- SAND April Sell-off

- VARA Sandbox metaverse adoption

- Sandbox capital raising spree

April was a tough month for cryptocurrencies and investors. A good number of the coins posted double-digit percentage declines in line with a sell-off wave that gripped the stock market. The direct correlation between stocks and cryptos came as a surprise.

In recent years, cryptocurrencies have emerged as valuable instruments for diversifying an investment portfolio. However, with crypto trading in tandem with equities, things look bleak amid growing concerns about a push by the Federal Reserve to hike interest rates.

Sandbox sell-off

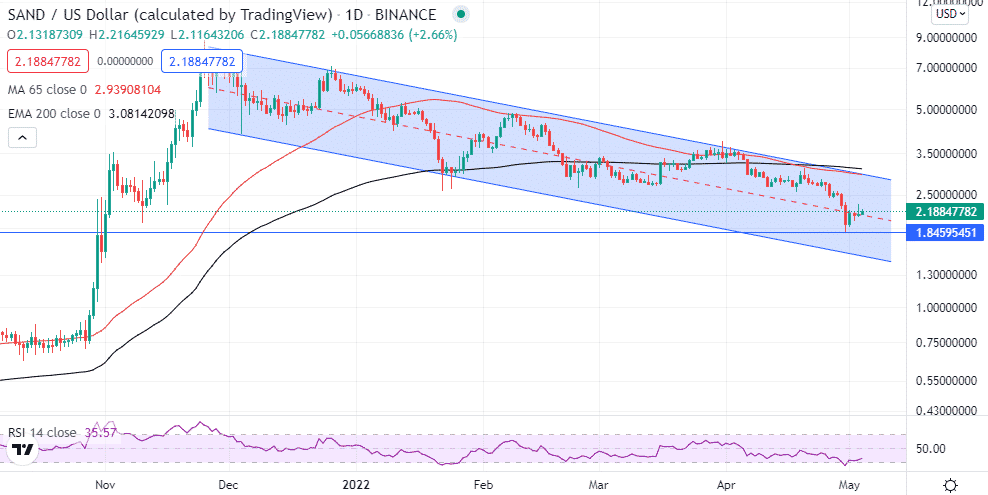

Sandbox is one of the coins that has felt the full brunt of investors shunning speculative assets amid the sell-off in the equity markets. Its native token SAND shed more than 30% in market value in April alone after failing to hold above key support levels. The drop came as investors shrugged off risky assets amid the effects of runaway inflation.

SANDUSD appears to have hit bottom and is ready to bounce back. The pair has found support above the $2 level from where it is trying to bounce back. The Relative Strength Index has already started pointing higher, signaling a buildup in upward momentum.

Consequently, SANDUSD bouncing back and stabilizing above the $2.5 level would affirm its bounce-back credentials. Above the $2.5 level, bulls could steer a rally to the $3 a level, which is crucial for the Sandbox coin to turn bullish in the short term.

On the flipside, SANDUSD retreating and closing below the $2 handle will only trigger renewed sell-off in continuation of the long-term downtrend. A daily close below the $1.8 level would only accelerate a drop below the $1 psychological level. In the meantime, Sandbox is looking increasingly bullish and likely to find support above the $2 level.

Sandbox metaverse growing popularity

The latest development offering support to the SAND token is a confirmation that Dubai Virtual Assets Regulatory Authority (VARA) is poised to establish its virtual headquarters on top of Sandbox metaverse. The news sent the token up by more than 5%, averting further sell-offs.

By establishing its virtual headquarters on Sandbox, VARA opens to promote Dubai as a leader in virtual assets. In addition, it should help in growing Dubai’s digital economy. The purchase of virtual land on the Sandbox metaverse affirms strong belief in the sector. It also demonstrates Dubai’s commitment to enhancing how customers adopt and scale the economy around virtual assets.

VARA recognizing Sandbox metaverse and setting base for its virtual asset is an important development. It affirms Sandbox’s growth prospects in the burgeoning space. Consequently, it should continue to offer support to the battered SAND token.

Capital raising drive

In addition to the VARA adoption boost, investors note Sandbox’s push to raise money. The push is already fuelling speculation that the company has growth plans. There have been reports that Sandbox, the owner of blockchain game developer Animoca Brands intends to raise up to $400 million.

Late last year, it raised $93 million in Series B funds. The funds are being used to scale the Sandbox growth as a premier destination for brands IPS and celebrities. It is also expected that the latest round of capital raising drive will go a long way in supporting similar growth drives. Sandbox is one of the companies looking to flourish in the metaverse world, an area with tremendous growth opportunities.

Final Thoughts

Sandbox has taken a significant beating year to date, going by the 40% plus pull back. While the short-term outlook remains uncertain, the same cannot be said about the future. The platform becoming a big player in the metaverse world is one factor that affirms long-term prospects. Consequently, SAND token finding support above the $2 level could pave the way for further price gains.