What makes a stablecoin different from ordinary cryptocurrencies? The aim of stablecoins is to provide a cryptocurrency that’s less volatile, with stable prices, and suitable for everyday use.

If things go a bit cuckoo and we try to buy something with Bitcoin, but a sudden 10% drop in price occurs within a few hours, what do we do? The solution here is stablecoins, a new breed of cryptocurrencies aiming to achieve little to no volatility by being pegged against ‘stable’ assets like a conventional fiat currency or precious metal on a 1:1 basis.

This concept has not proven a fad, prompting widespread study into stablecoins and slowly-growing mainstream adoption. Tether, the largest-capped stablecoin globally, holds a coveted fourth spot of most-traded cryptocurrencies with an impressive market capitalization of about $19.1 billion (as of 02 December 2020).

A coin so close behind the ‘darlings’ of the cryptocurrency industry must be doing something right. This article will explore what makes stablecoins unique and necessary, how they work, the different types available, and their distinct pros and cons.

Why stablecoins?

The purpose of stablecoins is to provide a cryptocurrency that has no chance of erratic price fluctuations. Stablecoins are usually not considered investments since they maintain relatively stable prices.

However, if there is to be greater adoption of cryptocurrencies for everyday use, it is impractical to transact with some of the popular cryptocurrencies like Bitcoin, which can experience volatile price shifts at any moment.

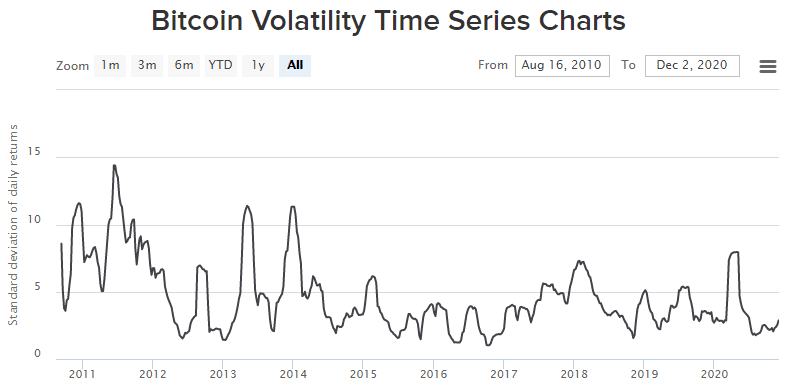

The image above details the all-time 60-day BTC/USD volatility of Bitcoin. If we compare that to fiat currencies, which experience between 0.5%-1% daily deviation on average, we can observe an apparent discrepancy.

In 2020 alone, the daily deviation reached as high as 7.96%. Therefore, stablecoin developers proposed to mitigate this problem in utilizing the technology of cryptocurrencies while providing the stability of the fiat currencies we know.

How do stablecoins work?

Stablecoins work slightly differently than traditional digital currencies. Depending on the type of stablecoin (covered later), some stablecoins can either be centralized or decentralized.

For centralized stablecoins, the private company owning the currency promises that whenever they issue new tokens, a proportional amount of fiat money exists in reserves. Decentralized stablecoins emulate some of the principles of orthodox cryptocurrencies.

Users can purchase stablecoins from the many cryptocurrency exchanges available that store the tokens in a crypto wallet.

