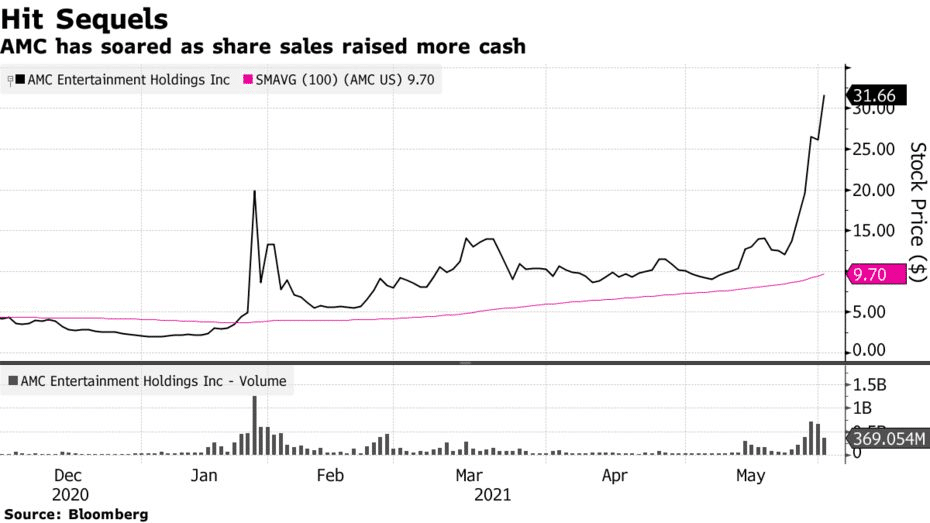

Investment firm Mudrick Capital divested all its holdings in AMC Entertainment Holdings Inc. the same day an announcement was made on the acquisition of $230.5 million worth of shares, Bloomberg reported.

- Mudrick sold its AMC shares at a profit after it found the movie theater to be overvalued, according to a person close to the matter.

- AMC on Tuesday said Mudrick bought 8.5 million shares of common stock at $27.12 apiece, with an agreement that the shares could be sold at any point.

- AMC Chief Executive Officer Adam Aron said the transaction with Mudrick would allow the firm to go aggressive in acquisitions.

- Mudrick in January agreed to acquire $100 million of new secured bonds to get a commitment fee worth 8 million AMC shares in return.

- The deal also included a provision for Mudrick to exchange $100 million of AMC bonds due 2026 for some 13.7 million shares.

MUDS: Nasdaq is up 0.95%, while AMC: NYSE is up 18.57% premarket.