The MicroStrategy stock price sold off on Wednesday after the prices of Bitcoin made a parabolic decline. The stock declined to a session low of $412, which was its lowest level since January this year. The decline exceeded 65% from the all-time high of $1,305. The firm has a market capitalization of more than $4.4 billion.

Other Bitcoin-exposed companies like Square and Paypal have also dropped substantially in the past few sessions. Square has experienced a 27% decline from its YTD high while PayPal has dropped by more than 20%.

MicroStrategy Bitcoin exposure

MicroStrategy is a technology company that provides business intelligence and data analytics services to companies. Some of the companies it serves are Pfizer, Disney, eBay, and ServiceNow. It competes with other technology companies like SAP and Microsoft.

Run by Michael Sayler, MicroStrategy is well-known for its huge investments in Bitcoin. The company owns over 110,000 Bitcoins that are currently worth more than $4.1 billion. This means that investors are currently valuing the combined company for its Bitcoins rather than its overall business intelligence solutions.

Therefore, the MicroStrategy stock price has struggled lately because of its exposure to Bitcoin. The digital currency has been in a sharp downward trend this week as it fell to the $30,000 mark. This means that the currency has lost half its value from the all-time high of near $65,000.

There are several reasons why BTC has tanked. First, there is the fear that the Federal Reserve will start a new tightening cycle as the US economic recovery continues. The bank published the minutes of the April meeting on Wednesday evening.

The minutes showed that officials started talking about exiting the pandemic response measures like the $120 billion a month asset purchases. Higher interest rates tend to be bearish for most assets, especially technology companies and cryptocurrencies.

Second, BTC declined after a warning by Chinese regulators about cryptocurrencies’ volatility. In a statement, a group of Chinese regulators warned banks and other companies against accepting Bitcoin and other cryptocurrencies. Further, the currency tumbled because of panic selling.

What next for MicroStrategy stock?

In a tweet on Wednesday, Michael Saylor insisted that the company was not planning to sell any of its Bitcoins. Therefore, the next moves of the stock will be closely correlated to the movements of BTC. If BTC recovers, there is a possibility that the stock will recover too.

As a relatively small company, MicroStrategy is not followed by many analysts. In a report this week, analysts at Jefferies lowered the company’s target from $700 to $540. This is substantially higher than the current price of $454.

Early this month, before the BTC sell-off started, analysts at Citigroup boosted their target for the stock to $450. And in April, those at Canaccord Genuity upgraded their target to $900.

MicroStrategy stock analysis

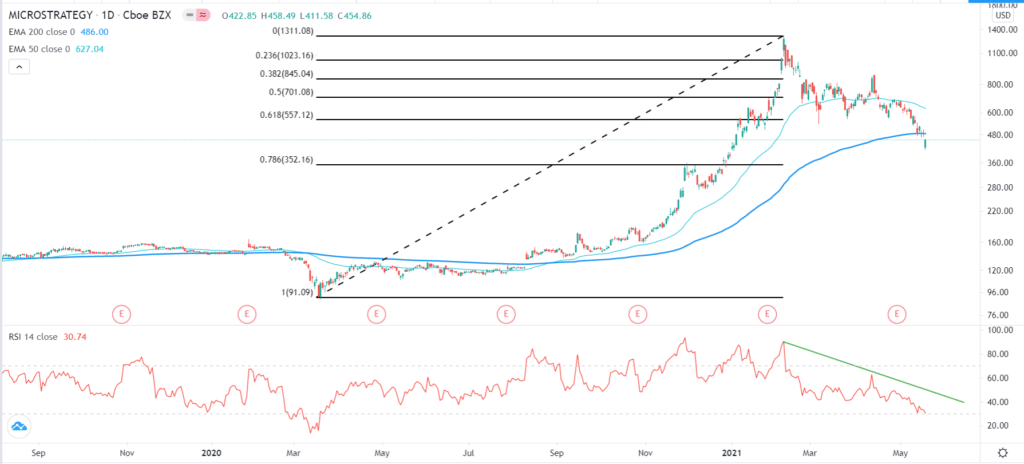

The daily chart shows that the MicroStrategy stock price has come under pressure lately. The shares have tumbled from the YTD high of $1,311 to the current $452.

Along the way, the stock has crashed below the 50% and 61.8% Fibonacci retracement levels. Worse, it has moved below the 200-day exponential moving average, which is a bearish signal.

The Relative Strength Index (RSI) has also started declining. Therefore, while volatility is expected, the stock may keep falling as bears target the 78.6% Fibonacci retracement level at $352.