Vigorous EA from Responsible Forex Trading is an expert advisor that has undergone backtesting for 21 years. This scalping robot works on the EURUSD pair nearly 100 times a week, and according to the vendor, makes daily profits. Promising consistent profits, this EA has an average trading length of 2 hours.

Is Investing in Vigorous EA a Good Decision?

As part of our review, we have carried out a meticulous evaluation of the various aspects of this ATS. We have assessed the trading results, approach, backtests, customer support, vendor transparency, and more. From the evaluation, our initial conclusion is that this is an unreliable FX robot. The reasons for this initial overview are discussed in detail below.

Company Profile

The founder of Responsible Forex trading is Ryan Brown. He has 15 years of experience in FX trading and 8 years in algorithmic trading. He has two other EAs, PinPoint, and Ranger, besides Vigorous EA. According to Brown, the focus of the company is on creating sustainable FX approaches that deliver consistent results.

However, there is no info on the location of the company and no phone contact number is present. Other than an online contact form there is a live chat feature for support. The lack of vendor info makes us suspect that this is an unreliable company.

Main Features

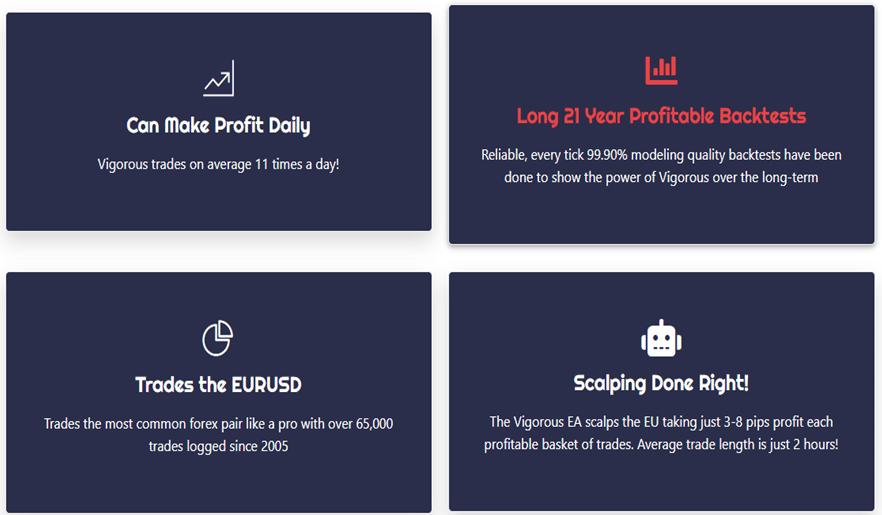

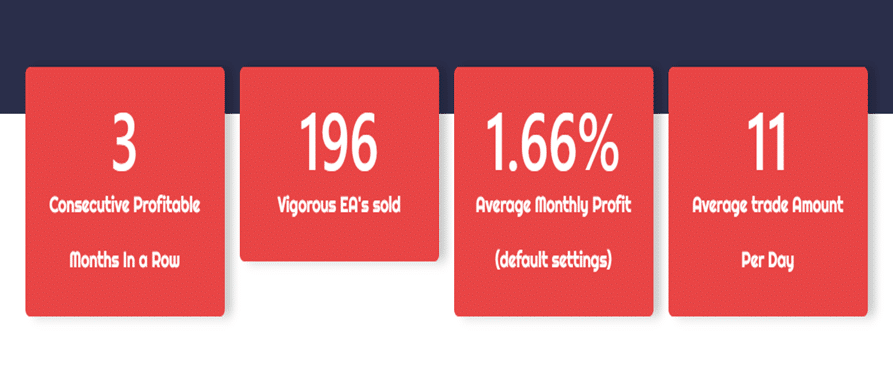

According to the vendor, this FX EA trades 11 times in a day and has 21 years of backtests that show profitable results. This is a scalping system that makes a small amount of 3 pips to 8 pips for the individual trade baskets with the average trade length being 2 hours.

As the achievement of this ATS, the vendor claims that it has given three consecutive profitable months with an average monthly profit of 1.66%. The strategy used by this EA is explained as a flexible grid money management approach. But no further explanation is provided which is inadequate to assess the efficacy of the approach.

As per the vendor, this approach works only when there is an active trend hence the approach is termed adaptive and is said to work on all types of market movement on the EURUSD pair. The recommended leverage for this EA is 250:1 and the balance recommended is $5000.