Different types of stablecoins

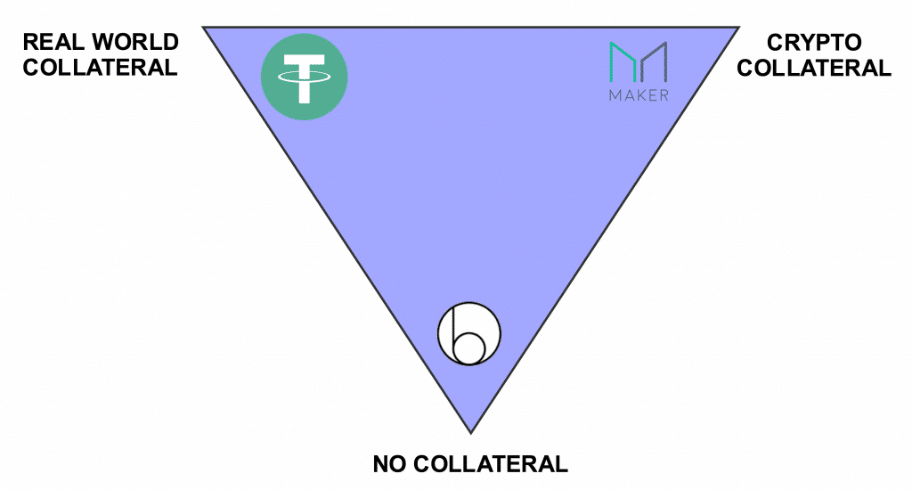

It’s essential to understand the different kinds of stablecoins to observe how exactly they maintain their value and stability. We can classify these coins into three camps:

- Fiat-backed

- Crypto-backed

- Non-collateralized

Fiat-backed stablecoins

Fiat-backed stablecoins are the easiest to grasp and most commonly found stablecoins. This type of stablecoin uses another established fiat currency like the US dollar as collateral on a 1:1 basis.

A designated custodian will need to guarantee the issuance of the given stablecoins, and audits need to be in place, ensuring there is indeed a reserve asset backing the coin. Not only are fiat currencies used here, but also commodities such as gold and silver can be suitable alternatives. Examples of fiat-backed stablecoins are Tether, TrueUSD, USD Coin, and Gemini, among many others.

Crypto-backed stablecoins

This kind of stablecoin is the least encouraged because instead of being backed by another recognized fiat currency or commodity, it uses another cryptocurrency. Although we could argue that even fiat currencies can, on rare occasions, become highly unstable, cryptocurrencies are volatile more frequently.

To compensate for this lack of stability, crypto-collateralized stablecoins are ‘over-collateralized.’ For every unit of stablecoin, at least twice the amount of the cryptocurrency will need to be in reserve.

Essentially, we can think of crypto-backed stablecoins as existing on at least a 2:1 basis. Though this method appears to solve the underlying problem, a black swan event can quickly render the stablecoin worthless. Nonetheless, examples of these stablecoins include MakerDAO and Haven, to name a few.

Non-collateralized stablecoins

An even more obscure kind of stablecoin is known as non-collateralized. Instead of pegging against another fiat or cryptocurrency, these coins rely on a protocol called Seigniorage Shares.

This algorithm uses smart contracts to automatically maintain value according to a specific fiat currency or commodity. Basis, Carbon, and SagaCoin are some of the stablecoins in this realm.

Advantages

The creation of stablecoins was to safeguard against the volatility of traditional digital currencies while also maintaining a medium of exchange practical for everyday use. Therefore, stablecoins are the most stable digital currency form, seeking to bridge the gap between fiat and cryptocurrencies, two markets currently siloed.

With volatility mostly out of the way, stablecoins exhibit several benefits of fiat currencies, such as engaging in credit markets, and fast & affordable transactions, among other things.

Developers of stablecoins also meant solving the ‘backing issue’ plaguing government-issued fiat currencies backed by public faith. Many proponents would trust a currency like stablecoin backed by a real, tangible, and valuable asset like a commodity or other currencies.

Disadvantages

Perhaps one of the biggest advantages of stablecoins is their lack of investment value, a stark contrast compared to other cryptocurrencies. People love digital currencies not just for their utility but also as a speculative asset with astronomical growth potential. This trait is absent in stablecoins that inherently maintain a constant value.

Technically, some stablecoins also go against the core values of decentralization, transparency, and privacy other cryptocurrencies hold since most have a more centralized structure. For example, Tether has been scrutinized numerous times for failing to produce audits proving they hold the US dollar reserves that form part of their currency.

Analysts have also argued that stablecoins do not entirely solve the volatility problem since even fiat currencies themselves can become highly unstable or drastically lose value in a short space of time.

Conclusion

At this point, it should be clearer what the purpose of stablecoins is: maintaining a stable cryptocurrency pegged against a reserve asset. We can also think of stablecoins as the hybrid between fiat and cryptocurrencies.

Despite some of these positives, stablecoins, like other cryptocurrencies, face an uphill battle in greater public acceptance due to concerns over control, privacy, security, and validity. Nonetheless, they do have a demand amongst the growing cryptocurrency industry.