The Bitcoin (BTC) price recovery gained steam during the weekend as risk sentiment in the market improved. The coin’s price jumped to $42,825, which is about 30% above the year-to-date low of $32,820.

US jobs data

The BTC price jumped even after the US published strong jobs numbers on Friday. Data published by the Bureau of Labor Statistics (BLS) surprised most investors.

The numbers revealed that the US economy created more than 467k jobs in January, which was better than the median estimate of fewer than 200k jobs. Notably, the BLS upgraded its December jobs numbers from 197k to 550k.

On Wednesday, ADP showed that the American private sector lost 301,000 jobs in January. Additionally, in the past few weeks, the number of Americans filing for jobless claims has been in a slow increase.

US jobs numbers have an impact on Bitcoin prices because of their role in monetary policy. The Federal Reserve typically looks at inflation and the situation in the labor market when making decisions.

In its recent decision, the bank said that it would continue tightening as long as the American economy remained strong. Therefore, there is a likelihood that the bank will end its asset purchase in its March meeting and then start increasing interest rates.

Analysts are torn about the number and size of rate increases expected this year. The Fed dot plot pointed to three rate hikes this year while some officials have toyed with the idea of four increases. Some analysts expect that the number of boosts this year will be greater than four. For example, Bank of America expects seven hikes this year while Goldman Sachs sees five raises.

The US will publish the latest consumer price index (CPI) data on Thursday. Economists polled by Reuters expect that the country’s inflation rose to 7.6% in January. Therefore, if analysts are accurate, it means that the Fed will accelerate its tightening process.

Sentiment improves

The Bitcoin price continued rising as the market sentiment improved on Friday following the strong Amazon earnings. The firm’s results helped to ameliorate the damage caused by Meta Platforms, PayPal, and Spotify.

Amazon said that its total revenue jumped to $137 billion in the fourth quarter while its profitability jumped amid the soaring costs.

As a result, the Nasdaq 100 index rose by over 300 points on Friday. In the past few months, we have seen a close correlation between tech stocks and Bitcoin.

Meanwhile, the CNN Money fear and greed index (FGI) has improved slightly from 33 to 35. The crypto FGI, on the other hand, has moved from the weekend low of 35 to 45. Further, the CBOE VIX index has declined slightly, signalling that the market sentiment is improving.

On-chain data also shows that the level of activity in Bitcoin’s network is doing well. For example, the number of transactions has increased while non-zero accounts have also jumped. That is a sign that some investors rushed to buy the dips.

Bitcoin price forecast

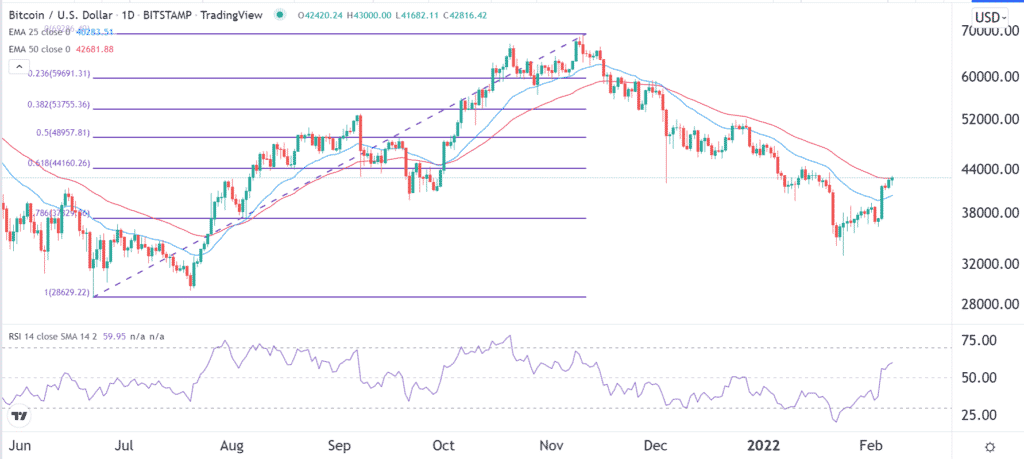

The daily chart shows that the BTCUSD pair has held relatively steady in the past few days. As a result, the coin has managed to move close to its 61.8% Fibonacci retracement level. It has also managed to move slightly above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) is approaching its overbought level. Therefore, there is a likelihood that the Bitcoin price will keep rising this week.