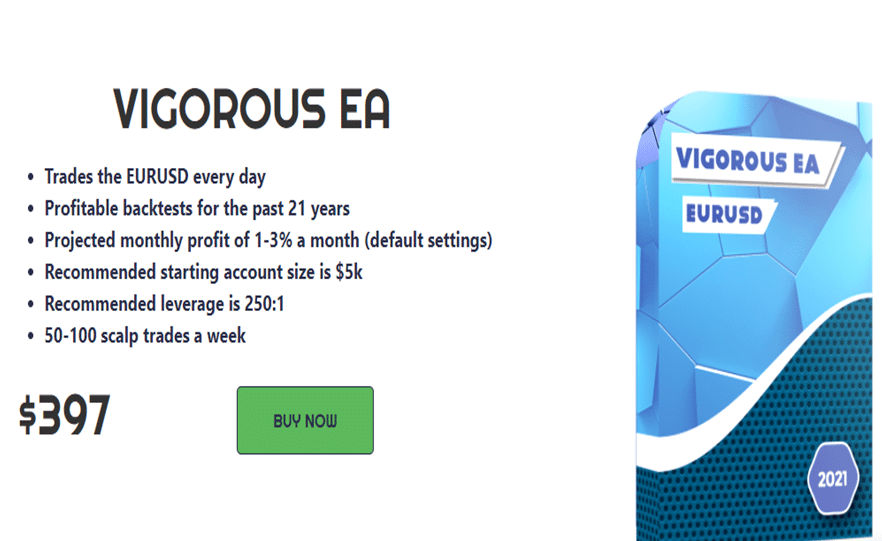

Price

To purchase this FX EA, you need to pay $397. This is a one-time payment that includes the trading software and user guide. The vendor does not provide other features included with the package like updates, settings, etc. When compared to the competitor EAs in the market, the price of this ATS is very exorbitant. Considering the fact that our initial conclusion had deemed the system as unreliable, we do not find the EA is worth this money.

Trading Results

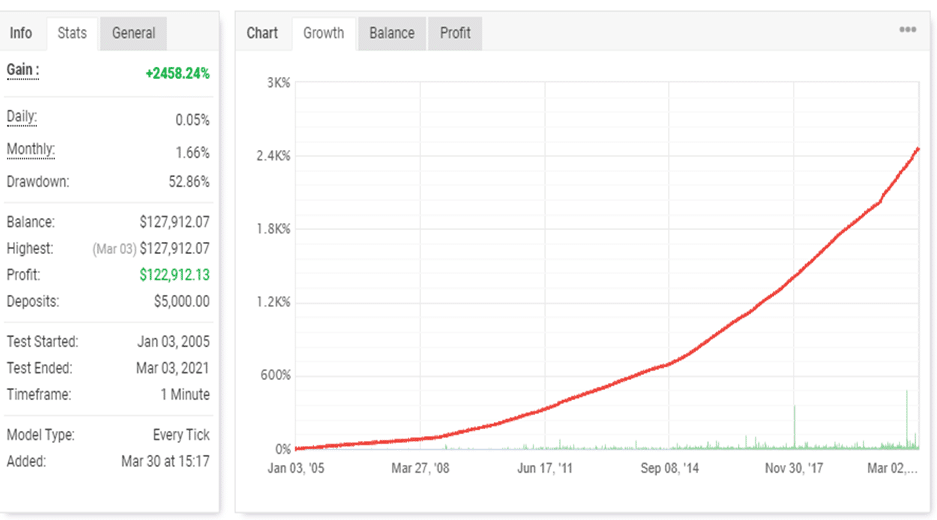

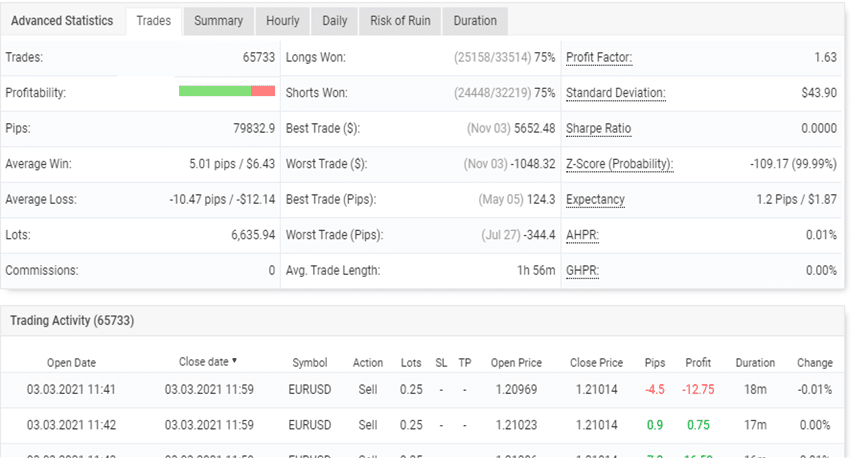

Backtesting done on the EURUSD pair with the ‘Every Tick’ model of 99.9% modeling quality shows a total profit of 2458.24% and a drawdown of 52.86%. The test started in January 2005 and ended in March 2021 using an M1 timeframe. A total of 65733 trades have been completed with a profitability of 75% and a profit factor of 1.63. The lot size used is 0.25.

