MyForexPath uses Metatrader 4 and Metatrader 5 trading terminals to trade on multiple currency pairs. The developer states that the algorithm can achieve a 65-70% win rate, boosting it as an outstanding result. The robot is compatible with all brokers and comes with multiple backtesting records. Our review will analyze all the features of the expert advisor while keeping in mind the unpredictability and volatility of real market conditions.

Is investing in MyForexPath a good decision?

The presentation of the robot is convincing, but a bit more insight into the strategic game plan would have been great. The EA comes with a refund policy and ensures a high win rate, but the slightly big drawdown exhibits a high-risk strategical approach evident in real account and backtesting stats. The pricing is a bit high compared to other options available on the Forex market.

Company profile

The team members’ names, social media handles, email addresses, and other contact information are absent on the official website of the MyForexPath, and only one single product is listed for sale. The vendor kept the users blind regarding their location or company biography. Only online fill-in forms are present on the website to reach the service provider to ask your queries.

Main features

Following are the main feature of the EA:

- The FX boot can work on three major currency pairs such as AUDUSD, USDCAD, and EURUSD.

- It’s a 100% automated forex solution.

- The expert advisor comes with eight years of backtesting stats.

- The robot trades in both MT4 and MT5 platforms.

- The algorithm claims an average 65-70% winning rate.

- The developer offers a refund policy for 30-days.

- It’s not broker-sensitive.

- The system is easy to install and use.

- The devs provide a 24/7 customer support.

- MyForexPath comes with free updates and upgrades.

Strategy

As per the developer, the EA is determined to open trades in the trend direction, and it comes with an innovative stop-loss feature that closes it if the position goes in the opposite direction. Each pair receives an individual treatment from the robot, allowing it to open a large number of positions. The expert advisor uses indicators like Parabolic and MA to ensure accurate entries.

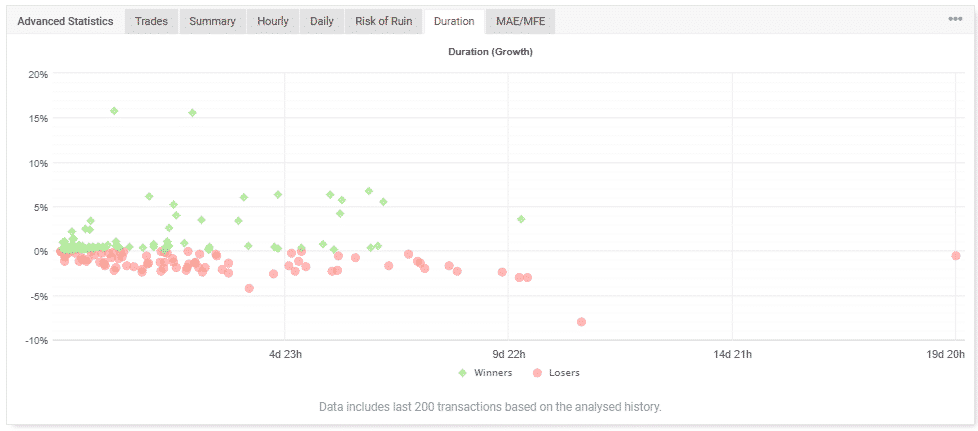

MYfxbook history shows us that most of the trades have an average trade length hovering around 4 days.

There is an aggressive use of martingale here as the trades are multiplied by 10x the initial lot size as they move several pips away from the initial direction.

Price

MyForexPath is available to purchase at $285 with one unlimited license, compatibility with both MT4 and MT5 trading terminals, a detailed user guide, free updates, and 24/7 technical support. The developer claims a 30-days refund policy, but the product lacks renting options and multiple purchasing plans. Furthermore, the EA is a bit overpriced, considering its performance and features.

