- Japanese yen is under immense pressure against the dollar, USDJPY above 110.

- Chinese yuan weakness amid escalating delta variant situation.

- Gold sell-off persists with bears eyeing $1700.

- Bitcoin retakes $45,000 level as bullish momentum gathers pace.

The USDJPY pair has regained positive traction on rallying to two-week highs at the back of a growing bid tone around the US dollar. The pair is trading above the 110.00 level and looking increasingly bullish in the aftermath of the Non-Farm payroll for July, fuelling suggestions that the US economy is doing well and that the FED could start tapering.

Dollar strength yen weakness

After finding support above the 110.00 level, bulls could push USDJPY to the 110.60 levels as more bids on the dollar continue to fly in.

Growing talk that the FED could start tapering as early as October and December continues to fuel the bid tone on the dollar, sending the pair higher. A strong move by US Treasury bond yields is also fuelling the bullish momentum on the greenback against the yen.

However, the growing concerns over the escalating delta variant situation are already fuelling demand for safe-havens which could benefit the yen and keep a lid on strong gains for the pair. A lack of substantial economic data from the US and Japan leaves the pair at the mercy of USD price moves.

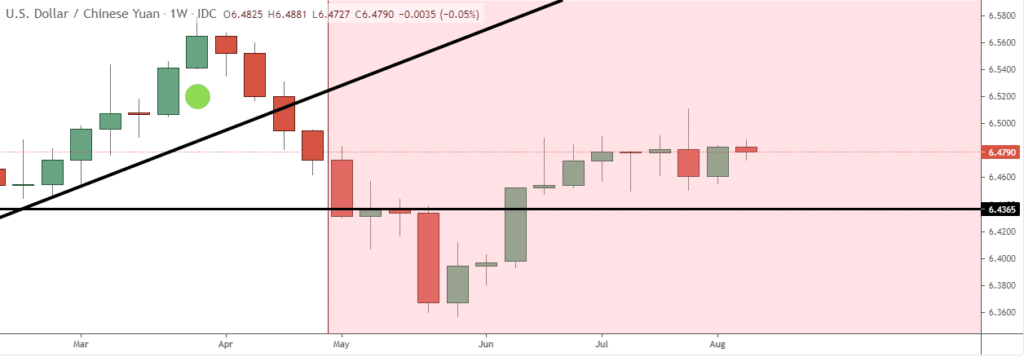

Yuan weakness

The Chinese yuan is another currency under immense pressure as the US dollar continues to strengthen across the board. The spread of the delta variant in China, which has triggered a new round of restrictions, is already fuelling economic growth concerns, consequently hurting the yuan sentiments in the market.

That said, the yuan looks set to weaken across the board amid talk that the People’s Bank of China could be called into action. There is already talk that the central bank could trim the reserve requirement ratio in contrast to the Fed discussing tapering.

Gold turns bearish

In the Commodity markets, gold (XAUUSD) is trying to bounce back after plunging below the $1700 level early Monday morning. While the precious metal has rallied to above the $1730 level, it remains under pressure amid the ongoing bid tone on the US dollar.

The fundamentals backdrop remains in favor of bears pushing XAUUSD lower in the market. A sell-off followed by a close below the $1725 level could result in the precious metal declining back to the $1700 level.

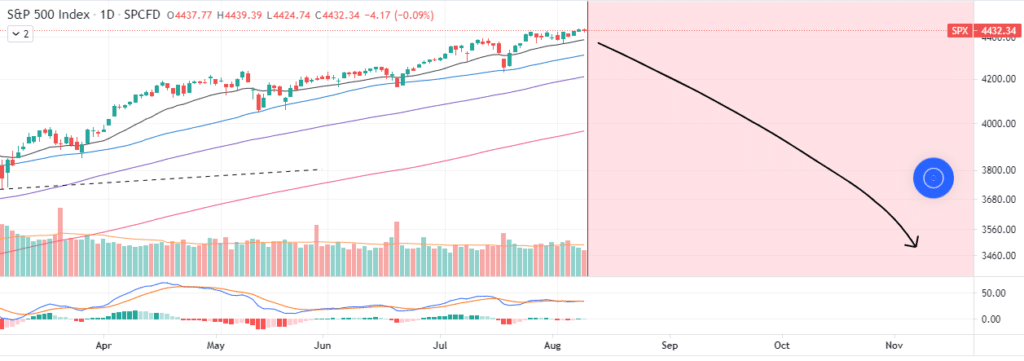

US indices under pressure

US stocks were again under pressure at the start of the week, with the Dow Jones Industrial Average and the S&P 500 pulling back from record highs. The pullback comes on the heels of growing concerns that the FED could start tapering stimulus in the aftermath of a better than expected jobs report.

Despite a spike in Delta variant cases across the US, recent mobility data has shown that consumer spending remains high, affirming economic growth. Consequently, there is growing talk that the FED could hike interest rates in a bid to stem a further spike in inflation levels.

The rise of interest rates poses significant dangers to the equity markets amid growing concerns that it could fuel an uptick in borrowing costs.

Bitcoin rally persists

Bitcoin’s impressive run that began last week continued to gather steam, with the flagship cryptocurrency powering through critical resistance levels in recent days. A rally to three-month highs of $46,000 has once again fuelled talk of the BTCUSD making a run for its record highs.

Bitcoin has received special support from Elon Musk, reiterating he still remains invested in crypto. He has also reiterated that Tesla could resume BTC payments once the mining standoff is sorted out.

However, it is growing talk of a new cryptocurrency tax provision in the US that seems to be fuelling the bullish momentum. Early indication is that a good number of senators are opposed to the tax provision, a development that has worked in favor of the crypto strength.