Gold and Bitcoin have become relatively popular alternative assets to invest in. They are also controversial assets that have mixed opinions in the financial market because of their overall usage. In this article, we will compare the two and identify the better performer.

Gold and Bitcoin introduction

For starters, gold is a precious metal that has been beloved by most people for centuries. Today, it does not have much real use. Indeed, most of it that is mined is used for investment purposes, while only a small portion is used to manufacture jewelry and ornaments. The total market value of all mined gold is about $10 trillion.

On the other hand, Bitcoin is a digital currency whose original goal was to substitute fiat currencies like the dollar and euro.

The founder created a way of using computers to mine the currency. He also created a fixed amount of BTC that can ever be mined to prevent market manipulation. At the time of writing, the market cap of all Bitcoins in existence is more than $1 trillion.

Gold vs. BTC: Performance

Gold has been an average investment in the past few decades. From 1983, the metal’s price has surged by more than 325%. During this period, it has lagged stocks since the S&P 500 has gained by more than 2,500%.

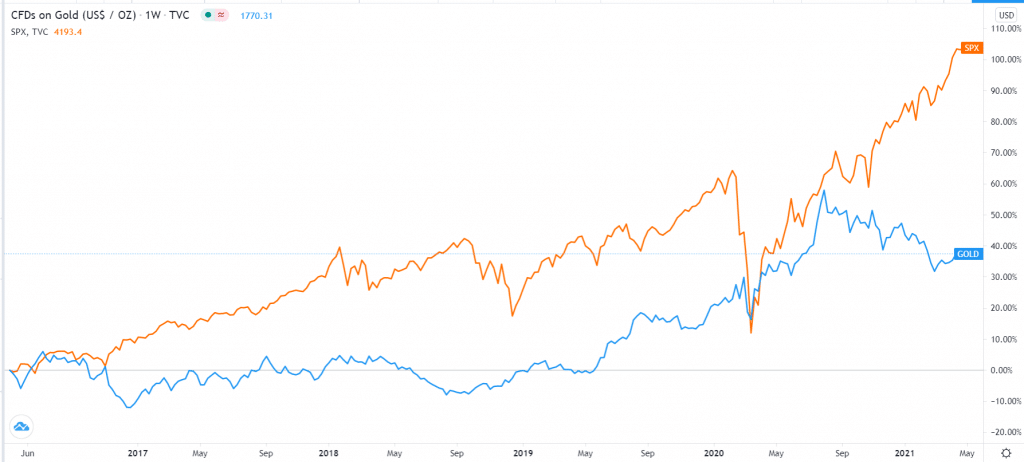

Since 2,000, gold has outshone, rising by more than 520%, while the S&P 500 has risen over 200%. Finally, as shown below, in the past five years, the meta’s price has risen by 40%, while the S&P 500 index has risen by more than 100%.

Gold vs. S&P 500 5-year performance

On the other hand, Bitcoin is a relatively new investment asset that has been around for about 11 years. While the currency is widely known for its volatility, it has been a star performer.

Indeed, very few asset prices have grown from less than $5 to more than $60,000 ever. As shown below, Bitcoin has surged more than 12,000% in the past five years, while S&P 500 has risen under 50%.

Bitcoin vs. S&P 500

Therefore, based on the two asset’s performance, it seems like Bitcoin has been a better performer overall.

The case for gold

There are a number of reasons why many investors invest in gold. First, they view it as a good asset that has been tested over the years.

The metal has been a valuable asset for centuries. Indeed, its importance can be found in most traditional manuscripts. This means that the metal will likely continue having value over the years.

Second, investors love gold for its inflation hedge. Since the dollar and other currencies tend to lose value over time because of inflation, investors see gold as a viable alternative.

Indeed, while gold has been a lackluster investment over the years, people who converted their fiat currencies into gold have done better than those who didn’t.

Third, the metal is loved because of the fact that many central banks own it. In the United States, the Federal Reserve owns more than 13 million troy ounces of metal. The government itself owns 261 million ounces. Other Central Banks that own the most gold are Russia, China, Germany, France, and Italy.

Therefore, there is confidence in owning an asset that central banks believe in.

Fourth, the gold supply will run out in the next few decades. According to some estimates, gold will become economically unsustainable by at least 2045. Therefore, as it becomes rare, the price could keep rising.

The case against gold

There are several reasons why many investors are generally cautious about gold. First, they believe that it is not a good hedge against inflation. For example, its price rose in 2020 even as inflation in the United States remained below 1%. In 2021, as inflation rose, its price lagged.

Second, gold critics point to its overall returns over the years. They argue that there are other better investments based on returns than gold. For example, they prefer stocks, which generally rise over decades. In addition to share appreciation, stocks also pay dividends, which makes them better.

Finally, physical gold is a relatively illiquid asset that is difficult to convert into cash.

The case for Bitcoin

Bitcoin is often viewed as a viable alternative to gold. BTC proponents cite several reasons why investing in it makes sense.

First, they cite its short history of performance. Within a few years, the currency has moved from less than $5 to more than $60,000. This makes it one of the best assets to invest in over the years.

Second, unlike gold, Bitcoin has a finite supply in that only 21 million of them will ever be mined. Eighteen million of them have been mined already. Therefore, as mining gets more difficult, the price of BTC will keep rising.

Third, many enthusiasts view BTC as a viable alternative for gold. In other words, they see it as a new-age version of the traditional metal. Fourth, BTC is a highly liquid asset that is easy to convert into cash.

Finally, user adoption is rising. Recently, companies like Tesla and Square have bought billions of Bitcoin. If other large companies allocate a small portion of their treasuries to the metal, its price will keep rising.

The case against BTC

There are some major concerns about Bitcoin. First, critics cite its volatility as a key reason to stay away from it. Indeed, it is common for its price to change by more than 5% within a day. Second, there are regulatory concerns. Indeed, some countries like Turkey and India are mulling banning the currencies.

Third, there are concerns that the price of BTC is manipulated. In 2021, Research Affiliates reported that the currency was being manipulated by Tether, the biggest stablecoin in the world.

Finally, there are security issues associated with BTC. In the past decade, Bitcoins worth billions of dollars have been lost because of security lapses in their exchanges.

Bitcoin vs. Gold: Summary

There are pros and cons of investing in both gold and Bitcoin. However, we recommend that investors should put a small portion of their portfolios into the two assets. Doing this will help them capture long-term gains as their prices rise without risking too much money.