Trading results

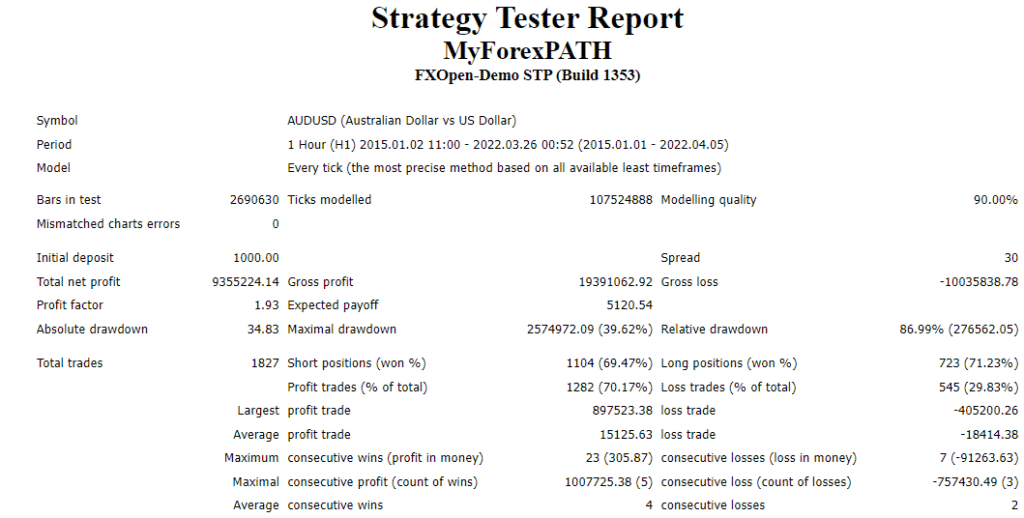

H1 timeframe backtesting stats are available on the AUDUSD from 2015.01.01-2022.04.05, with more than eight years of performance on historical data.

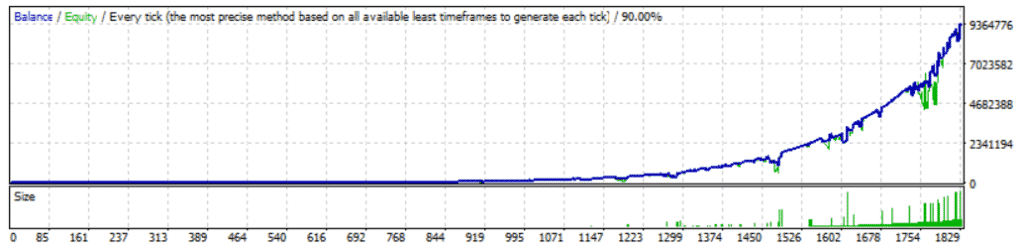

Every rick model was used with 107524888 ticks and 90.00% modeled quality. The developer deposited an initial amount of $1000. The system opened 1827 trades and showed a winning rate of 70.17%. The ratio between the average profitable and losing positions alongside the profit factor shows a poor overall game plan.

The total profit was 9355224.14 with a profit factor of 1.93. The relative drawdown of the robot was seen at 86.99%, which is very high and exhibits the high-risk trading approach of the EA.

