Corporate events provide some of the best opportunities for investors and traders because of the substantial volatility they cause. This article will look at some of the top corporate events and how to position yourselves before and when they happen.

Initial Public Offering (IPO)

An IPO is an event where a company moves from being a private entity to a publicly traded firm. They do this by working with bankers who recommend the best exchange to list at. The two most popular exchanges in the US are the New York Stock Exchange (NYSE) and Nasdaq.

The bankers and other advisors also help the company come up with a good valuation and market its listing to institutional investors like hedge funds and pension firms. Some of the biggest IPO advisors in the US are Goldman Sachs, JP Morgan, and Morgan Stanley.

After doing a roadshow, a company then goes on to become public. In it, its stock starts to be traded by both private and public investors.

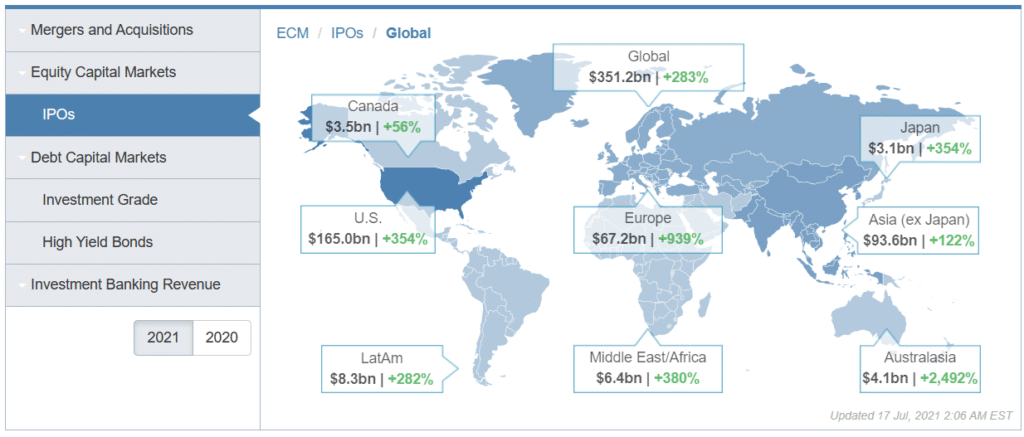

Fortunately, the number of American and foreign companies going public has been on an upward trend. Notably, this trend is being driven by shell companies established for the sole purpose of merging with a private company. The chart below shows the volume of global IPOs in the first half of 2021.

As a stocks investor, IPOs give you an opportunity to invest in a good company that has gone public. For example, investors who bought shares in popular companies like Microsoft, Apple, Netflix, Shopify, and Goldman Sachs have realized substantial returns in the past few years.

Mergers and acquisitions (M&A)

M&A is another popular corporate event that gives investors an excellent opportunity to buy and short shares. A merger happens when two companies of almost similar size decide to combine. In most cases, a merger happens by swapping shares. On the other hand, an acquisition is a situation where a bigger company decides to buy a relatively smaller company. In most cases, the deal usually happens through a combination of cash, shares, and debt.

Companies carry out M&A deals for several reasons. First, they combine in a bid to boost their market share. For example, the announcement that Discovery would merge with Time Warner was intended to create a big company that will compete with the likes of Disney and Netflix.

Second, companies merge with the goal of diversifying their businesses. For example, IBM bought Redhat with the goal of diversifying its business in the open-source business. Similarly, Verizon bought Yahoo with the goal of becoming a leading player in online marketing.

Third, at times, M&A happens as a defensive strategy. This happens when a company rushes to buy another firm to prevent a competitor from acquiring it. Others merge as an easy way of entering another geographical location.

