How do proof of work and proof of stake work in cryptocurrencies? This article will explain the differences, advantages, and disadvantages of the two most popular consensus mechanisms.

Blockchain technology wouldn’t thrive without consensus mechanisms. Of course, there is no one to rule them all. Interestingly, we have several of these (some of them barely known), like proof of elapsed time (PoET), proof of authority (PoA), proof of capacity (PoC), and more.

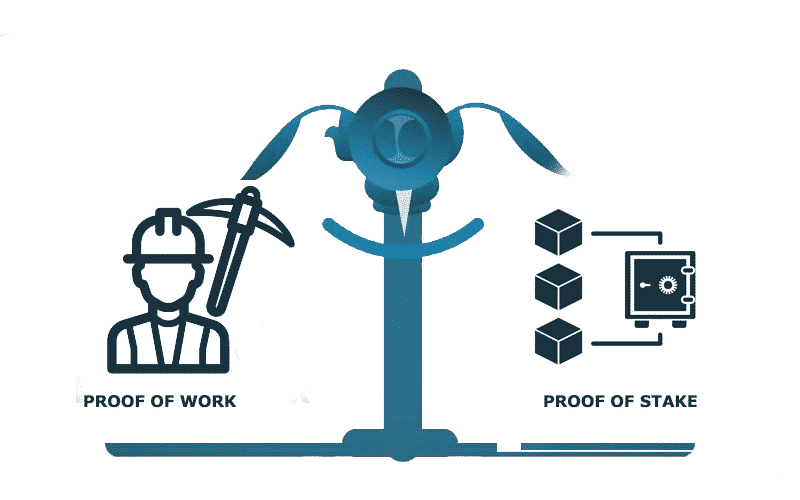

Yet, undoubtedly, proof of work (PoW) and proof of stake (PoS) are the most prominently used with the vast majority of the cryptocurrencies. As expected, both of these systems are very different despite being designed to achieve the same objective.

So, what are the main distinctions? Is one technically and considerably superior to the other? What are the pros and cons of each? We’ll answer all these questions in this article.

Firstly, what is a consensus mechanism?

The terms ‘consensus mechanism’ or ‘consensus algorithm’ sound complex but merely refers to how a group of nodes or computers in a blockchain agree to a data value and overall network state.

We should remember blockchains are non-centralized and run autonomously without any intermediaries. While a centralized system has its flaws, a network of this type is easier to run since only one party agrees to the same thing.

With distributed ledgers or blockchain, this objective is far more difficult to achieve consistently. We have thousands of nodes worldwide who can fail or act dishonestly.

A consensus mechanism aims to solve a distributed computing protocol known as the Byzantine generals’ problem or Byzantine fault tolerance. Several computer scientists authored this concept in 1982.

In simple terms, this idea refers to the logical dilemma where a group of Byzantine generals could experience communication issues in deciding their next move, whether to attack or retreat.

If we apply this concept to blockchains, each ‘general’ or computer must agree on the same action (or reach consensus) to avoid failure and confusion. Hence, a consensus mechanism is simply a set of rules for ledgers to follow.

So, what is proof of work?

Proof of work is a system where one party proves to others a particular amount of computational power has been done. Bitcoin first introduced this model in 2009. Without getting into the complexities, PoW is about solving blocks through computational mining to ‘mint’ new tokens on a blockchain.

Each block comes with cryptographic hashes, a numerical function producing a random encrypted output according to the pre-programmed rules of the consensus mechanism. Of course, the mathematics behind these are far too complicated even for the most advanced human mind to solve.

Hence, miners employ advanced computers to perform this job through a competitive ‘guessing game.’ Whichever miner or miner group is first in the race of solving the blocks, according to the block time, is afforded the right to add the block and is rewarded with the associated coin.

Popular cryptocurrencies using this system include Bitcoin, Ethereum, Litecoin, Dogecoin, and numerous more.

Why is proof of work beneficial? (and why it’s not)

Experts consider proof of work more secure mainly because it becomes more expensive to attack as the network becomes greater. However, it isn’t necessarily true for blockchains with fewer computers.

Of course, there is the financial incentive to mine, as with most blockchains. Some PoW cryptos like Bitcoin offer the earning of transaction fees associated with each block, aside from the initial block reward itself.

On the downside, PoW is notoriously energy-consuming, using up terawatt-hours of electricity annually (enough to power up some countries) and emitting millions of tons in carbon dioxide.

Therefore, proof of work cryptocurrencies are not good for the environment and have been heavily criticized by experts. Moreover, mining is less egalitarian because of the expensive computers required, electricity, and maintenance costs.

Lastly, proof of work is far less scalable, meaning confirming transactions is much slower than PoS or other mechanisms.

So, what is proof of stake?

Introduced in 2011, proof of stake is a non-mining consensus algorithm confirming blockchain transactions and securing the network based on the stake of users. Since no mining is required, you earn rewards according to the size of your stake and not your computational power.

Moreover, no work is required from the user other than contributing the minimum stake to become a validator or forger. Proof of work relies on a pseudo-random election process in choosing which validator confirms the next block based on their wealth and staking age.

The bigger your stake, the higher your chances of being selected to validate or forge the next block in the network autonomously. As a disciplinary measure, users who act maliciously often stand a chance to lose their entire locked stake.

Polygon, Polkadot, Stellar, Solana, and Cardano are some prominent names using PoS, although there are countless others as well.

Why is proof of work beneficial? (and why it’s not)

PoS trumps PoW when it comes to energy consumption. Projects employing the former model use significantly less electricity, making them more eco-friendly. Another massive advantage with proof of stake is scalability.

Proof of stake cryptocurrencies can confirm substantially more transactions per second since the algorithm isn’t relying on computers solving hashes as with proof of work. On the downside, experts consider PoS less secure since it’s less expensive to attack than with mined coins (although this point is contentious).

Also, although mining is a pricey endeavor, some staking projects also require a substantial financial commitment. Experts believe staking rewards are not as high as those from mining.

The last issue is decentralization. As with PoW, it’s common to find only a handful of groups controlling the network based on their wealth, meaning they get more rewards than others.

Final word: which is better?

Arguments still continue over which is objectively beneficial for blockchains, proof of work, or proof stake. Ultimately, both models are a means to end, verifying transactions and keeping the ledger running efficiently and securely.

Deciding which one is better is highly subjective, and many enthusiasts tend to ignore objectivity when comparing the two. We have seen a trend in crypto communities for more cryptocurrencies to move towards PoS because of its power-reducing consumption and scalability.

Although PoW is still prominent, it’s likely to become less relevant over time due to how much electricity it consumes, the expensive mining equipment, and the amount of computational work involved.