Last week has been volatile, helped by numerous economic data releases, Fed’s speech and China declaring a doomsday for tutoring businesses. Forex market and stock indices were mixed, as the US dollar remained under pressure, while risk-on currencies didn’t show gains either. The oil that’s been recovering from the recent dip still gives some hope to risk-takers. Let’s delve into the headlines and the markets’ responses.

Dovish Fed, and diverging economic data

How soon will we see any decisions from the Fed regarding tapering? According to last week’s FOMC statement and the comments from Powell, the regulator may announce asset purchases reduction in the fall. As the statement mentions multiple “meetings” before the decision, we may expect the first signs of tightening in November instead of September.

JP Morgan sees Fed’s stance about the rates as dovish. Goldman Sachs also considers the first signs of tapering to appear not earlier than December. If so, the time gap gives the markets the time to digest the changes in the monetary policy, avoiding shocks and reducing the odds of sharp corrections.

The US “hard” economic data hasn’t been exciting. The New and Pending Home Sales (MoM), Durable Goods Orders (MoM, including Core) and Core PCE Price Index (MoM) disappointed the markets with worse-than-expected results and the decline compared to the previous readings.

Interestingly, various July’s “confidence metrics” such as CB Consumer Confidence, Chicago PMI, Michigan Consumer Expectations exceeded expectations. The optimism among businesses and consumers may be related to the general reopening of the US economy, the vaccination campaign and the initial recovery spurt, with GDP expanding 6.5% versus 6.3% in the previous quarter. However, the actual economic growth might be losing steam, as July’s data suggests.

As there is a divergence between the expectations and the actual data, we may expect sluggish growth in risk assets and overall mixed market performance to continue.

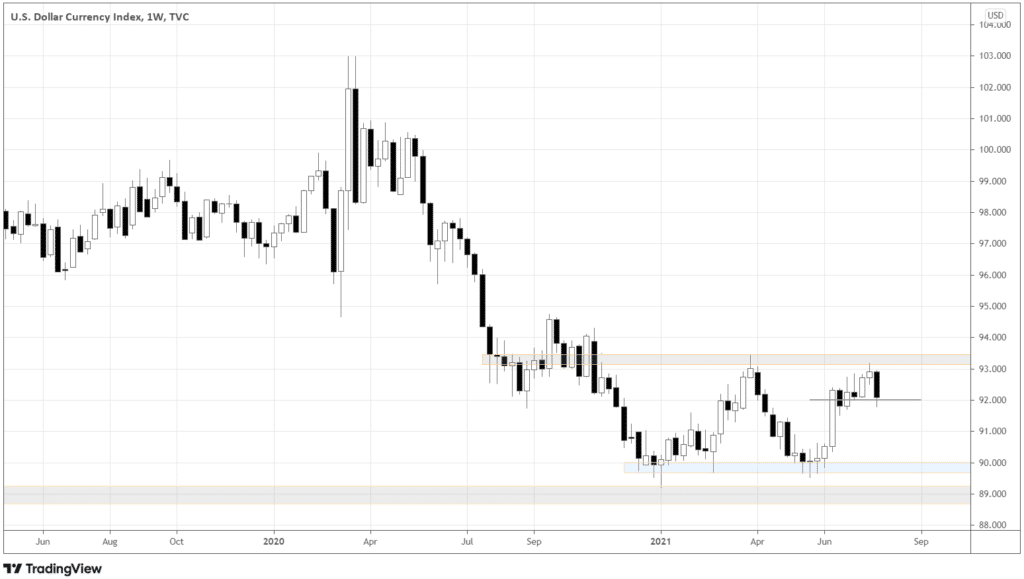

Technical view on DXY

As the Fed’s tapering doesn’t seem happening in the next 2-3 months, the short-term US dollar bulls shouldn’t be happy about that. In the weekly DXY chart below, the dollar index closed the week, forming a big bearish candle. Together with the prior week’s small white candle, the big black candle made an engulfing pattern, a solid bearish reversal signal. Notice, the engulfing pattern came up near the resistance – an upper border of the current 90.0-93.0 range.

Swing traders may find the setup legitimate to short the index, with the protective stop above July’s high and the target near the down border of the range around 90.0. The potential trade offers around 2:1 R/R potential, which is usually acceptable.

Day traders should pay attention that last week didn’t manage to close above 92.0, the short-term support. As the week pierced the support, some upward impulse is likely, so it’d be prudent to look for a short-sell entry once the market gets below 92.0

JPY – the safe haven to turn to

With the Fed being mostly dovish, cooling down the economy and mixed market performance, investors flock to safe havens. If USD doesn’t look appealing to weather the dubious market environment, what risk-off currency should we consider?