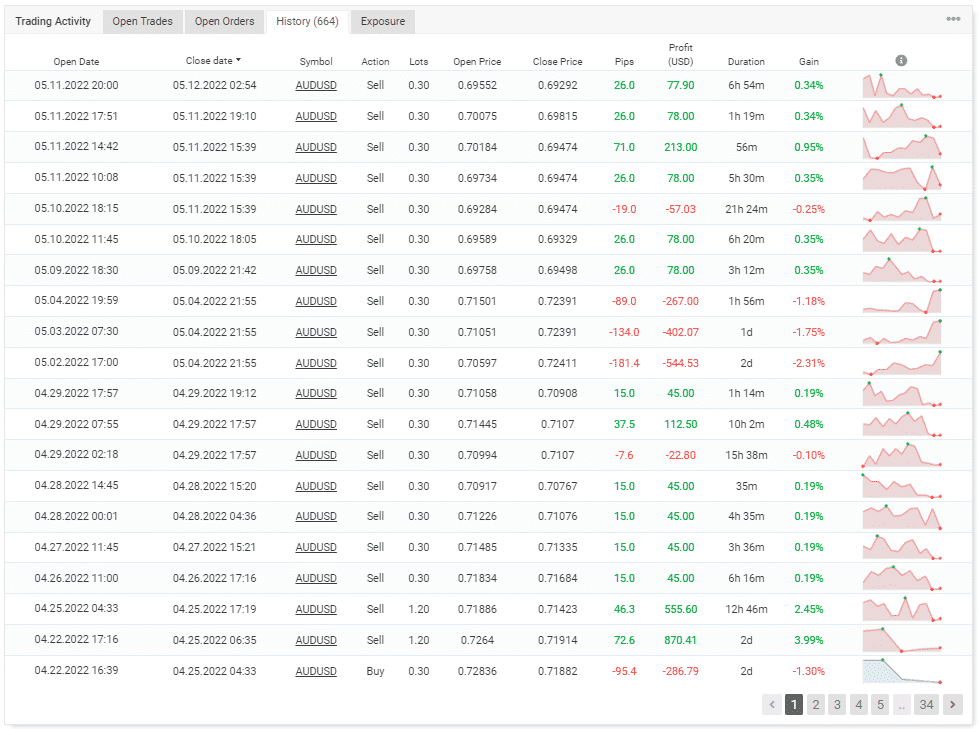

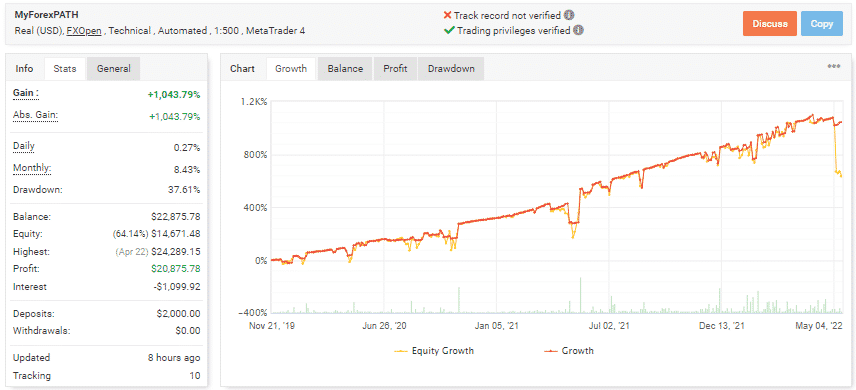

Live track records of MyForexPath are available on Myfxbook, but they are not ticked as verified by the platform. The account was added on Apr 21, 2022, using the 1:500 leverage on a real account. The profit factor is 1.47, a bit high than shown on the backtesting records, with a total gain of +1043.79%. The initial amount deposited by the developer is $2000, and the current total balance is $22,875.78. The expert advisor made a profit of $20,875.78, and the average trading time of the EA is three days.

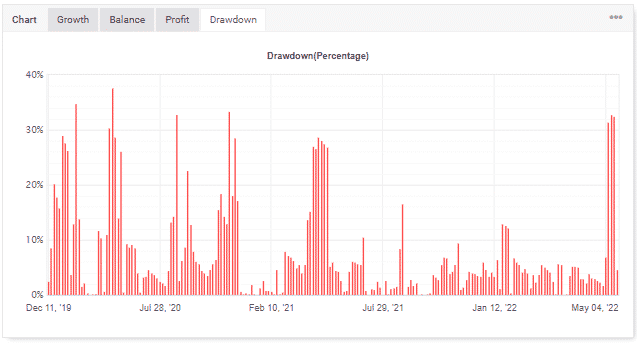

The average drawdown value of the system stood at 37.61% with a fluctuating chart, which shows that the EA is taking a high-risk strategical approach to trading.

Customer reviews

There are no customer testimonies present on any reputed third-party website such as Forexpeacearmy, Trustpilot, Quora, etc., that can ensure credibility and give an insight into their experience with the product. The absence of user comments also exhibits the lack of interest in the forex market traders.

The Review

MyForexPath provides extensive data of more than eight years and live trading stats with a good winning percentage, but the high drawdown value indicates the risky strategical approach. A bit expensive pricing, absence of customer testimonies, and lack of vendor information also raise concerns over the developer claims and credibility of the system.

Review Breakdown

-

Overall rating