By default, every crypto investor aims to buy the dip and sell high. This is an especially favorable strategy when the market is trending. However, most of the time, prices will stage sideways movements, manifesting no discernible trend. Such instances may discourage some traders, but there are ways to profit from these periods of consolidation. A tried and tested strategy is grid trading, which involves setting up multiple buy and sell orders within a price range.

About grid trading

This is a strategy that involves placing a strategic limit on buy and sell orders. When the market is range-bound, grid traders establish a lower and upper limit within which prices are most likely to fluctuate. The space between these limits is then divided into grids comprising pending buy and sell orders below and above the current market price, respectively. The wider the gap between the buy and sell orders, the bigger the profit potential. For instance, if the trader places a buy order at $40,000, a sell order at $45,000 would yield more gains than one at $41,000.

How it works

Grid trading is inherently a short-term trading strategy. For that reason, it works best on shorter timeframes, preferably anywhere from the 1-minute chart to the hourly one. This is because, on larger timeframes, crypto prices may appear stable, but on shorter timeframes, they are characterized by numerous whipsaws. These whipsaws constitute the volatility our strategy aims to take advantage of.

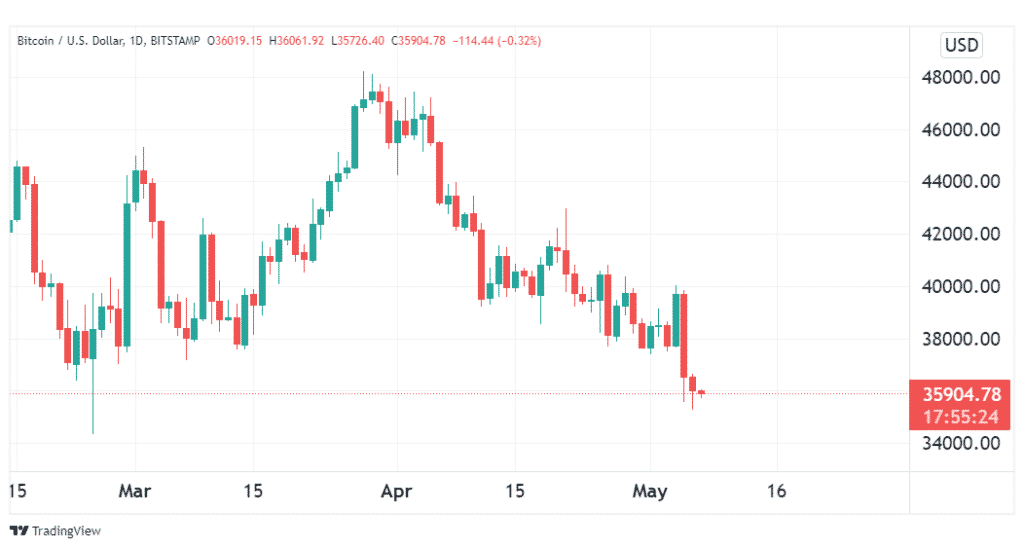

Case in point, the chart above shows a daily BTC price chart. From the chart, BTC is in a strong downtrend, which would render it unsuitable for grid trading. However, on shifting to the 15-minute chart as shown below, we observe that BTC is currently range-bound and displaying high volatility. This would be ideal for grid trading.

In the last 12 hours, Bitcoin has been violently fluctuating between $36,500 and $35,500. To trade this, a grid trader could create a grid with a lower limit of $35,000 and an upper limit of $37,000. Thankfully, on platforms such as Bitsgap, you can create a trading bot to execute this system autonomously.

Vital parameters to consider

Whether you are grid trading manually or with a bot, there are five key parameters that you need to define for your strategy.

- Take profit – This is the profit target you set for your trade. Your bot will automatically close all open positions when prices hit this level.

- Stop loss – This is a price point below the lower limit of your grid. When prices hit this level, your bot closes all open positions to prevent further losses.

- Upper limit – This is the highest price within your grid. Your bot will place no further sell orders above this price. Therefore, the higher it is, the greater the profit you stand to make.

- Lower limit – This is the lowest price of your chosen grid. The bot will not be placing any buy orders below this price.

- Grid number – This is the total number of buy and sell orders within your grid. Usually, they will be evenly divided. If you set a grid number of 8, for example, you’ll have 4 buy and 4 sell orders.

In the example above, the market price of BTC is $35,900. The upper limit is $37,000, and the lower limit $35,000. Assuming we use a grid number of 8, buy orders can be placed at:

- $35,000

- $35,250

- $35,500

- $35,750

Similarly, sell orders will be placed at:

- $36,250

- $36,500

- $36,750

- $37,000.

You will notice that we obtained our figures relative to Bitcoin’s volatility for the day. Since this is an ever-changing statistic, we would need to adjust these parameters daily to match the current market conditions.

The best time to utilize this strategy is when the coin in question fluctuates around 2-3% in a day. This is because a sudden price spike would cause the bot to take profits early. On the other hand, a quick price decline would trigger the stop loss.

Risk management

Risk management is a vital part of any trading strategy. Grid trading has a clear advantage because it inherently incorporates hedging. Since it involves several trades, losses from some can be compensated by profits from others. What’s more, by utilizing a stop-loss, you reduce the risk of incurring large losses.

It is also important to pay attention to the fundamentals of the coin you’re trading. Oftentimes news has a direct effect on crypto prices. Good news, such as a coin being listed on an exchange, tends to be bullish, while bad news, such as the ban of a token or software bugs, tends to be bearish for the coin. Additionally, you should avoid using a large grid number as each trade will be subject to transaction fees. To further reduce these fees, always utilize a suitable exchange with low trading fees.

Perks of grid trading

- Grid trading is ideal for automation, which means you can make profits even without actively studying the markets.

- It allows traders to profit from sideways markets, which constitute most of the trading cycle.

- By utilizing multiple buy and sell trades, traders are able to minimize risk and maximize profits.

In a nutshell

Grid trading is a strategy that aims to take advantage of consolidating markets. Once the upper and lower price limits have been established, equally spaced buy and sell orders are placed below and above the current market price, respectively. However, keep in mind that each of those trades will be charged a transaction fee. For that reason, it’s prudent not to place too high a grid number and to utilize an exchange with low trading fees. Additionally, a stop-loss order is vital, just in case prices break out of consolidation.