCI and moving average. In essence, the moving average computes the exit point, while CCI confirms that the exit points are the correct ones.

Price

The vendor is offering the bronze, silver, and gold packs at $99, $149, and $249, respectively. These packages feature real and demo accounts and a 30-day money-back guarantee.

Trading results

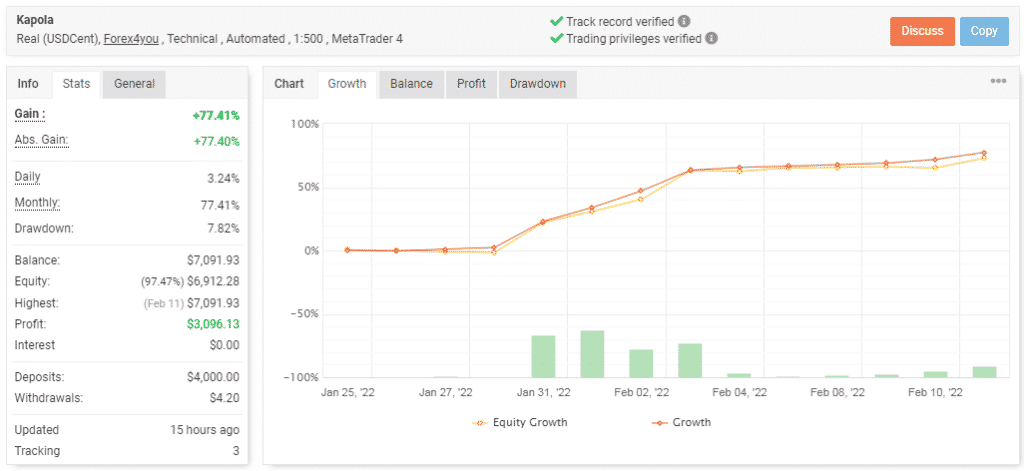

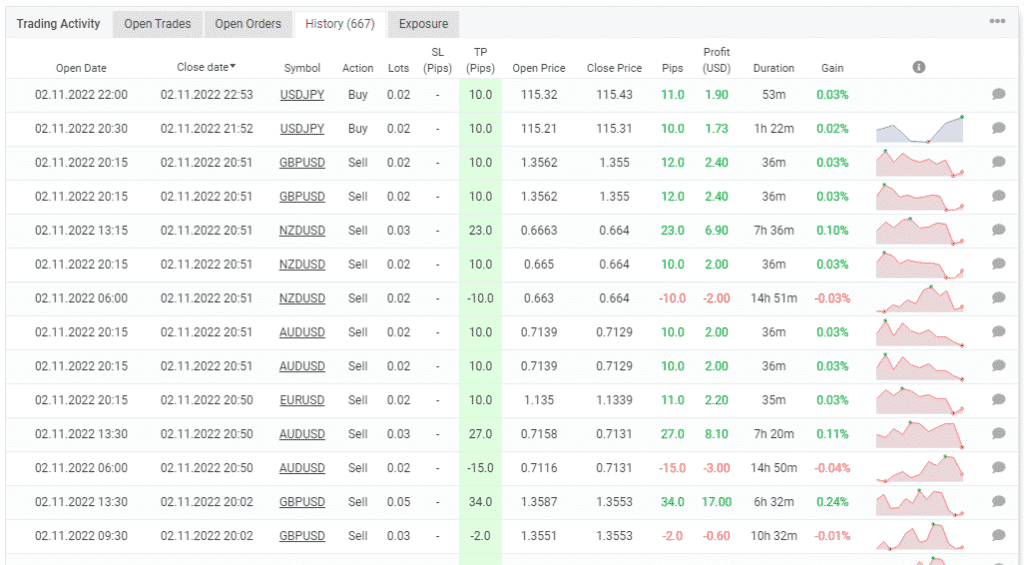

The backtest report of this system is not presented. Therefore, its performance on historical data remains a mystery. The good thing is that you will find the system’s live trading records on Myfxbook. Let’s have a look at them below:

At present, Kapola is running a real USDCent account and the host is the Forex4you brokerage. The account was opened a few weeks ago and deposited at $4000. So far, it has brought in a profit of $3096.13, which is a good sign. Trading risks are low considering that the drawdown is below 10%. The total gain is 77.41%.

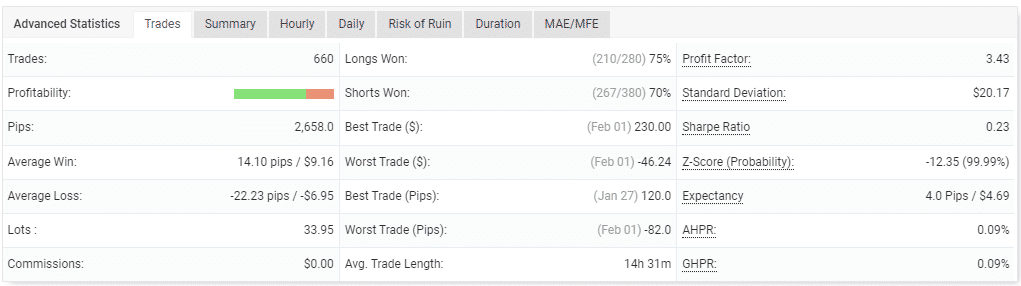

The robot is also quite active, having completed 660 trades to date. Out of these, 75% of the long positions and 70% of the short ones have been won. For now, the average loss (-22.23 pips) is more than the average win (14.10 pips). So, the robot is likely to record more losses than wins. The profit factor is 3.43.

The GBPUSD is the most used pair, while NZDUSD is the least traded symbol. The USDJPY instrument is the only one that has made losses till now.

The grid strategy is part of the trading algorithm. The martingale approach can also be seen. Each order has a take profit attached to it.

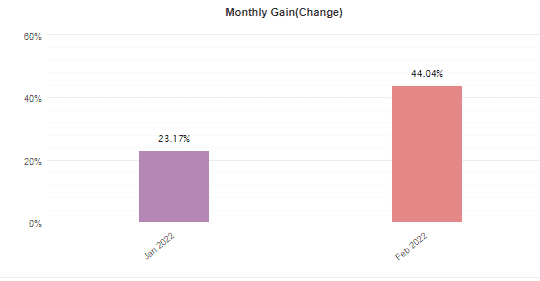

Both January and February have recorded substantial profits.

Customer reviews

Kapola Trader doesn’t have customer reviews. So, we don’t know if traders have worked with it or not.

Summing up

We have established that the EA works with low risks to the balance and makes significant profits for the user under the right market conditions. Unfortunately, the vendor does not provide the backtest results, so we cannot determine if the system can trade safely and profitably in the long run. Moreover, the presence of grid and martingale approaches puts the account at high risk of experiencing losses in the future should the market take an unexpected trend.