- BTCUSD retreats from $45,600.

- Bitcoin sell-off coincides with stock market pullback.

- Bitcoin bullish thesis.

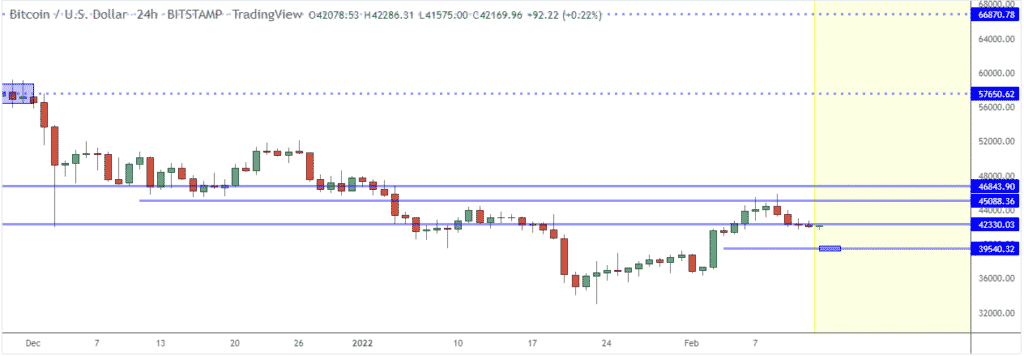

Cryptocurrencies are under pressure at the start of the week, edging lower in continuation of a sell-off wave that began late last week. Bitcoin is one of the cryptos leading the move lower after struggling to find support above the $45,600 handle.

BTCUSD technical analysis

BTCUSD has since tanked to one-week lows flirting with lows of $41,965. A pullback to the $41,000 handle leaves the crypto susceptible to further losses, especially on tanking and posting a daily close below the $40,000 level.

The $40,600 level is the line on the sand above which the flagship cryptocurrency remains well supported for further upside action. A drop below the level could leave BTCUSD susceptible to dropping to about $36,800, the next key support.

A pull back from the $45,000 handle could be a minor correction on traders taking profits following the recent bounce back from seven-month lows near the $33,260 level. Consequently, a pullback from five-week highs of $45,865 to lows of $41,965 might as well present an opportunity for traders who missed out on the initial leg higher to enter long positions at a discount.

On the flipside, BTCUSD bulls face short-term resistance near the $45,800 level. A daily close above the level should reignite the upward momentum, which could see the flagship cryptocurrencies eyeing higher highs to the $50,000 handle.

Bitcoin and stock market correlation

Bitcoin and the broader cryptocurrency market have been trading in tandem with the overall stock market. A rally in the stock market has often affirmed demand for riskier assets, all but fuelling a buying spree in the crypto market. Similarly, a sell-off in the broader stock market has often acted as a warning sign against riskier assets, consequently resulting in the dumping of cryptos.

The trigger behind the recent sell-off around BTCUSD has to do with hawkish rhetoric from the US Federal Reserve. The central bank hinting of accelerated monetary policy tightening has sent fears in the capital markets.

The prospect of higher interest rates does not board well with investors. For starters, it threatens to trigger higher borrowing costs, something that could make it difficult and expensive for investors to access cheap capital for investing in riskier assets such as Bitcoin.

Consequently, the prospect of higher interest rates has forced investors to dump BTCUSD, all but explaining the recent deep pull back from record highs as well as the bounce back from seven-month lows stalling.

The US dollar factor

The strengthening of the US dollar has also curtailed BTCUSD’s upward momentum amid rising treasury yields and the prospects of a hike in interest rates. The strengthened dollar tends to have a net effect of sending BTCUSD lower.

Fuelling the downward momentum on BTCUSD are concerns about regulatory pressures. China and Russia embarking on a crackdown of crypto trading and mining has also fueled jitters in the market, all but fuelling the sell-off.

1 million Bitcoin prediction

Amid the steep pullbacks, bounce back from multi-month lows have also come into play. The catalyst behind the bounce back is traders and investors using the opportunity to buy on the dip. For instance, Ark Invest’s Cathie Wood triggered a bounce back from lows of $30,000 after stating Bitcoin could exceed $1 million by 2030.

In addition, Bitcoin has emerged as an ideal tool for hedging rising inflation. With US inflation rising to 40-year highs of 7.5%, most people have resorted to Bitcoin investing.