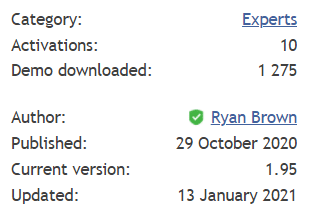

Pinpoint EA is a robot that we can see published on MQL5. It was designed by Ryan Brown and introduced on October 29, 2020. The last version is 1.95. It was released on January 13, 2020.

Is Investing in Pinpoint EA a Good Decision?

According to the trading results, the system is a scam. It’s a dangerous trading solution.

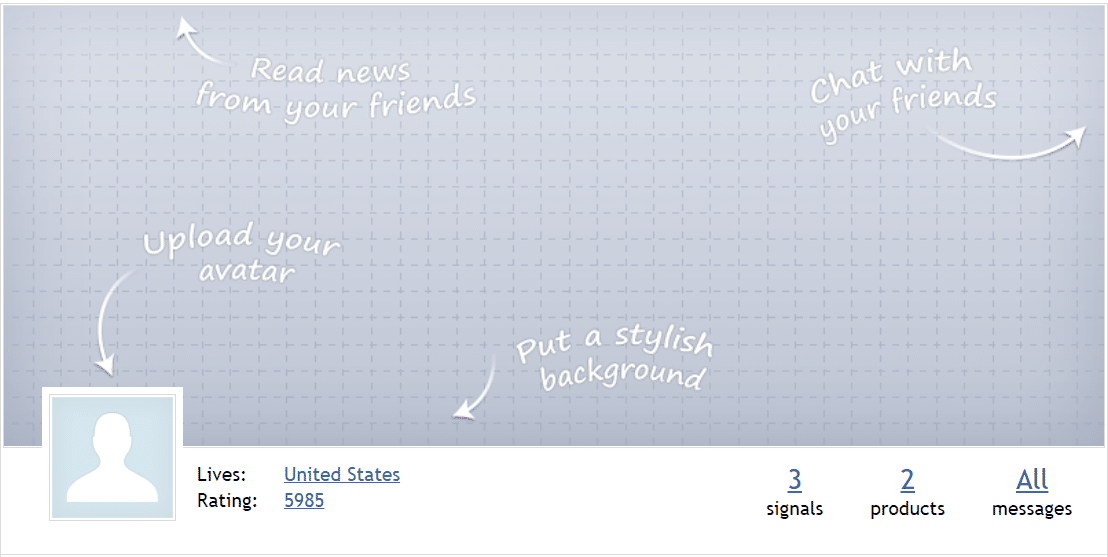

Company Profile

Ryan Brown has a faceless and coverless profile with a 5985 rate. There are three signals and two products on the board. The developer has only one friend connected.

Main Features

The presentation is a half-page short, but there’s something to notice:

- Pinpoint EA is an automatic trading solution.

- The robot was backtested based on 17-year tick data.

- The win-rate was over 94% on the backtests.

- The system has never lost two trades in a row.

- It places orders with a medium frequency.

- The default settings can provide up to 2.5% monthly.

- The robot can work only with two currency pairs EUR/USD and GBP/USD.

- The money management system covers all open orders with SL levels preventing losing deals when the market goes wild.

- The main strategy is trading in the trend direction.

- The robot works according to FIFO regulation rules.

- The main time frame to work is M15.

- The settings are optimized the best for GBP/USD.

- An ECN account is an option to work with.

- The leverage should be 1:30 or higher.

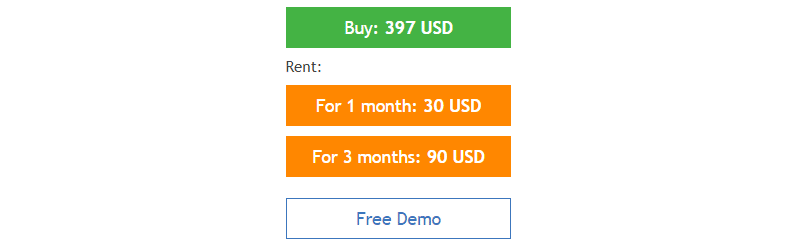

Price

The copy of Pinpoint EA costs $397. There are two rent options: one-month rent costs $30 when a three-month rent costs $90. We are free to demo download the system to check it on the terminal. There’s no money-back guarantee provided.

