- Cryptocurrencies turn bearish

- Bitcoin bears eye $30,000

- Bitcoin-stock market correlation

The broader cryptocurrency market starts the week under pressure with a sell-off that started last week, gathering pace. Leading the slide lower is Bitcoin, which has dropped below the pivotal $34,000 handle following a 10% drop last week.

The world’s largest cryptocurrency by market cap has lost more than 50% in market value from its peak, registered in November of last year. The recent sell-off comes at the backdrop of the stock markets worldwide dropping, all but fuelling fear among the investment community.

Bitcoin sell-off

Bitcoin losses have been piling up, leading to extended declines for a sixth successive week. This is the first time since 2014 that the cryptocurrency has posted such losses. The losses in the flagship crypto have pulled the entire market lower, with the market cap dipping below $1.6 trillion.

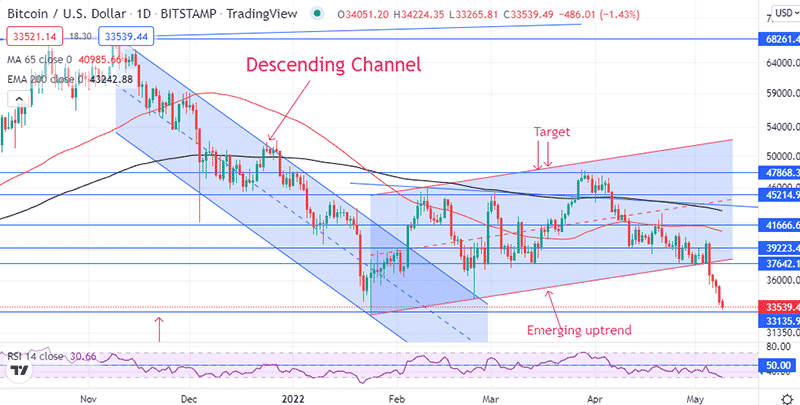

A breach of the $37,600 support level has paved the way for shorts sellers to steer a drop to 2022 lows near the $33,130 level. With short sellers in control, BTCUSD could drop to the $30,000 psychological level on closing below the $33 000 handle.

Bulls face an uphill task to defend the $33,000 level to avert further losses even as the broader sector remains under pressure. Above the key psychological level, Bitcoin could make a run for the $36,000 handle.

All the critical indicators have turned bearish, signaling a buildup in selling pressure. The Relative Strength Index is already pointing lower after failing to power through the 50 level. In addition, Bitcoin is trading below the 200-day moving average, affirming the cryptocurrency has turned bearish after a stalled bounce back.

Why is Bitcoin dropping?

Bitcoin has been trading in tandem with the stock markets. Any sell-off in the equity markets has often spilled over into the crypto market, with Bitcoin the most affected by virtue of being the largest in the burgeoning sector. The direct correlation has everything to do with the influx of professional investors into the cryptocurrency sector.

In the recent past, hedge funds and money managers have invested heavily in Bitcoin, as is the case in the stock market. Consequently, Bitcoin and other cryptocurrencies have always followed movements in the stock markets.

The US stock markets have turned bearish in recent days in the wake of the US Federal Reserve hiking interest rates by 50 basis points and affirming plans to hike more aggressively going forward. The prospect of higher interest rates has spooked the markets amid concerns it could lead to higher borrowing costs and affect global economic growth.

Conversely, many investors have scampered for safety in safe havens. Bitcoin as a speculative asset has paid the ultimate prize on investors shunning riskier assets in aver treasuries and bonds.

Long term outlook

While the short-term outlook remains bearish, the long-term outlook remains bullish amid increased adoption. The Central African Republic is the latest country to join El Salvador in approving Bitcoin as a legal tender.

Bitcoin adoption in the mainstream sector is one factor expected to support prices wings going forward. The adoption is expected to trigger strong demand amid limited supply. As with most cryptocurrencies, Bitcoin is also poised to benefit from its blockchain being sued to enable fast and secure cross-border payments. The use of the Bitcoin blockchain in international payments is expected to fuel strong demand for BTC, which should see its value appreciate in return.

Final thoughts

Bitcoin is expected to remain under pressure after sliding below the $34,000 level. A slide below the $32,000 handle could accelerate a drop to below the $30,000 handle. Additionally, the losses will depend greatly on developments in the stock markets, given the recent direct correlation.