Red Horse EA uses a top-bottom strategy with a customizable news filter to trade the markets. The developer states that the robot can maintain the drawdown below 10% and provide a monthly profit of 12-13%. To minimize the risk, the company looks after all the activities. We will verify the veracity of the vendor’s claims to see if the system is a good choice for traders.

Is investing in Red Horse EA a good decision?

Red Horse EA is not fully transparent on the backtesting records and uses risky grid and martingale strategies. The live records on Myfxbook are for a short duration which is not enough for us to analyze its true performance.

Company profile

Sinry Advice is a company that stands behind this EA. The group has a total of 2 robots and one indicator in their product list, and Red Horse EA is one of them. The company’s address is 2 Fredrick Street London WC1X OND, UK. The enterprise provides contact details: phone number and email on their website.

Main features

The essential features of the EA are as follows:

- The purchase provides one real and one demo account.

- It comes with examination of fundamental and technical news.

- It allows customized news filter.

- It comes with risk and money management systems.

- It assures a maximum of 12%-25% expected monthly profit and a maximum drawdown limit of 9.7%.

How it works

The algorithm works in the following way:

- Purchase the product

- Install the files into your computer after clicking on the download button

- After downloading the files, go to the MetaTrader 4 platform and place the robot in the expert’s section

- User should give their Metatrader 4 account details to the seller product activation

- Bring down the robot onto the chart section

- Allow auto-trading

Strategy explanation

The robot trades on gold while using the top-bottom strategy. It also implements volume and volatility indicators alongside fundamental and technical analysis.

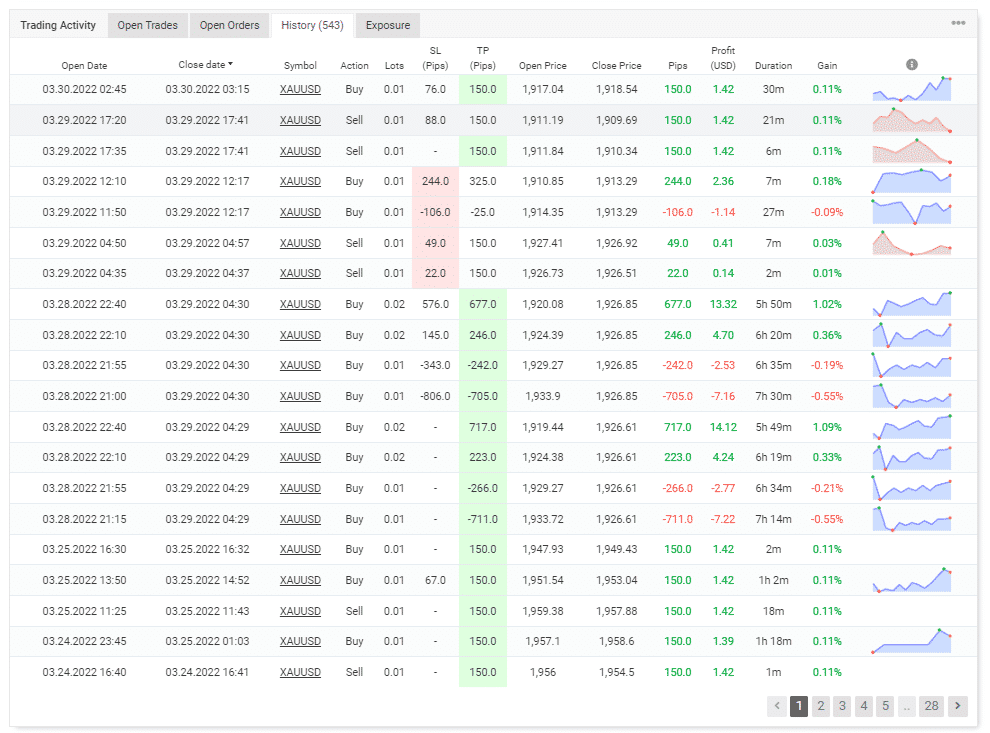

From the live records present on Myfxbook it is clear that the EA uses averaging and martingale strategies. It can place a high stop loss exceeding 100 pips in most cases and has an average trade length of 4 hours and 17 minutes.

Price

There are two offers available for the purchase of monthly and yearly plans. The one-month package comes at $49, whereas the user must pay $495.6 for an annual deal. Clients can pay for the order through a Mastercard, Visa card, etc., and can apply for a refund by sending them an email if they are not satisfied with the purchase.

Trading results

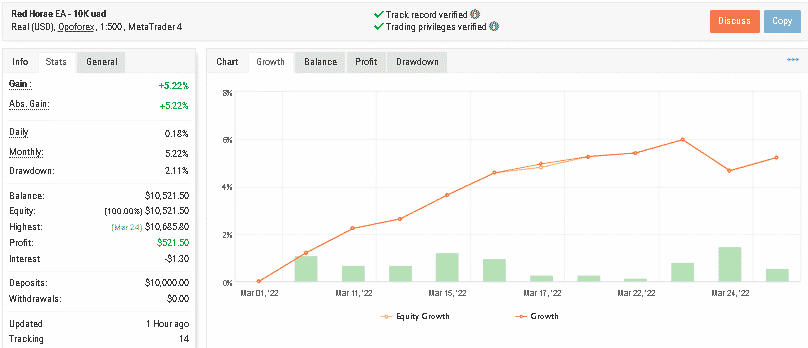

The algorithm has no backtesting records, which is not a good approach in the trading market. Red Horse EA started trading in March 2022 and is currently active, according to Myfxbook. The gain percentage is 5.22%, and the profit factor is 2.39. The drawdown observed was 2.11%, with a daily gain of 0.18%.

The initial deposit was $10000, and the current balance stands at $10,521.50. The robot made a total of 54 trades, out of which 78% were profitable, with a sharpe ratio of 0.28.

Customer reviews

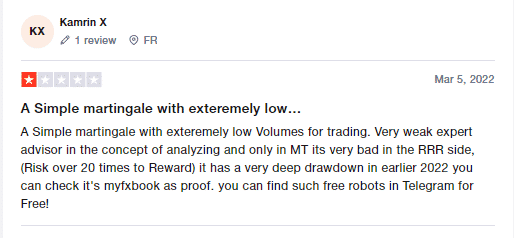

Red Horse EA has a rating of 4.1 on Trustpilot for 115 customer feedback. One of the clients comments the robot uses the simple martingale strategy with a small lot size. The trader adds that the risk is 20 times higher than the reward portion and the drawdown on the account is high.

Summing up

Red Horse EA does not come with any backtesting records and uses a combo of risky grid and martingale strategies. The robot requires high leverage of 1:500 which adds to the downsides.