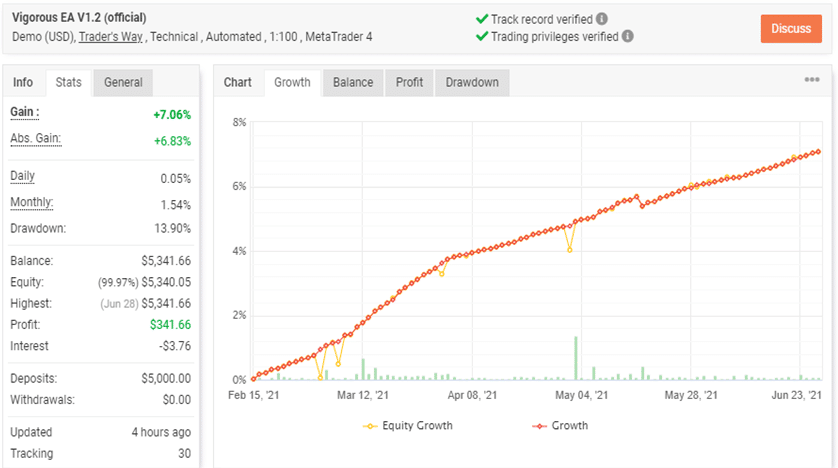

The developer provides a demo USD account using the Trader’s Way broker and the leverage of 1:100 on the MT4 platform. Here is a screenshot of the results:

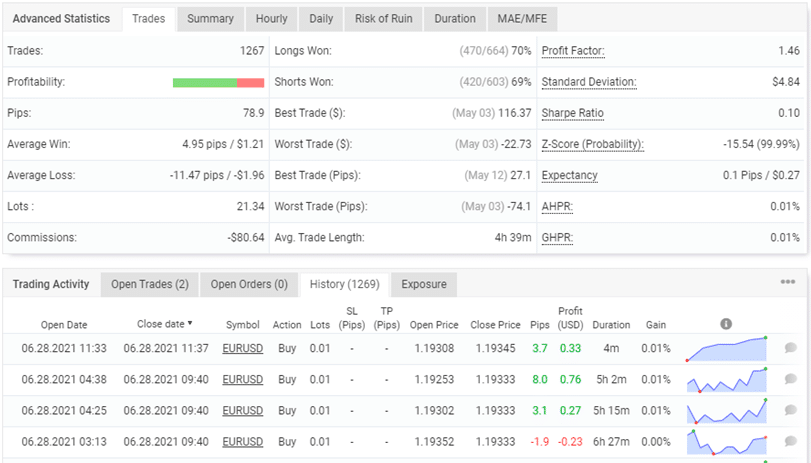

From the above trading stats, we can see that a total profit of 7.06% and an absolute profit of 6.83% is present. A drawdown of 13.90% is shown for deposits worth $5000. This live demo account started trading in February 2021 and has completed 1267 trades with a profitability of 70% and a profit factor of 1.46. The trading history shows lot sizes ranging from 0.01 to 0.02. Compared to the backtests, the profitability is low and there is a difference in the lot sizes used. While the drawdown is low in the demo account it is too high for the backtest. However, we cannot arrive at a proper conclusion on the results as only a verified demo account is present.

Customer Reviews

We could not find testimonials of users for this FX EA on reputed sites like Forexpeacearmy, Trustpilot, etc. The absence of feedback indicates the system is not a popular one among traders.

Summing Up

Vigorous EA claims to provide a monthly profit of 1.66% on average with its default trade settings. From our in-depth analysis of the EA, we can see that the developer does not provide a proven track record to justify the high-profit claim. Although the backtests show profits, the drawdown is too high. When it comes to the trading results, the lack of real account trading is disappointing. Although the vendor provides a verified trading account, the demo account is inadequate to assess the performance. Further, the expensive price is another downside that makes us refrain from recommending this FX robot.