Tioga robot uses the M5 chart for trading on the EURUSD currency pair and requires a minimum of $300 in account balance with a 1:100 leverage. The algorithm can use money management and has customizable stop loss and take profit for trades. It trades at the end of the US session using a mean reversion strategy. We will look at the trading methodology in our article to see if the robot can be profitable for us.

Is investing in Tioga a good decision?

The live records show that the algorithm can trade without a stop loss. It can wait for a long duration for the price to return for closing a losing trade in profit. This can contribute to a high drawdown.

Company profile

Ozkan Kara is the author of the robot that resides in Turkey. He has a total rating of 5 based on three reviews. The developer has two products published on the MQL 5 marketplace and has 15 subscribers. The MQL 5 website says that he has a trading experience of 4 years. However, there are no records that can prove the said statement.

Main features

The robot has the following features:

- Traders can use money management or fixed lot

- The exit values are customizable

- It can be used on multiple currency pairs

- There is no implementation of martingale grid or hedging strategies

To get the service up and running, you the following steps:

- Open a trading account with a broker

- Purchase the EA from MQL 5

- Login at the MT4 or MT5 platform and refresh your experts’ tab

- Attach it to the charts to start trading

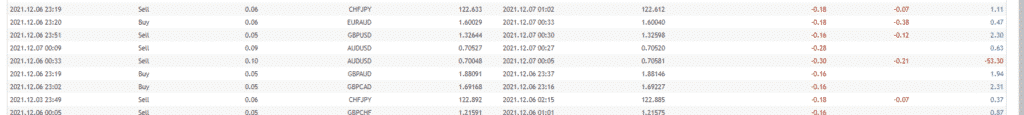

The robot trades on AUDUSD, CHFJPY, EURAUD, EURCHF, EURGBP, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPUSD, USDCHF with full automation. It enters the market at the end of the US session and uses a mean reversion approach. There is no implementation of lot multiplication, averaging, or other dangerous strategies. From the history of MQL5 records, we can see a slight martingale approach. There is no stop loss attached to trades, leading to big losses.

Price

The EA is available for an asking price of $195. The dev claims that the next price will be $495. According to the MQL 5 marketplace rules, there is no money-back guarantee. Traders can also rent the product for three months at $45.

Trading results

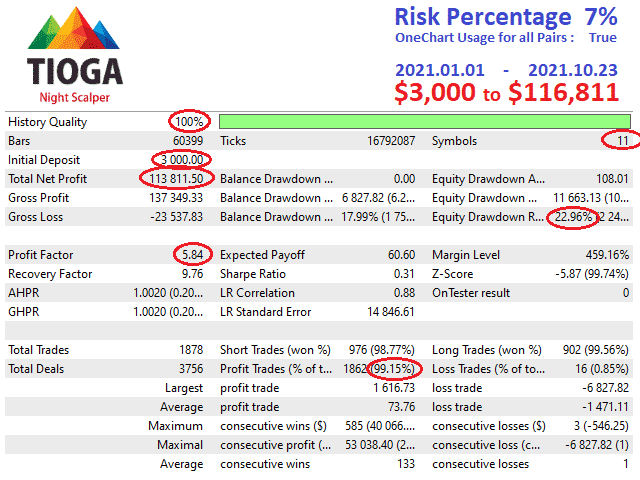

Backtesting results are only available in images where the relative drawdown was around 22.96% for 7% risk. The winning rate was 99.15%, with a profit factor of about 5.84. With a starting balance of $3000 the robot tanked an average profit of $113811.5. There were 1878 trades in total, with 3756 deals. The best trade was $1616.73, while the worst was $6827.82. The algorithm had a total of 133 consecutive wins and 1 loss. The modeling quality of the test was 100%.

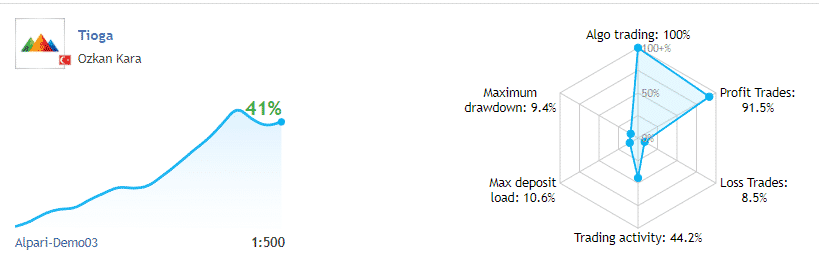

Verified trading records are available on MQL 5. The performance is available from September 09, 2021, till the current date. The system made an average monthly gain of around 12.6%, with a drawdown of 9.4%.

The winning rate stood at 91.5%, with a profit factor of 2.03. The best trade was $12.17, while the worst was -$56.65 in a total of 553 trades. The drawdown value may increase in the future as there are no proper exit points and due to the usage of martingale.

Summing up

The trading records of the Tioga robot are on a demo account. Virtual portfolios are not able to provide accurate results as they do not respect real market conditions such as liquidity and slippage. As the robot uses a night scalping strategy when the volume is scarce, the difference between demo and live can be huge.