The Live Nation stock price has been in focus lately. The stock surged by more than 14% on Friday last week after it reported strong earnings. It then pared back some of those gains on Monday after a deadly concert in the United States. The LYV stock price ended the day on Monday at $117, which was slightly below the weekend high of $128.

Live Nation earnings

Live Nation is an entertainment company valued at more than $25 billion. It is the biggest concert company in the United States. Before Covid, the company used to generate more than $11.5 billion in revenue per year.

Live Nation makes money in several ways. First, it makes cash through the ticket sales that people pay to move to its venues. Second, the company is a leading brand advertiser. It has contracts with companies who want to advertise their businesses in its concerts.

Third, the company operates one of the biggest event booking portals in the US. It owns TicketMaster, a place where people can book their events. In this line, it mostly makes money by taking a cut of what people pay to attend these events. It competes with a company like Eventbrite.

Being a concert business, Live Nation was deeply affected by the Covid-19 pandemic. For a long time last year, the company was not making any money since people were not attending concerts. Indeed, its 2020 revenue was more than $1.8 billion. Most of this revenue came in the first quarter.

Therefore, the Live Nation stock price has more than doubled this week as investors anticipate a quick recovery for the company.

Indeed, the company’s growth has started. In the most recent quarter, the company announced that it had already sold 22 million tickets for its shows in 2022. Its business had more than 17 million fans who attended its shows in the summer.

Its concert revenue jumped to more than $2.15 billion in the third quarter, while its ticketing division had more than $372 million in revenue. Its sponsorship and advertising brought in more than $174 million. These results were better than what was expected.

Astroworld concert

The Live Nation stock price erased some of the gains it made on Friday. This happened as the company faced several lawsuits after a major accident that happened during the weekend.

The company held a major concert that was headlined by rappers Travis Scott and Drake. It had more than 50,000 attendees. The event ended tragically as a crowd surge led to 8 deaths and hundreds of injuries.

The company said that it had more than 700 security staff on duty while local security agencies had hundreds of officers.

Therefore, the Live Nation stock declined because of the lawsuits that were filed on Monday. It will face more lawsuits going forward. Also, analysts believe that the accident will lead to the slower recovery of its business as more people avoid concerts. Still, there is a likelihood that the event will not have a major impact on future ticket sales.

Live Nation stock price forecast

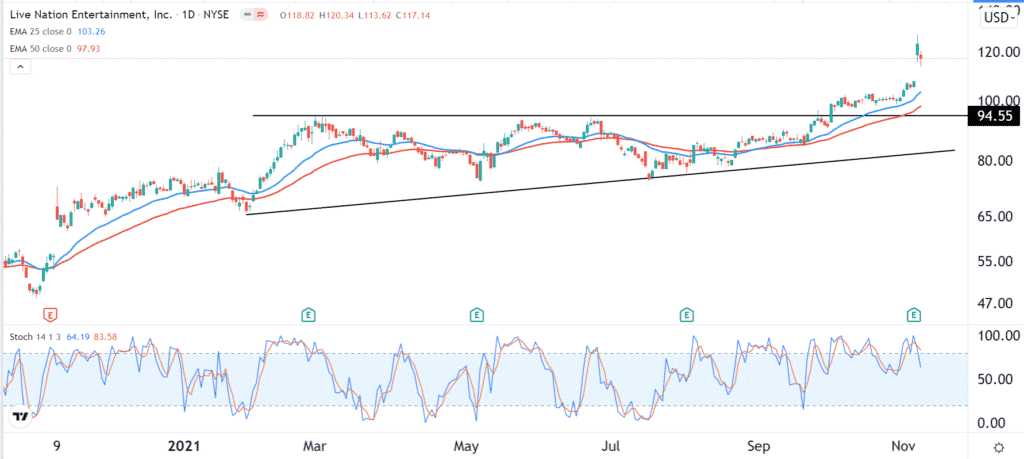

The daily chart shows that the Live Nation stock made a major bullish breakout recently. The stock managed to move above the upper side of the ascending triangle at $94. It then retreated slightly on Monday, but it remains about 10% above its Thursday’s close.

It is above the short and longer-term moving averages while the Stochastic Oscillator has moved relatively lower. Therefore, the stock will likely see more weakness in the near term, but the overall trend is bullish.