Cryptocurrencies have come a long way. The industry came to life a few years ago and has now become closely watched. According to CoinMarketCap, there are now almost 10,000 cryptocurrencies that have a market capitalization of more than $1.5 trillion in total. In this article, we will look at the relation between cryptocurrencies and interest rates.

How interest rates are set

In most countries, interest rates are set by the central bank. Some of the most important central banks in the world are the Federal Reserve, European Central Bank, Bank of Japan, and Bank of England. In relation to cryptocurrencies and other financial assets, the most important central bank is the Fed because they are mostly traded in dollars.

A central bank looks at several things when setting interest rates. The Fed’s Federal Open Market Committee (FOMC) meets eight times per year to decide on rates in the US. In these meetings, they look at several metrics like inflation, retail sales, and the unemployment rate as they gauge the economy’s health. If they conclude that the economy is doing well, they are most inclined to tighten the monetary policy to prevent it from overheating.

On the other hand, if they suspect that the economy is in bad shape, they will be inclined to slash interest rates. At times, like during the 2008/9 financial crisis and the coronavirus pandemic, the central bank will combine lower rates and quantitative easing (QE). QE is a situation where the bank prints money and expands its balance sheet by buying treasury bonds and mortgage-backed securities (MBS).

An easy money policy boosts the economy by incentivizing people to buy items like houses, cars, and gadgets since borrowing costs are low. The policy also incentivizes investments in assets like cryptocurrencies and stocks.

Furthermore, many people and investors are not always comfortable investing in low-yielding bonds and certificate deposits (CD) but instead choose alternative assets, like cryptocurrencies.

Factors that influence interest rates

Therefore, since interest rates impact cryptocurrency prices, investors and traders must understand what influences interest rates in the United States.

Broadly, the Fed looks at the overall state of the economy and acts as required.

To do that, the bank looks at several key economic numbers, such as the ones below.

- Inflation – This number measures the change of prices of items like gasoline, furniture, and food. The Fed is mandated to ensure that the economy has stable inflation. Therefore, if the Consumer Price Index (CPI), Producer Price Index (PPI), and the Personal Consumption Expenditure (PCE) are rising, it could influence the Fed to tighten.

- Employment – The other mandate of the Fed is to ensure that the economy has full employment. As such, officials pay close attention to the actual and flash employment numbers.

- GDP – The US publishes GDP numbers every quarter. As such, the Fed tends to pay close attention to these numbers because they show whether the economy is growing, stagnating, or contracting.

- Retail sales – The retail sector employs millions of Americans. Spending is also the biggest constituent of the economy. As such, the Fed pays close attention to the trends in this sector.

Other key factors that influence the Fed’s monetary policy are services, manufacturing, industrial production numbers, and the housing sector figures.

The intersection of interest rates and cryptocurrency prices

There is a close relationship between interest rates, cryptocurrencies, and other financial assets like stocks and bonds. In theory, the price of cryptocurrencies tends to do well in a period of easy money, meaning when interest rates are low. A rotation tends to happen from the value or the safe assets like bonds that yield nothing to growth assets. This market sentiment is often known as a risk-on sentiment.

On the other hand, cryptocurrency prices tend to underperform when the Federal Reserve turns hawkish and starts tightening. This trend is also often seen in the stock market, where growth stocks tend to underperform value stocks in a high-interest rate environment.

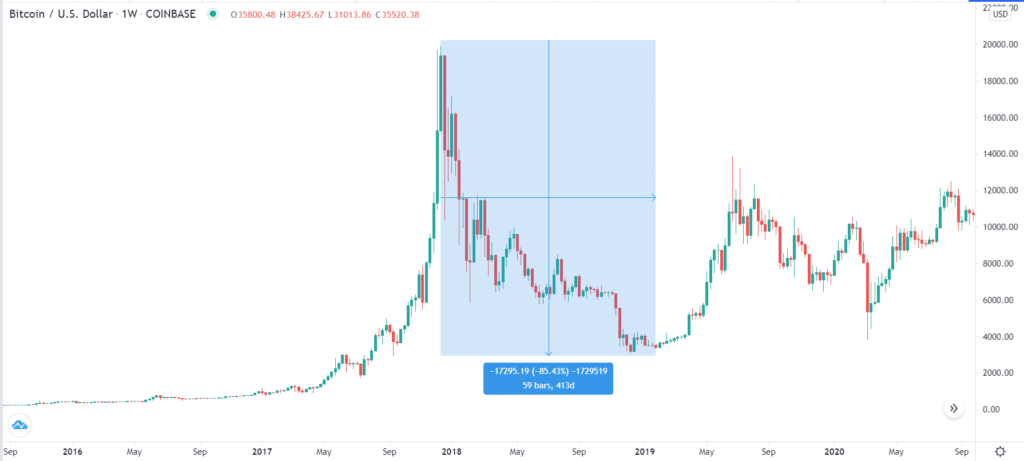

The highlighted part of the chart below shows the performance of Bitcoin in 2018. As you can see, the digital coin declined by more than 80% from January to December 2018. Interestingly, this happened in a year when the Federal Reserve raised interest rates four times.

Bitcoin performance in 2018

After falling in 2018, the price then bounced back in 2019. The Fed slashed interest rates two times as it tried to stem growth fears.

After rising in 2019, the coin declined sharply in the first quarter of 2020 as the pandemic started. It then roared back and jumped to the highest level on record as the Federal Reserve lowered interest rates and launched the biggest quantitative easing program on record. Other cryptocurrencies followed suit, pushing the total market capitalization to more than $2 trillion.

Further, in 2021, as shown below, the price of Bitcoin declined substantially. At the time, the Fed was still adamant that low-interest rates and quantitative easing policies were not going away. Still, investors were unconvinced, considering that the labor market was tightening while inflation was soaring.

Bitcoin declined as higher interest rates remained on the horizon

Therefore, it is clear that the overall monetary policy in the United States impacts Bitcoin prices. Still, other factors push its prices higher or lower, including regulations, hacks, and the overall demand and supply.

Final thoughts

In this article, we have looked at the close intersection of Bitcoin prices and interest rates. The article shows that, at times, like all other financial assets, cryptocurrencies have a close relationship with interest rates. As a crypto investor or hedge fund, you must understand this relationship and interpret them, taking into account the Fed’s actions, as well as understanding other aspects of trading cryptocurrency.