- Bitcoin and Dogecoin remain under pressure edging lower amid an ongoing crackdown in China and the US.

- The EUR/USD rally from three weeks lows stalled near the 1.2200 level amid a sluggish US dollar.

- Oil prices powered through the $70 a barrel level amid the lifting of travel restrictions by the US.

- The US indices continue to trade in a tight range amid monetary policy uncertainty and inflation concerns.

Cryptocurrencies remain under pressure, with Bitcoin and Ethereum leading the slide lower amid a brutal sell-off. BTC/USD fell to three weeks low on Tuesday as concerns about the security of the flagship cryptocurrency sent jitters across the board.

Crypto sell-off

The pair touched session lows of $30,900, with the sell-off wave showing no signs of easing off. After the recent sell-off, the $36,000 level has emerged as the immediate resistance level blocking any move to the upside.

On the downside, BTC/USD faces strong support at the $30,000 level, a break below which could fuel further sell-off to the $28,000 level.

The catalyst fuelling the recent sell-off confirms that US officials managed to seize most of the ransom paid to hackers that targeted the Colonial Pipeline. Immediate reports indicate that investigators accessed the password of one of the hacker’s Bitcoin wallets and recovered $2.3 million in Bitcoin payments.

Bitcoin sentiments have also been weighed heavily by Tesla CEO Elon Musk’s rhetoric in recent weeks. The EV giant blocking Bitcoin payments also pushed BTC/USD lower. However, China’s move to block Bitcoin mining and trading continue to rattle the market fuelling the sell-off.

Dogecoin addition to Coinbase

Dogecoin is another coin that has not been spared amid the fierce sell-off in the broader cryptocurrency space. After touching record highs of $0.74, DOGE/USD has come down tumbling, shedding more than 50% of its market value from all-time highs.

After the meme crypto rallied after the crypto exchange, there was some reprieve last week after the crypto exchange confirmed it would add support for the altcoin on its Coinbase Pro platform. After initially rallying to highs of $0.3747, it has once again come down tumbling.

Sluggish US dollar

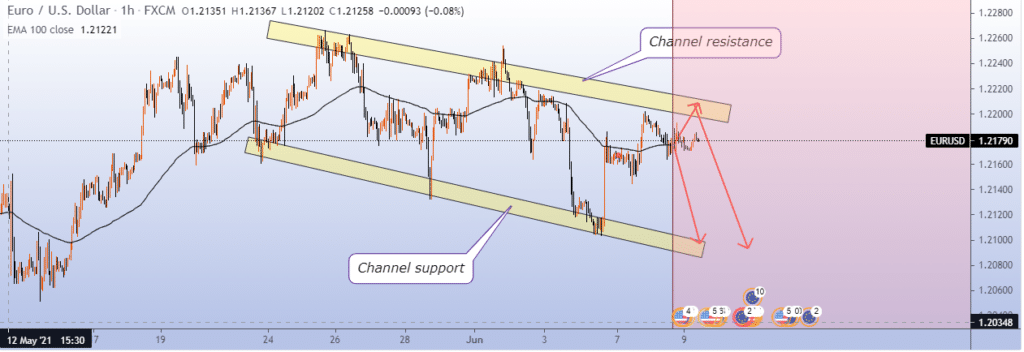

A sluggish US dollar is the catalyst offering support to price gains on the EUR/USD pair in the forex market. The pair is increasingly showing signs of edging higher after bottoming out of three weeks lows of 1.2103 levels following a disappointing US jobs data report.

However, the pair appears to have hit strong resistance near the 1.2200 level. Further upside action has been curtailed by the US dollar index, which tracks the greenback strength against the majors sticking around the 90 levels.

Mixed economic data out of the Eurozone have also curtailed the common currency strength against the greenback. Disappointing data out of Germany has shown a contracting manufacturing sector leading to further deterioration in investors’ sentiments. Looking ahead, the focus is on the European Central Bank meeting on Thursday. The CPI data out of the US will also weigh heavily on the pair.

Oil prices rally

In the commodities market, US oil-powered through the elusive $70 a barrel level as investors grew optimistic about demand outlook amid easing travel restrictions.

Brent crude oil was up 0.26% to $72.41 a barrel early Wednesday morning as Crude Oil WTI Futures jumped 0.33% to highs of $70.28.

The rally in oil prices came after the US, the largest consumer of black gold, lowered travel warnings to several countries. The easing of travel restrictions to France, Canada, and Germany is expected to fuel air travel, resulting in a spike in oil demand.

US equities flat

In the equity markets, major US indices were relatively flat near all-time highs. The S&P 500 climbed 0.74 points or less than 0.1% on Tuesday to close at 4,227.27, just 0.1% from its all-time highs. Tech heavy NASDAQ was up 0.3%, closing the day at 13,924.91, less than 2% from its all-time highs of $14,000.

Major US indices have been moving sideways in recent weeks as investors remain on the sidelines amid inflation concerns and the next course of action of the FED regarding monetary policy. After blockbuster movies last year, high valuations prevent investors from opening new positions, thus the relatively tight trading range.