Wild Side is an MT4 tool that works on the night Forex market. It is an automated EA that uses proprietary algorithms and an indicator of the developer for trading. The developer claims that this ATS does not use toxic trading approaches like the grid, Martingale, and other such strategies. As per the developer, the backtests and forward tests on the system have provided excellent results.

Is Wild Side a good EA to invest?

With the market being flooded with expert advisors of diverse types, finding the right one for your trading is an overwhelming task. Is this EA as effective as the vendor claims it to be? We have evaluated the company profile, features, strategy, trading results, and other factors meticulously.

From our analysis, our initial conclusion is that this is not a reliable FX EA. The inadequate support options, poor performance in trading results, and a few other factors indicate this EA is not worth investing in. Let us look into each of the influencing factors in detail.

Company profile

Marat Baiburin is the developer of this FX EA. He published it in April 2021 and the system is in version 1.81 with the recent update being in August. As per the MQL5 profile he is based in Russia and has developed 9 signals, 2 products, and 989 demo versions. We could not find a location address or phone contact for the company.

For contacting the developer, messaging via Skype and the MQL5 message board seem to be the options present. The lack of vendor transparency raises doubts regarding the reliability of the MT4 tool.

Main features

As per the info that the developer provides, this EA does not require a news filter. It uses a unique algorithm for tracking transactions besides the trade algorithms based on price action. Multiple timeframes are available for this EA, but the developer recommends using the M5 timeframe. The main currency pairs the FX EA works on include EURAUD, USDCAD, AUDUSD, CHFJPY, EURCAD, EURCHF, EURUSD, USDCHF, and GBPUSD. This EA is FIFO compliant.

Some of the recommendations by the developer include the use of RAW or ECN accounts that use a low-ping VPS, leverage starting from 1:50, and a minimum deposit of $50 with a lot size of 0.01. We could not find an explanation of the trading approach other than the mention of price action algorithms and an indicator designed by the developer. The lack of info raises a red flag.

Price

To buy this EA you need to spend $249. A couple of rental options are also present. For a single-month rental, the vendor charges $69 and the cost is $129 for a three-month rental. A free demo is present which users can exploit to know how the system works and the performance of the EA. When compared to other competitor systems in the market, the price is not too expensive. However, the vendor does not provide a money-back guarantee, which is disappointing to note.

Trading results

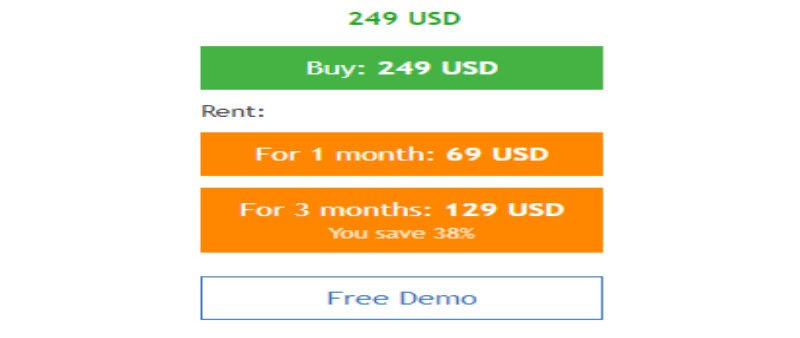

The developer provides backtests for all the currency pairs it works on. Here is a strategy tester report for the EA working on the EURUSD pair in the 5-minute timeframe done from 2003 to 2021.

For an initial deposit of $1000, the account has netted a profit of 9068.05 and a profit factor of 2.02. The modeling quality for this backtest was 99.90% and the maximum drawdown was 7.55%. From the results, we can see that the profits were not high but the drawdown was low and within acceptable limits.

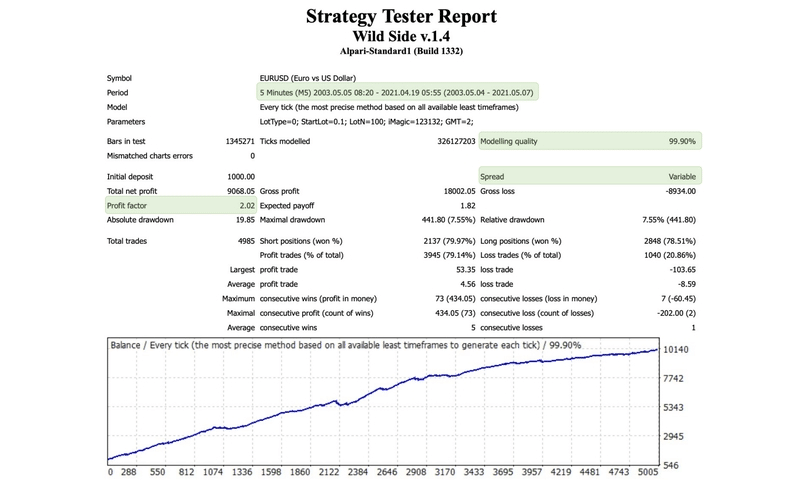

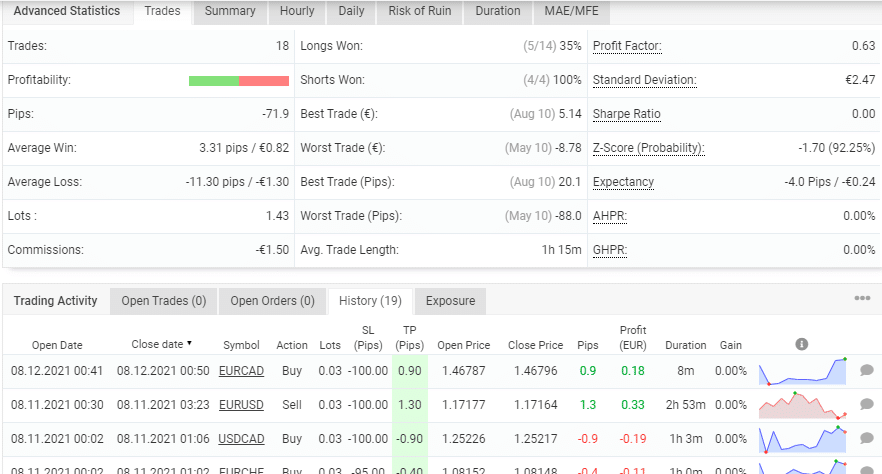

A live demo EUR account using BDSwiss broker on the MT4 platform and a leverage of 1:1000 is found on the Myfxbook site. Here are a couple of screenshots of the results verified by the myfxbook site.

From the trading stats shown in the above images, a total loss of 0.04% and an absolute loss of 0.045 are present for the account. The daily and monthly values include 0.00% and -0.01% respectively with a drawdown of 0.10%.

For the live demo account that started in April 2021, a total of 18 trades have been executed with a profitability of 50% and a profit factor of 0.63%. This ATS uses a lot size of 0.03. The loss in the total and absolute value, low profitability, and low profit factor indicate poor performance. Comparing the backtest results and the real demo account results, it is clear that the EA is not performing well.

Customer reviews

We could not find user reviews for this EA on reputed sites like Forexpeacearmy, Trustpilot, etc. The absence of reviews indicates this is not a well-known site among traders.

Summing Up

Wild Side claims to be a safe and profitable system. Our review of the strategy and performance of this FX robot reveals poor performance and an ineffective approach. The lack of adequate support options and absence of vendor transparency are other factors that confirm our assessment that this is not a trustworthy EA.