Verified Trading Results

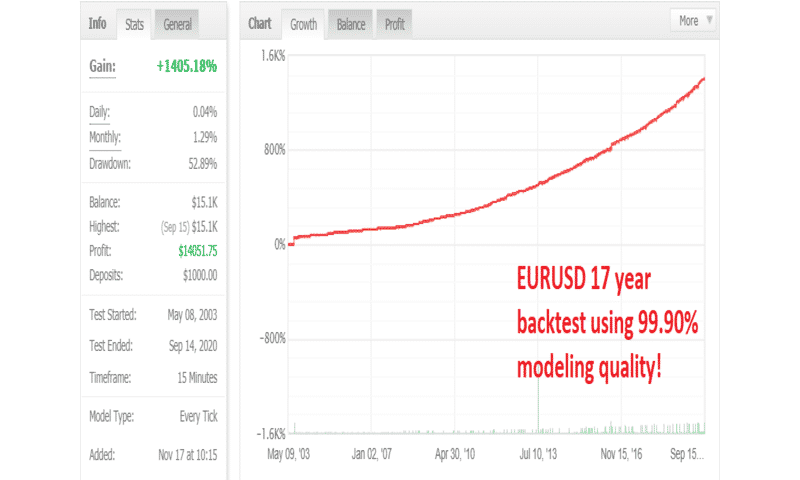

We’ve got a screenshot of the chart with a bit of data of a EUR/USD currency pair backtest report on the M15 time frame. The backtest was started on May 08, 2003, and finished on September 14, 2020. The modeling quality was 99.90% (without proof). The absolute gain was 1405.18%. An average monthly gain was 1.29% only. The maximum drawdown was truly high for that number of profits – 52.89%.

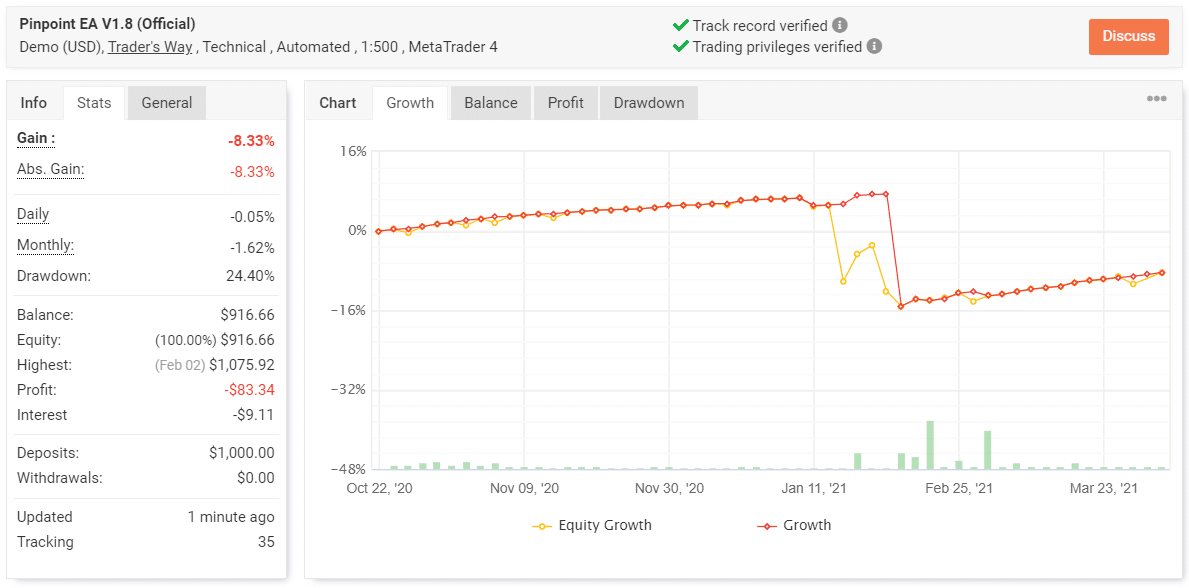

Pinpoint EA works on a demo USD account on the Trader’s Way broker house automatically with 1:500 leverage on MT4. The system uses technical indicators in its work. The account was created on October 22, 2020, and funded at $1000. Since then, the absolute gain has become -8.33%. An average monthly gain is -1.62%. The maximum drawdown is 24.40%. The account is tracked by 35 traders.

