Semiconductor technology had brought about a revolution in the industry, with manufacturing giants switching from ‘electrical’ equipment to ‘electronic’ equipment. The physical nature of semiconductors allows them to send short and very selective electric signals. The ‘semiconductor chips’ soon became building blocks for nearly all computation-related equipment, from calculators to supercomputers.

The beginning of the computer and mobile era fueled by the internet exponentially increased the importance of semiconductor chips. Nearly every task undertaken in the modern world can’t be done without being powered by a semiconductor chip. But the design and manufacture of these chips is extremely complicated, requires very specific elements with high purity, and must be done under highly controlled conditions. As a result, only companies with years of experience and expertise are involved in the semiconductor design and production process.

In fact, due to the ongoing Covid-19 crisis, the demand for semiconductor chips has skyrocketed. Suppliers are struggling to meet the demand, which has caused a shortage crisis in industries such as the automobile industry. Cryptocurrency mining is also highly dependent on high compute power which comes from modern semiconductor chips.

The semiconductor companies can be broadly divided into two categories: design and manufacture. There’s another category in which companies are only into designing the chips and not manufacturing them.

The first category, design, and manufacture are also known as Integrated Device Manufacturers. These are the companies that design their own chips and also undertake the manufacturing process. Some of the examples of IDM companies are Intel, Texas Instruments, and Samsung Electronics.

Intel was particularly in the news lately when it announced last year that it will stop making its own chips and will outsource that part of the process. However, early this year, Intel’s new CEO announced that it would make significant investments into chip manufacturing plants in the US and even look to challenge Asia’s dominance in the same.

The other category which is only into manufacturing the chips is called ‘pure-play foundries.’ The plants that manufacture chips are called foundries. The Taiwan Semiconductor Manufacturing Company (TSMC) is the world’s largest pure-play foundry company. Several large tech giants such as Apple are highly dependent on TSMC for its chip supply. Other pure-play foundries include the GlobalFoundries based in the US and Taiwan’s UMC.

Finally, the third category, which only designs chips, is called ‘fabless.’ These include Nvidia, ARM, AMD, Apple, and IBM. Having understood the types of semiconductor companies and their importance, let’s discover the world’s most tracked semiconductor index – the Philadelphia Semiconductor Index or SOX.

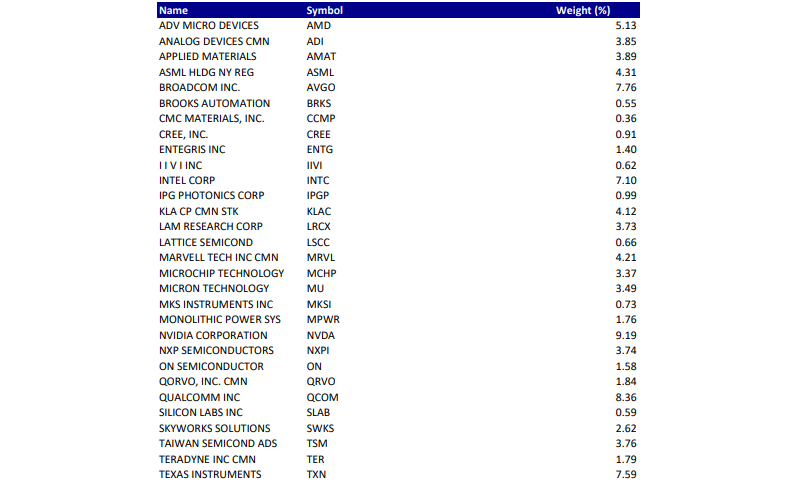

The SOX is a market capitalization-weighted index. So, the larger companies have more weight in the index than the smaller ones. It consists of 30 major companies that are involved in the design or manufacture of semiconductor chips.

As can be seen above, the US chip giants Nvidia, Qualcomm, and Intel hold the highest weights. These three names together account for nearly a quarter of the index. The depository receipt of TSMC is also a member of the index and has a weight of 3.8% at the time of writing. The two lowest weighted constituents in the index are Brooks Automation (0.55%) and CMC Materials (0.36%).

The main driver for the profits of these companies is the demand for semiconductor chips. The supply chain for this sector is highly globalized, with most of the designing happening in the US while a majority of the manufacturing happening in Asia, mainly Korea and Taiwan. Hence the effects felt in this sector are also similar across countries. Earnings results for one company can be a reliable leading indicator for most other companies.

The major customers for these companies are large technology giants like Apple, Amazon, and Sony. Most of these companies sell consumer-facing products such as smartphones, laptops, and other gadgets. Hence the sector is also cyclical in nature to some extent and is sensitive to demand. However, during the Covid-19 pandemic, when demand for most consumer products was falling due to government-enforced lockdowns, the semiconductor sector thrived.

This is because due to the work-from-home situation for most offices, the demand for reliable computers and phones skyrocketed. Moreover, several companies also scrambled to upgrade their technology infrastructure, which meant further demand for electronic devices. This led to a boom in sales for these companies. In fact, many of the companies rushed to expand capacity as their existing foundries were not able to meet the total demand.

Companies such as TSMC are still undergoing massive capital expenditure in order to expand and improve their manufacturing facilities. The resurgence of Covid-19 due to the Delta variant means that many of the technological changes will still be critical for companies to maintain their normal operations. As a result, analysts continue to see healthy demand for these chips in the near future.

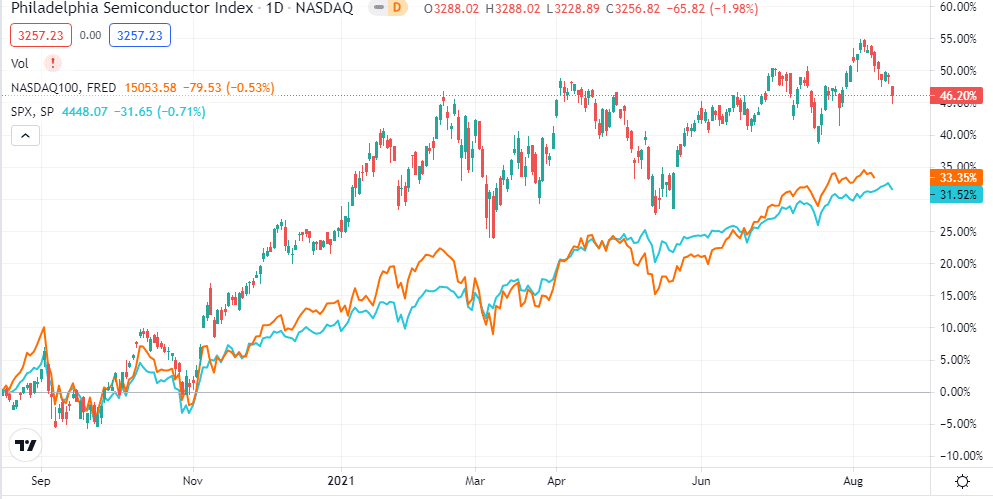

Taking a look at the performance of the SOX index, it has returned 46% over the past year. These returns are far higher than the benchmark S&P 500 index, which was up by 31%, and the tech-heavy Nasdaq 100 index, which was up by 33%.

As can be seen above, even as the FAANG companies saw a marginal slowdown in stock price momentum post the vaccine roll out and reopening, SOX continued to see higher although volatile returns.

One can observe the deep drawdowns that the index has seen over the past year. Another point to be kept in mind is the high concentration of the index. As we observed above, three stocks accounted for nearly 25% weight, and the index is composed of just 30 stocks as opposed to 100 stocks for Nasdaq and 500 stocks for S&P.