Currently, JPY is a reasonable candidate, with monthly Industrial Production growing in Japan, shrugging off the virus impact. The labor market also seems healthy, as June’s Jobs/applications ratio has improved, beating forecasts.

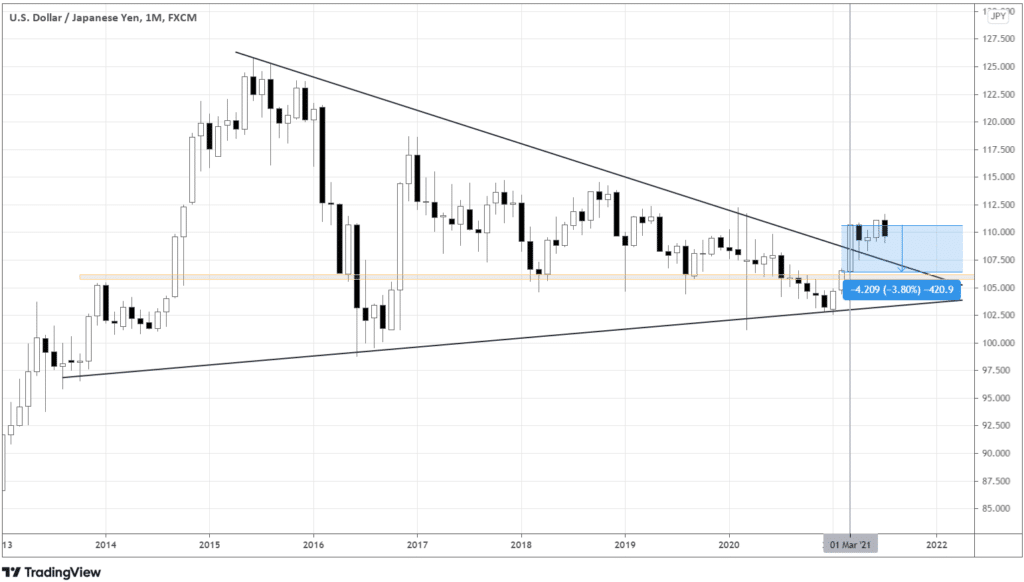

Below is the monthly USDJPY chart. The long-term outlook on USD is still bullish due to the symmetrical triangle breakout in March.

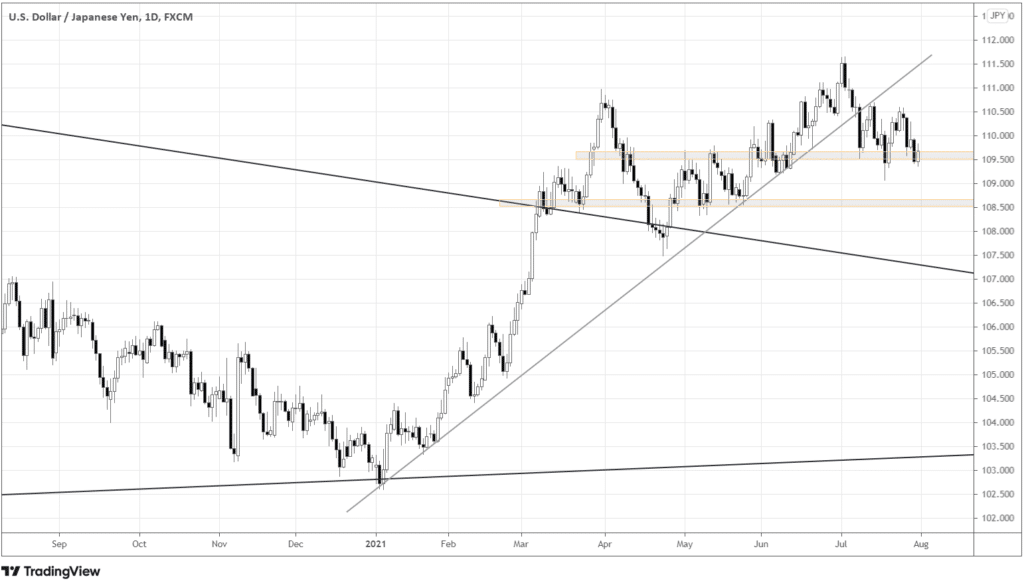

However, on the daily scale, the short-term uptrend was broken, as we see the market got below the trendline and stabilized.

We may be witnessing the correction within the overall uptrend. I’d expect the pair’s ultimate downward target to be around 106.0 – the long-term level that’s been tested since 2014 and proximity to March’s opening.

Conclusion

Markets remain mixed on the Fed’s dovish remarks and diverging economic data. Traders can take advantage of the short-term bearish setup in DXY, thus abstaining from fleeing to the greenback as a safe haven. Instead, JPY looks more appealing to shelter in, with Japan’s economic resilience and a favorable technical view in USDJPY.