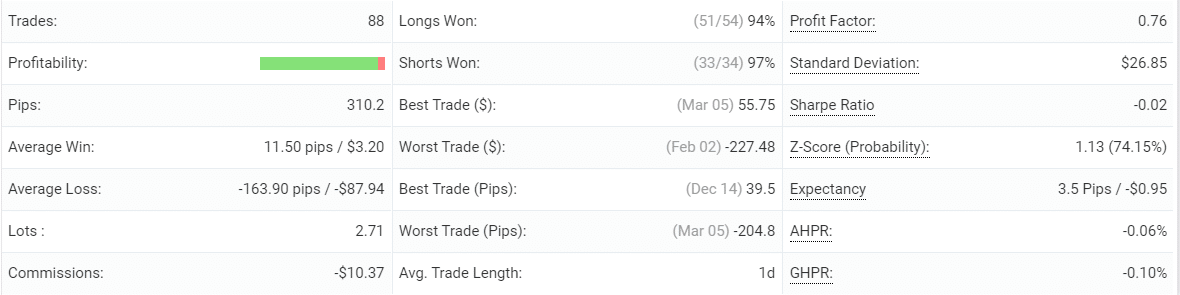

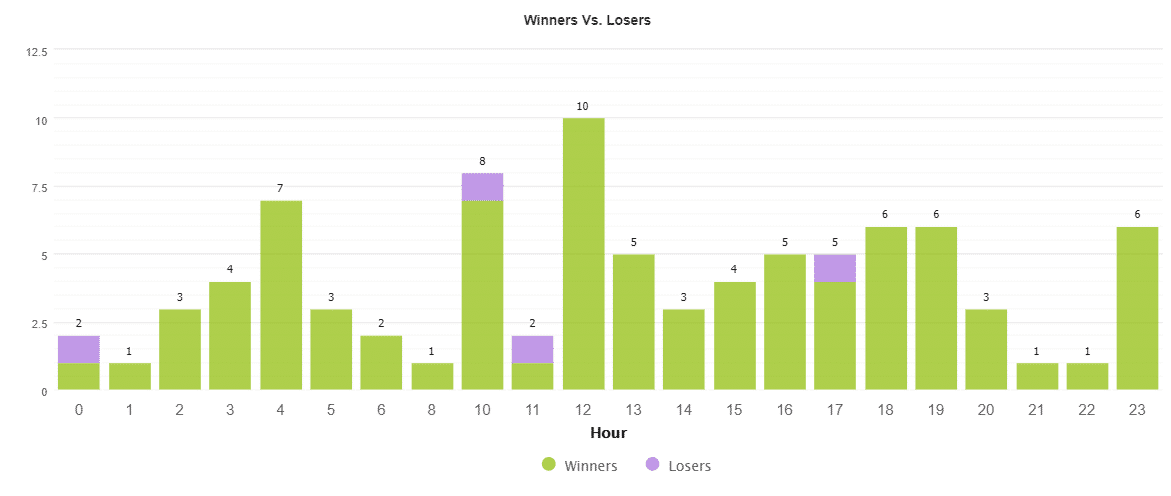

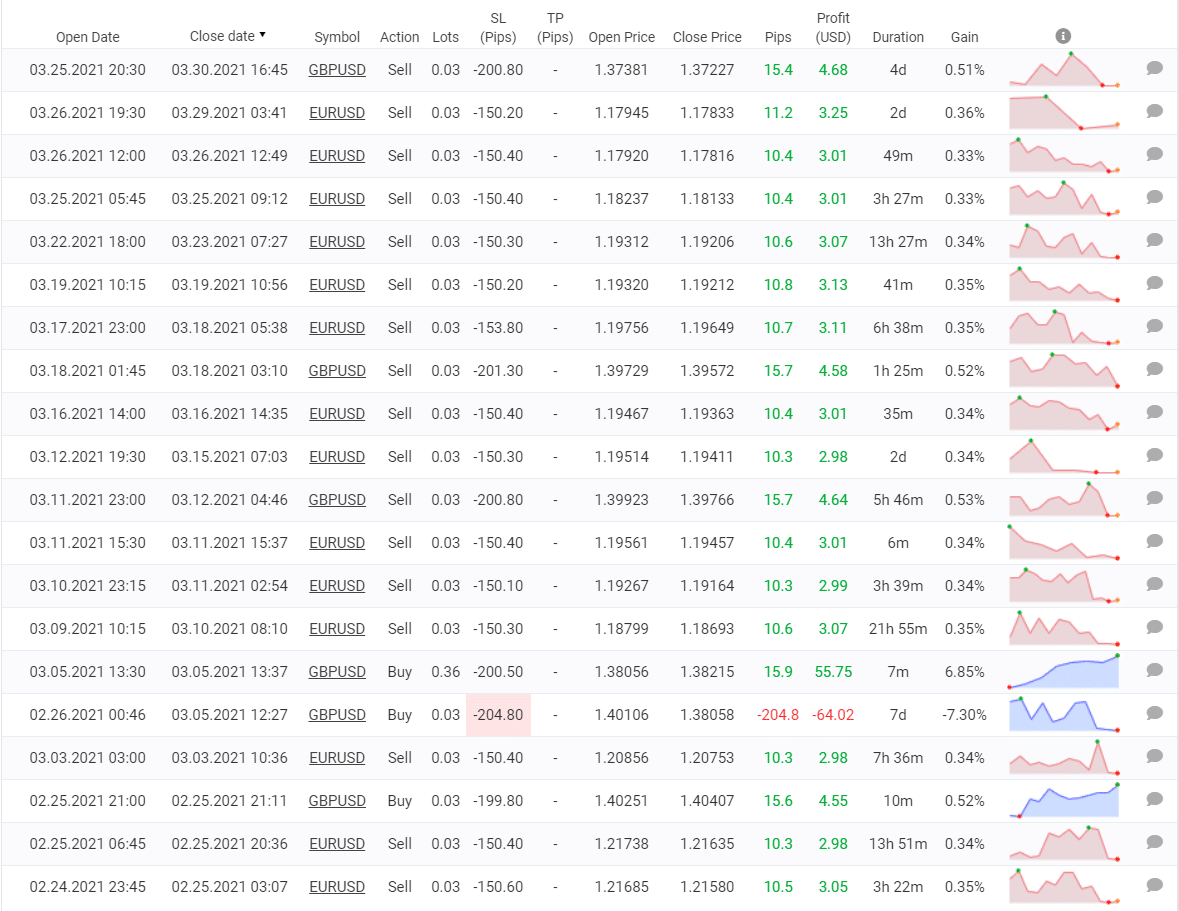

Pinpoint EA traded 98 deals with 310.2 pips. An average win is 11.609 pips when an average loss is fifteen times higher -163.90 pips. The win-rate is 94% for Longs and 95% for Shorts. An average trade length is one day. The Profit Factor is 0.76.

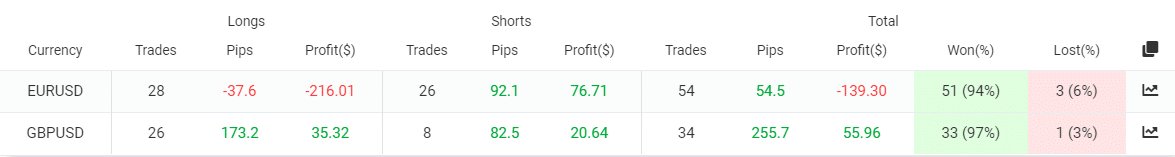

The EUR/USD long direction has brought -$216.01 of losses.

The system trades during the European trading session only.