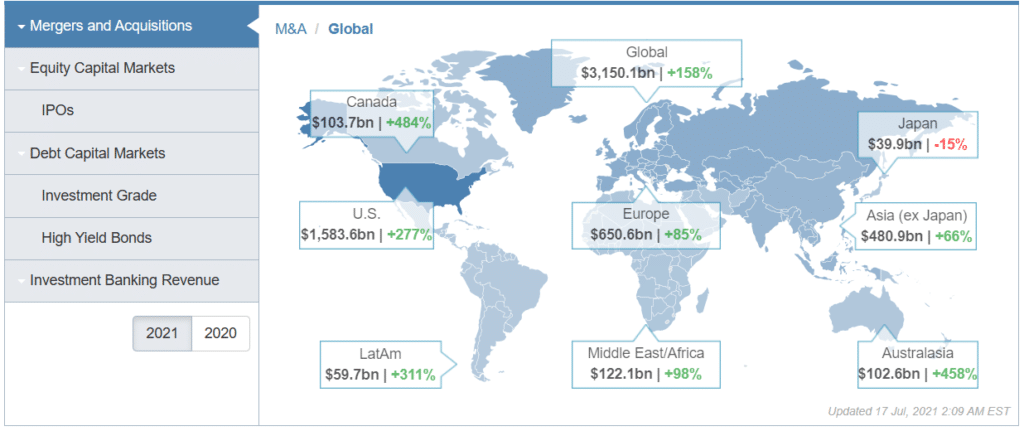

The number and sizes of deals have been rising recently. As shown below, the volume of global deals by mid-2021 was more than $3.15 trillion.

M&A deals provide important opportunities for investors and traders. In fact, there are hedge funds that focus on these events. This is because when a deal is announced, the acquirer shares tend to drop while that of the firm being acquired rises. The events also create significant market moves in the market.

Spin-offs

A spin-off is the opposite of a merger and acquisition. It happens when a company decides to separate part of its business. This happens for several reasons.

First, a company can spin-off a division that does not meet its goal. For example, in 2021, Anglo American decided to spin off its coal business. This formed a new independent publicly-traded company known as Thungela Resources.

Another example is when United Technologies separated from its Carrier company. This separation was because United wanted to merge with Raytheon to become a major military contractor.

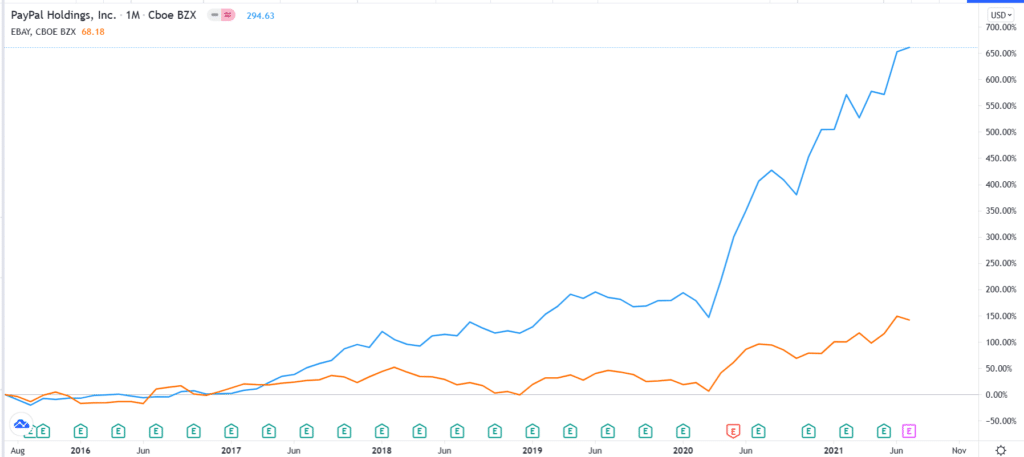

Second, companies separate in a bid to attract a better valuation for their entities. A good example of this is eBay and PayPal. eBay was the parent company of PayPal a few years ago. The company then decided to separate its PayPal business and turn it into an independent publicly-traded company. Since then, PayPal has grown its market capitalization to more than $200 billion, while eBay is valued at more than $46 billion. eBay has lagged, as shown below.

PayPal vs eBay shares

Spin-off offers investors an opportunity to buy shares in a company that will likely outperform its parent company.

Corporate earnings

Another important and more frequent corporate event is earnings. In the US, companies are required by law to publish their quarterly results. These numbers provide investors with an opportunity to see the company’s performance. In these results, they mostly publish their GAAP and non-GAAP financial results. While it is not mandated by law, many companies tend to offer an earnings call with analysts.

Unlike the past three events, corporate earnings are scheduled in advance and are easy to anticipate. They also lead to significant volatility among the reporting companies and others that are related to them. For example, shares of a company like Morgan Stanley will rise if Goldman Sachs releases strong quarterly results.

An earnings calendar is a must-have tool when you are trading corporate earnings. The tool highlights the companies that will publish, the time they will do it, and what analysts are expecting. The earning season gives you an opportunity to buy companies with growing earnings and exit those with disappointing results.

Summary

Corporate events provide investors with an excellent opportunity to buy, sell, and hold stocks. We have looked at four of the most popular corporate events in the market today. Some of the other popular events we have not mentioned are when companies go ex-dividend, when there is a management change, and when the company split its shares.