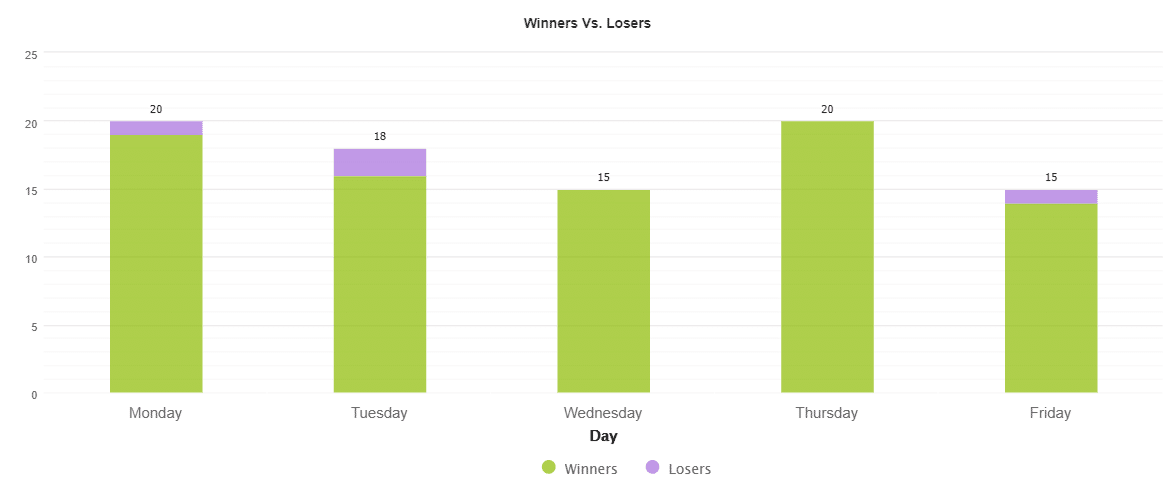

The less traded days are Wednesday and Friday (15 deals) both.

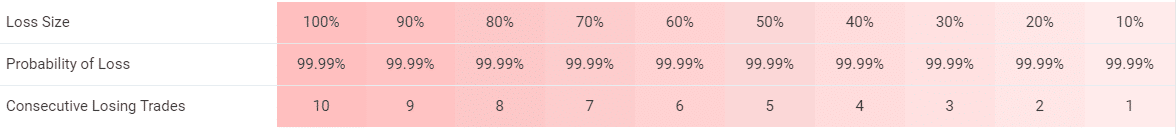

The robot trades with the maximum risks to the account balance.

As we can see, the system does not only use deep Stop Loss levels, but also Martingale Lot Sizing to recover after a loss.

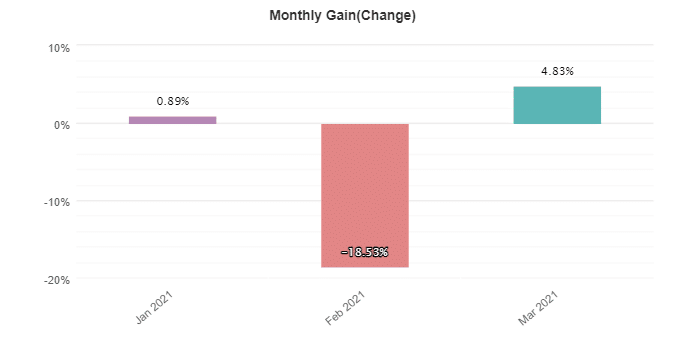

February 2021 spoiled the picture of the system.

People feedback

There are not so many testimonials to say for sure that the system is 100% good or scam. The robot is too young to be convinced that it’s stable and safe.

Summing Up

- Strategy – score (2/10)

- Functionality & Features – score (2/10)

- Trading Results – score (2/10)

- Reliability – score (2/10)

- Pricing – score (2/10)

Conclusion

Pinpoint EA is a Trend and Martingale trading solution. The presentation tells us nothing about money-management, settings, indicators, and so on. Trading results showed that the system trades with a high win-rate and uses Martingale to recover but still has lost much in February 2021. Now, it’s not a good time to buy it asap. We’d suggest you keep watching what’s going on with it.